Is QQQ a good investment? How has it performed historically, and what should investors anticipate in the future? Read on to learn more about QQQ’s holdings and long-term performance and some alternatives you might want to consider for your portfolio.

Introduction to the QQQ ETF

The QQQ ETF is an alternative name for the Invesco QQQ Trust, one of the world's most widely exchanged tech-based ETFs. QQQ aims to track the performance of the NASDAQ-100 Index, composed of 100 of the largest non-financial companies listed on the NASDAQ stock exchange.

Some examples of top holdings in the QQQ include Apple NASDAQ: AAPL, Microsoft NASDAQ: MSFT and Amazon NASDAQ: AMZN, which make up about 25% of the fund’s total holdings. QQQ has performed historically well, combining a reasonable expense ratio with a wide range of assets. It’s a popular choice among newer investors, offering instant access to diverse tech exposure.

Understanding the QQQ ETF

So, what is the QQQ ETF exactly, and why is it such a popular choice for investors looking for tech stocks? Established in the late 1990s, the NASDAQ QQQ has produced consistent returns for investors despite taking a passive investing strategy.

Underlying Assets

Like other exchange-traded funds (ETFs), investing in QQQ stock shares also exposes you to all of the underlying assets held by the fund. Fund managers for QQQ choose how to divide investor funds based on the performance of the NASDAQ-100 Index, a collection of the top 100 companies traded on the NASDAQ exchange. Most of the QQQ holdings represent mega-cap companies, the decisions of which can have major effects on the overall economy due to their sheer size.

The QQQ ETF holds a diverse range of technology and growth-oriented companies. While the fund’s underlying assets primarily consist of popular technology companies, it also includes firms from other sectors like consumer discretionary, healthcare, communication services and more. The index (and the fund itself) are rebalanced quarterly and reconstituted annually to ensure that holdings align with the current corporate landscape.

Holdings and Weightings

What is in the QQQ ETF, and which companies do you gain exposure to after investing? Some top companies that make up the QQQ ETF include the following:

- Apple: One of the largest tech companies in the world, Apple is best known for its iconic product lines, which include the iPhone and Mac line of personal computers. With a history of innovation and strong brand loyalty, Apple is a leader in the consumer electronics industry. It currently has a total market capitalization of $2.76 trillion, making up 11% of QQQ’s holdings.

- Microsoft: Microsoft is a multinational technology company specializing in cloud computing and software development. People worldwide use its Windows operating system, and the company has also expanded into various ancillary computer services and arenas. Microsoft has a total market capitalization of $2.42 trillion, and makes up 9.64% of QQQ.

- Amazon.com: If you’re like most people, you’ve probably purchased a consumer discretionary or two from Amazon.com. Amazon is a global e-commerce and technology giant known for its vast online marketplace, which has spawned a series of digital streaming and logistics offshoots. In October 2023, Amazon.com’s total market capitalization was $1.30 trillion, about 5.23% of QQQ.

- NVIDIA: NVIDIA NASDAQ: NVDA is a semiconductor company specializing in graphics processing units and artificial intelligence (AI) technology. Its GPUs are widely used in gaming and data processing infrastructures, which have seen a surge in price due to a shortage beginning in the 2020s. In October 2023, NVIDIA had a total market capitalization of $1.10 trillion, making up 4.48% of QQQ.

- Meta Platforms: Formerly known as Facebook, Meta Platforms NASDAQ: META is a social media and technology conglomerate that owns popular platforms like Facebook, Instagram and WhatsApp. An innovative company in both the social and data processing sphere, Meta had a total market capitalization of $815 billion in 2023, making up 3.90% of QQQ.

These percentages may shift quarterly, as fund managers assess changes in the NASDAQ-100 index weighting and performance.

Structure and Expense Ratio

The QQQ ETF is structured as a passive ETF, a type of exchange-traded fund with a primary objective to duplicate the performance of an existing index. QQQ's goal is to replicate the performance of the NASDAQ-100 Index, which consists of 100 of the largest companies listed on the NASDAQ stock exchange. This structure is opposed to active investment funds, which fund participants manage in an attempt to outperform popular market indexes.

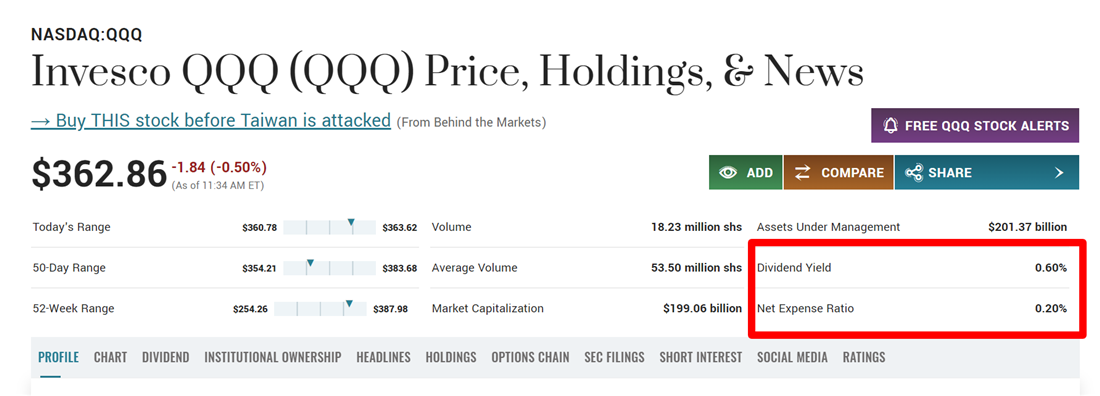

Passive ETFs like QQQ are more affordable than active investment options. You can track an ETF’s price by looking at its expense ratio. The expense ratio is a percentage measurement of how much a fund deducts in management expenses from investors based on the stock's current price. The current QQQ expense ratio is 0.20%, significantly less than the average NASDAQ-100 ETF expense ratio of 0.76%. This payment is deducted from the QQQ stock dividend distributed throughout the year.

Image: QQQ’s expenses deducted from its dividend payments, which comes from dividends issued by underlying stocks.

Image: QQQ’s expenses deducted from its dividend payments, which comes from dividends issued by underlying stocks.

Is QQQ a good long term investment? This fund has historically provided investors with solid returns thanks to the growth of tech giants in its holdings. Studying the historic performance of QQQ can help you determine if this ETF is suitable for your investment purposes.

Is QQQ is a good investment for a long-term portfolio? It can be helpful to examine both recent and long-term performance. Historically, the QQQ has been associated with strong returns, particularly when the technology sector experiences significant growth. Investors who made a $10,000 buy into QQQ in October of 2013 would see their holdings valued at $49,647 in October 2023.

When compared to other major indexes, QQQ remains a solid investment option. For example, the amount of money invested in the S&P 500 using the same timeframe listed above would result in a total investment of $30,820. This shows that QQQ has returned 60% more than the S&P 500 in the same period, largely related to high growth in the tech industry due to the COVID-19 pandemic.

Volatility and Risk

While QQQ has offered a higher rate of return than the S&P 500 in the last decade, its returns tend to be more volatile than broader market indexes due to its tech-focused holdings. About 57% of QQQ is cyclical tech stocks, which tend to experience growth booms and sharp price declines during bear markets. If you’re an investor more adverse to risk (for example, because you’re getting closer to retirement), QQQ might not be the best option due to its higher volatility.

Investment Strategies with the QQQ ETF

Because of its balance of growth-oriented stocks and its high daily trading volume, QQQ might be suitable for both passive and active investing strategies.

Passive Investing

QQQ offers exposure to some of the world's most innovative and dominant technology companies, making it an excellent long-term growth investment. With top holdings, including giants like Apple and Amazon.com, QQQ is well positioned to continue its growth trend so long as demand for these companies’ products and services remains high.

Tech companies have demonstrated their ability to adapt and innovate to changing consumer preferences, reflected in the growth of QQQ over time. Its expense ratio is also lower than the industry average, reducing the toll taken on investor dividends. This can make QQQ an appealing choice for passive dividend investors interested in options with historical performance data on their side.

Active Trading

QQQ is one of the most widely traded market ETFs, and its high liquidity has made it an appealing choice for short-term investors. Let’s look at an example of how a day trader might use QQQ to see a return on their invested capital.

Imagine you're a day trader with $10,000 to use as investment capital. To simplify this example, you buy stock shares directly instead of options contracts like most day traders. On October 5, 2023, the QQQ ETF price falls to $358.69 per share; you believe the market undervalues this, so you invest $10,000 to buy 27.88 shares.

Your assumption is correct, and the price of QQQ quickly rises. On October 6, the price of your shares climbs to $364.71, making your total position worth $10,168.11. If you were to sell your shares at the daily average price, you’d see a short-term profit of $168.11.

The performance of the technology sector and the overall movement of the economy both influence QQQ’s returns.

Technology Sector Influence

Tech stocks make up more than half of the assets held by the QQQ — so its no surprise that the tech sector's performance plays a major role in its returns. The technology sector is known for its potential for rapid innovation, growth, and profitability. As a result, when investor confidence and consumer spending are high, tech stocks and the QQQ both see value increases. Conversely, when tech stocks performed worse, QQQ shares also fell in value.

Economic and Market Factors

The overall economy also plays a role in the performance of QQQ — in particular, the ETF is sensitive to changes in interest rates. The technology sector, which forms the core of the QQQ, often relies on borrowing to fund expansion and innovation. When interest rates increase, borrowing becomes more expensive, potentially impacting profit margins and reducing investment in research and development. This can result in shaken investor confidence, leading to increased losses.

Alternatives to the QQQ ETF

While QQQ can offer a blend of growth-oriented returns and stability, it might not be the right choice for everyone. The following are some popular alternatives to the QQQ.

S&P 500 ETF

The S&P 500 is a collection of the largest 500 companies in the United States. ETFs like the SPDR S&P 500 ETF Trust NYSE: SPY have produced stable and consistent returns by focusing on a blend of major industries. This contradicts QQQ, which is weighted more heavily toward the technology sector. In October 2023, SPY had a rock-bottom expense ratio of 0.09%, less than half of QQQ.

Individual Stock Investments

In addition to other ETFs that track competing indexes, you can invest in an individual portfolio of stocks that comprise the QQQ. This gives you more control over the individual companies in your portfolio, which can be beneficial if you’re looking to avoid specific tech stocks. While this strategy allows you to avoid paying the expense ratio of investing in QQQ, it can also result in more individual risk.

Other Investment Options

Additional alternatives to QQQ you might want to consider include:

- NASDAQ composite ETFs: The NASDAQ composite is a broad-based stock market index that includes all the companies listed on the NASDAQ exchange. A NASDAQ composite ETF like the Fidelity Nasdaq Composite Index ETF NASDAQ: ONEQ can provide more broad exposure than QQQ.

- Tech-sector ETFs: If you’re looking for even more growth potential, you can invest in ETFs specifically composed of technology stocks like the Technology Select Sector SPDR Fund NYSE: XLK.

- Dow Jones Industrial Average ETFs: The Dow Jones Industrial Average (DIJA) is a competing stock index that tracks the performance of 30 well-established, large-cap companies across various industries. DIJA ETFs like the iShares Dow Jones U.S. ETF NYSE: IYY can provide exposure to a series of blue-chip stocks, which avoids concentrating your funds as heavily into the tech sector.

Should You Invest in QQQ?

While QQQ is a popular long-term choice for investors, it has some potential drawbacks. While the tech sector has shown great returns in recent years, it can also be more susceptible to market volatility and sector-specific risks. Its limited exposure to other sectors not included in the NASDAQ exchange can also reduce returns over time. QQQ may not be as suitable for investors getting closer to retirement or those whose primary goal is capital preservation.

Before you consider Amazon.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amazon.com wasn't on the list.

While Amazon.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.