StoneX Group Inc. acquired a new stake in shares of Lowe's Companies, Inc. (NYSE:LOW - Free Report) during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund acquired 10,018 shares of the home improvement retailer's stock, valued at approximately $2,713,000.

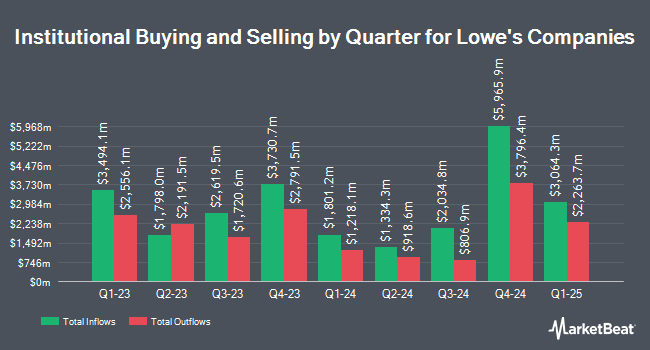

Several other hedge funds and other institutional investors have also made changes to their positions in LOW. Price T Rowe Associates Inc. MD increased its stake in Lowe's Companies by 36.6% in the first quarter. Price T Rowe Associates Inc. MD now owns 1,840,704 shares of the home improvement retailer's stock worth $468,884,000 after purchasing an additional 493,180 shares during the period. Mount Yale Investment Advisors LLC boosted its position in Lowe's Companies by 56.1% in the 1st quarter. Mount Yale Investment Advisors LLC now owns 4,642 shares of the home improvement retailer's stock valued at $1,182,000 after buying an additional 1,669 shares during the period. Ascent Group LLC increased its position in shares of Lowe's Companies by 4.3% during the first quarter. Ascent Group LLC now owns 3,596 shares of the home improvement retailer's stock worth $916,000 after acquiring an additional 148 shares during the period. Captrust Financial Advisors raised its stake in shares of Lowe's Companies by 18.3% during the first quarter. Captrust Financial Advisors now owns 724,325 shares of the home improvement retailer's stock valued at $184,507,000 after acquiring an additional 111,930 shares in the last quarter. Finally, Silvercrest Asset Management Group LLC boosted its holdings in shares of Lowe's Companies by 15.4% in the first quarter. Silvercrest Asset Management Group LLC now owns 46,509 shares of the home improvement retailer's stock valued at $11,847,000 after purchasing an additional 6,212 shares during the period. Hedge funds and other institutional investors own 74.06% of the company's stock.

Analyst Ratings Changes

Several research firms have commented on LOW. Bank of America raised their price objective on Lowe's Companies from $275.00 to $305.00 and gave the stock a "buy" rating in a report on Friday, October 11th. Gordon Haskett cut their target price on shares of Lowe's Companies from $245.00 to $240.00 and set a "hold" rating on the stock in a research report on Wednesday, August 21st. Evercore ISI upped their price target on shares of Lowe's Companies from $255.00 to $270.00 and gave the stock an "in-line" rating in a research report on Wednesday. Wedbush reissued a "neutral" rating and set a $250.00 price objective on shares of Lowe's Companies in a report on Wednesday, August 21st. Finally, JPMorgan Chase & Co. lowered their target price on Lowe's Companies from $272.00 to $270.00 and set an "overweight" rating for the company in a report on Wednesday, August 21st. Ten analysts have rated the stock with a hold rating and sixteen have issued a buy rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $277.92.

Check Out Our Latest Stock Report on LOW

Lowe's Companies Trading Down 0.2 %

Shares of NYSE LOW traded down $0.54 during trading on Friday, reaching $264.68. 2,411,086 shares of the company traded hands, compared to its average volume of 2,422,608. The stock has a market cap of $150.15 billion, a P/E ratio of 22.08, a PEG ratio of 2.22 and a beta of 1.10. The firm's fifty day simple moving average is $268.74 and its 200 day simple moving average is $244.83. Lowe's Companies, Inc. has a 12-month low of $196.23 and a 12-month high of $287.01.

Lowe's Companies Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Wednesday, November 6th. Investors of record on Wednesday, October 23rd were issued a dividend of $1.15 per share. The ex-dividend date was Wednesday, October 23rd. This is an increase from Lowe's Companies's previous quarterly dividend of $0.15. This represents a $4.60 dividend on an annualized basis and a yield of 1.74%. Lowe's Companies's dividend payout ratio is 38.37%.

Insider Activity at Lowe's Companies

In other news, EVP Margrethe R. Vagell sold 5,730 shares of the stock in a transaction that occurred on Wednesday, October 2nd. The stock was sold at an average price of $271.45, for a total transaction of $1,555,408.50. Following the transaction, the executive vice president now owns 13,214 shares in the company, valued at $3,586,940.30. This trade represents a 30.25 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, CAO Dan Clayton Griggs, Jr. sold 6,769 shares of the company's stock in a transaction on Thursday, September 12th. The stock was sold at an average price of $248.82, for a total transaction of $1,684,262.58. Following the transaction, the chief accounting officer now owns 9,383 shares of the company's stock, valued at $2,334,678.06. This represents a 41.91 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.26% of the stock is owned by company insiders.

Lowe's Companies Company Profile

(

Free Report)

Lowe's Companies, Inc, together with its subsidiaries, operates as a home improvement retailer in the United States. The company offers a line of products for construction, maintenance, repair, remodeling, and decorating. It also provides home improvement products, such as appliances, seasonal and outdoor living, lawn and garden, lumber, kitchens and bath, tools, paint, millwork, hardware, flooring, rough plumbing, building materials, décor, and electrical.

Further Reading

Before you consider Lowe's Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lowe's Companies wasn't on the list.

While Lowe's Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.