Telemark Asset Management LLC acquired a new position in shares of HubSpot, Inc. (NYSE:HUBS - Free Report) during the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm acquired 10,000 shares of the software maker's stock, valued at approximately $6,968,000.

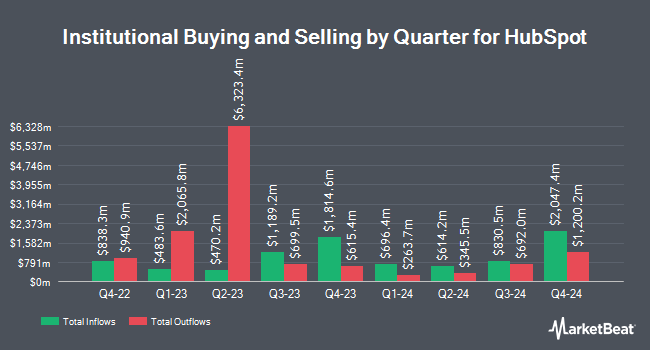

A number of other hedge funds have also recently added to or reduced their stakes in the stock. Wellington Management Group LLP increased its stake in shares of HubSpot by 52.2% in the 3rd quarter. Wellington Management Group LLP now owns 1,402,200 shares of the software maker's stock valued at $745,410,000 after purchasing an additional 480,796 shares during the last quarter. Raymond James Financial Inc. bought a new position in shares of HubSpot in the 4th quarter valued at $157,019,000. Wealthfront Advisers LLC increased its stake in shares of HubSpot by 3,090.2% in the 4th quarter. Wealthfront Advisers LLC now owns 133,543 shares of the software maker's stock valued at $93,049,000 after purchasing an additional 129,357 shares during the last quarter. Proficio Capital Partners LLC bought a new stake in HubSpot during the 4th quarter worth $79,135,000. Finally, Massachusetts Financial Services Co. MA grew its position in HubSpot by 17.9% during the 3rd quarter. Massachusetts Financial Services Co. MA now owns 571,274 shares of the software maker's stock worth $303,689,000 after acquiring an additional 86,688 shares during the last quarter. Institutional investors own 90.39% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities research analysts recently weighed in on HUBS shares. Piper Sandler boosted their price objective on HubSpot from $640.00 to $808.00 and gave the stock a "neutral" rating in a research report on Thursday, February 13th. Redburn Atlantic started coverage on HubSpot in a research report on Wednesday, February 19th. They set a "buy" rating on the stock. Jefferies Financial Group boosted their price objective on HubSpot from $860.00 to $900.00 and gave the stock a "buy" rating in a research report on Monday, February 3rd. Wells Fargo & Company boosted their price objective on HubSpot from $835.00 to $940.00 and gave the stock an "overweight" rating in a research report on Thursday, February 13th. Finally, Canaccord Genuity Group lifted their target price on HubSpot from $710.00 to $900.00 and gave the stock a "buy" rating in a report on Thursday, February 13th. Four investment analysts have rated the stock with a hold rating, twenty-one have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $863.96.

Check Out Our Latest Stock Report on HUBS

Insider Activity at HubSpot

In other HubSpot news, Director Lorrie M. Norrington sold 572 shares of the stock in a transaction on Friday, December 20th. The stock was sold at an average price of $690.00, for a total transaction of $394,680.00. Following the sale, the director now owns 1,697 shares in the company, valued at $1,170,930. This represents a 25.21 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, insider Brian Halligan sold 8,500 shares of the stock in a transaction on Tuesday, December 17th. The stock was sold at an average price of $729.65, for a total value of $6,202,025.00. Following the sale, the insider now owns 513,698 shares in the company, valued at approximately $374,819,745.70. This represents a 1.63 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 47,997 shares of company stock worth $35,796,526. Insiders own 4.50% of the company's stock.

HubSpot Trading Down 2.0 %

Shares of HUBS stock traded down $12.42 during trading on Thursday, hitting $598.64. The company's stock had a trading volume of 895,886 shares, compared to its average volume of 571,548. The company has a market cap of $31.22 billion, a PE ratio of 6,652.27, a P/E/G ratio of 41.44 and a beta of 1.80. The business has a fifty day moving average of $727.46 and a 200-day moving average of $649.63. HubSpot, Inc. has a 52 week low of $434.84 and a 52 week high of $881.13.

HubSpot (NYSE:HUBS - Get Free Report) last released its earnings results on Wednesday, February 12th. The software maker reported $0.20 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.18 by ($1.98). HubSpot had a net margin of 0.17% and a negative return on equity of 0.07%. As a group, research analysts predict that HubSpot, Inc. will post 1.01 EPS for the current year.

HubSpot Company Profile

(

Free Report)

HubSpot, Inc, together with its subsidiaries, provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific. The company's CRM platform includes Marketing Hub, a toolset for marketing automation and email, social media, SEO, and reporting and analytics; Sales Hub offers email templates and tracking, conversations and live chat, meeting and call scheduling, lead and website visit alerts, lead scoring, sales automation, pipeline management, quoting, forecasting, and reporting; Service Hub, a service software designed to help businesses manage, respond, and connect with customers; and Content Management Systems Hub enables businesses to create new and edit existing web content.

Featured Stories

Before you consider HubSpot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HubSpot wasn't on the list.

While HubSpot currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report