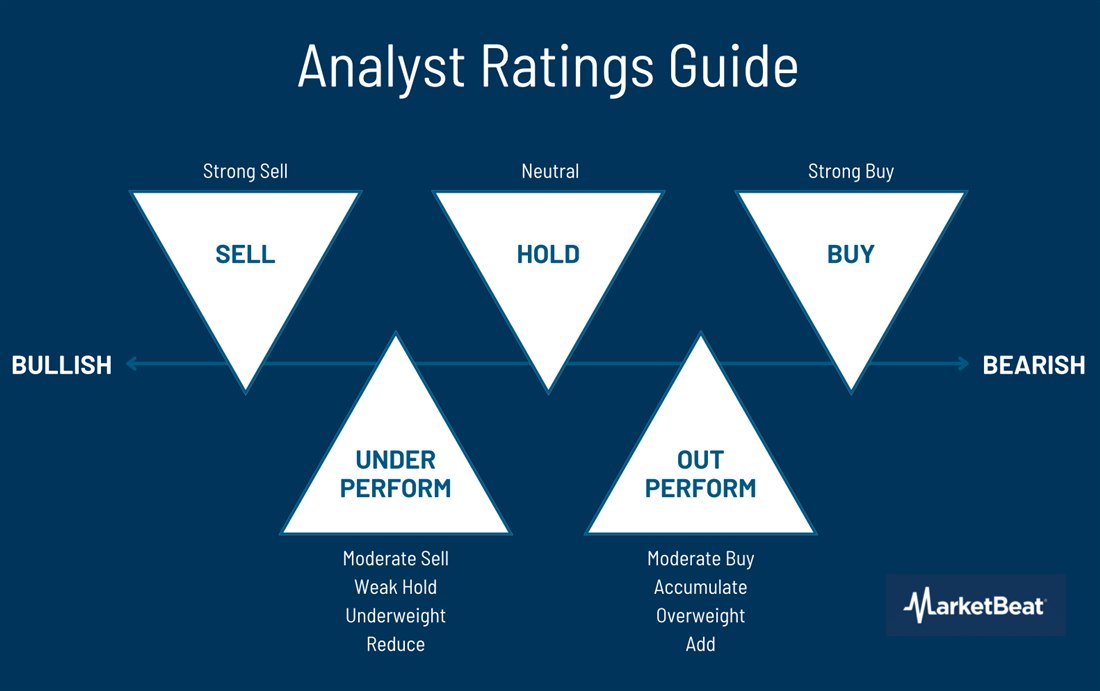

Analyst ratings are a crucial element within the complex terrain of the stock market, directly influencing investor decisions and market trends. These ratings, which financial analysts issue, reflect their assessment of a company's financial health, prospects, and overall investment potential. The spectrum of ratings is broad, ranging from the most positive (Strong Buy) to the most negative (Strong Sell), with Buy, Hold, and Sell representing the core categories.

Understanding the differences between these ratings is key to effective investment strategies. This article will specifically focus on deciphering the meaning and implications of a Buy rating, empowering you to make informed decisions. We will explore what factors lead analysts to assign a Buy rating, how these ratings should be interpreted, and how they fit into a broader investment strategy.

What Is a Buy Rating?

A Buy rating from a financial analyst signifies a positive outlook on a stock's performance, indicating the analyst believes it is undervalued compared to its intrinsic value or possesses significant growth potential. This positive assessment reflects confidence in the company's underlying fundamentals, including its financial stability, competitive positioning, and prospects.

A Buy rating generally suggests a higher probability of price appreciation than the broader market. It's crucial to remember that while a Buy rating represents a positive outlook, it doesn't guarantee future price increases. Analysts base their ratings on a variety of factors, including projected earnings growth, valuation metrics (such as price-to-earnings ratio (P/E)), and assessment of the company's competitive terrain. For example, a company demonstrating strong revenue growth and efficient cost management might receive a Buy rating even if its current market price appears high relative to its historical performance. Conversely, a company with a low price-to-earnings ratio but facing considerable headwinds in its industry might not receive a Buy rating.

Reasons Analysts Issue a Buy Rating

Several key factors contribute to an analyst issuing a Buy rating. These factors often work in concert, creating a compelling case for the stock's potential. Understanding these underlying reasons is crucial for you to evaluate the validity and potential implications of any Buy rating.

- Undervalued Stock: Analysts employ various valuation models, such as discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratios, to estimate a stock's intrinsic value. When the calculated intrinsic value significantly surpasses the current market price, it suggests undervaluation, which is a key driver for a Buy rating. This indicates that the stock's price doesn't fully reflect its underlying worth, presenting a potentially attractive investment opportunity. However, it's important to remember that valuation models rely on assumptions and projections that may not always hold true.

- Strong Growth Potential: A Buy rating often signals a strong belief in a company's future growth trajectory. This expectation might stem from multiple sources, including anticipated new product launches, positive industry trends that favor the company's operations, or a demonstrably strong competitive advantage. Exceptional management, efficient operations, and innovative products further reinforce this growth potential. However, projected growth must be realistically assessed; unexpected market changes or unforeseen company challenges could quickly impact future developments.

- Exceptional Performance: Consistent high performance and strong financial results that often exceed market expectations are strong indicators of a healthy company and frequently contribute to a Buy rating. This includes a proven track record of efficient management, sound financial practices, and a history of exceeding targets. It’s essential, however, to examine the sustainability of such performance and whether it is a one-time event or a consistent trend.

- Favorable Market Conditions: Broader economic trends and specific industry tailwinds can dramatically boost a company's outlook, increasing the likelihood of a Buy rating. Positive industry shifts, supportive government policies, or increased consumer spending in the company's sector can all significantly impact future performance. However, these positive conditions are not guaranteed and can shift quickly.

- Attractive Dividends: A hardy dividend yield, especially when paired with growth potential, enhances a stock's appeal and contributes to Buy ratings. This is particularly attractive for investors seeking income generation alongside capital appreciation. But remember that dividend payments are not guaranteed and can be reduced or eliminated depending on a company's financial state.

- Positive Catalysts: Upcoming events like regulatory approvals, strategic acquisitions, or strong earnings reports can boost future stock performance and increase the likelihood of a Buy rating. These catalysts offer a clear path to future growth. Yet, unforeseen complications or delays in these events could negate their positive impact.

While a Buy rating from a financial analyst reflects a positive outlook on a stock's potential, it's crucial to remember that such ratings are not guarantees of future success. Multiple factors influence these ratings, and investors should never rely solely on a Buy rating but rather incorporate it into a broader analysis that includes their personal risk tolerance and financial goals. Always conduct thorough due diligence and seek professional advice before making any investment decisions.

What Does a Buy Rating Mean for Investors?

The implications of a Buy rating differ depending on an investor's profile and strategy:

-

Current Investors: A Buy rating can bolster confidence in holding the stock and even justify buying more shares.

-

Potential Investors: The rating serves as a positive signal, suggesting the stock could be a worthwhile addition to their portfolio. However, further research remains critical.

-

Active Traders: While a Buy rating might trigger a short-term trading opportunity, active traders must carefully consider catalysts and momentum in conjunction with their overall risk tolerance.

Regardless of your investment style, remember that a Buy rating is just one data point. Your individual investment goals, risk tolerance, and timeframe should always drive your decisions. Don't blindly follow analyst ratings.

Navigating Analyst Ratings for Smarter Investing

Analyst ratings, including Buy ratings, offer valuable insights but shouldn't serve as the sole basis for investment decisions. Thorough research, considering diverse perspectives, and seeking professional financial advice are vital. Remember to critically assess analyst predictions, considering potential biases and the dynamic nature of market conditions. A Buy rating signals potential, but individual due diligence and a well-defined investment strategy are essential for success. Use ratings as a tool, not a rule.

Additional Resources on Analyst Ratings

Invest Smarter with MarketBeat

MarketBeat provides a comprehensive suite of tools to help you make informed investment decisions. Don't just rely on a single rating; use MarketBeat's resources to get a deeper understanding of stock performance and explore investment strategies. Start your free trial today and unlock the power of data-driven investing!

Before you consider Hyatt Hotels, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hyatt Hotels wasn't on the list.

While Hyatt Hotels currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.