GSA Capital Partners LLP bought a new position in shares of Intapp, Inc. (NASDAQ:INTA - Free Report) in the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund bought 10,063 shares of the company's stock, valued at approximately $481,000.

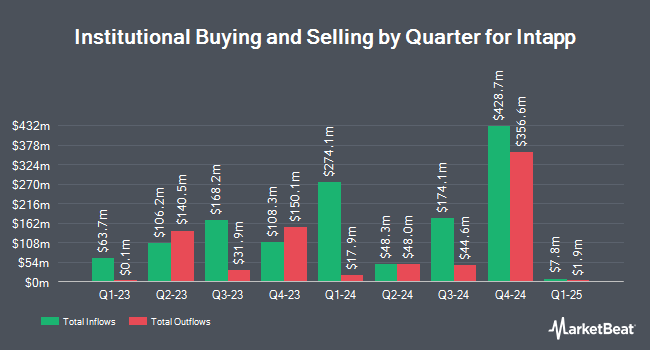

A number of other institutional investors and hedge funds have also recently bought and sold shares of the company. Vanguard Group Inc. increased its stake in Intapp by 42.7% in the first quarter. Vanguard Group Inc. now owns 5,014,640 shares of the company's stock valued at $172,002,000 after acquiring an additional 1,501,091 shares during the period. Clearbridge Investments LLC acquired a new stake in shares of Intapp during the first quarter worth $16,156,000. Jane Street Group LLC raised its holdings in shares of Intapp by 766.2% during the first quarter. Jane Street Group LLC now owns 166,456 shares of the company's stock worth $5,709,000 after acquiring an additional 147,240 shares during the period. Swiss National Bank grew its position in shares of Intapp by 58.1% in the 1st quarter. Swiss National Bank now owns 86,500 shares of the company's stock valued at $2,967,000 after acquiring an additional 31,800 shares during the period. Finally, Farther Finance Advisors LLC lifted its stake in shares of Intapp by 1,054.0% during the 3rd quarter. Farther Finance Advisors LLC now owns 577 shares of the company's stock worth $28,000 after buying an additional 527 shares during the last quarter. Institutional investors and hedge funds own 89.96% of the company's stock.

Intapp Price Performance

NASDAQ INTA traded up $0.48 during trading on Wednesday, hitting $58.37. The company's stock had a trading volume of 327,533 shares, compared to its average volume of 642,725. The company has a market cap of $4.52 billion, a PE ratio of -201.28 and a beta of 0.64. The business's 50 day simple moving average is $50.72 and its 200-day simple moving average is $41.94. Intapp, Inc. has a fifty-two week low of $30.36 and a fifty-two week high of $60.88.

Intapp (NASDAQ:INTA - Get Free Report) last released its earnings results on Monday, November 4th. The company reported $0.21 EPS for the quarter, topping analysts' consensus estimates of $0.13 by $0.08. Intapp had a negative return on equity of 2.08% and a negative net margin of 4.74%. The firm had revenue of $118.81 million during the quarter, compared to the consensus estimate of $117.88 million. During the same quarter in the previous year, the company posted ($0.20) earnings per share. The company's revenue was up 17.0% compared to the same quarter last year. Analysts expect that Intapp, Inc. will post -0.14 EPS for the current fiscal year.

Insider Activity

In other Intapp news, COO Donald F. Coleman sold 58,003 shares of the company's stock in a transaction on Friday, September 20th. The stock was sold at an average price of $49.31, for a total value of $2,860,127.93. Following the completion of the sale, the chief operating officer now directly owns 668,239 shares in the company, valued at $32,950,865.09. This represents a 7.99 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Ralph Baxter sold 50,000 shares of the company's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $57.10, for a total value of $2,855,000.00. Following the completion of the transaction, the director now directly owns 5,624 shares in the company, valued at approximately $321,130.40. This trade represents a 89.89 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 237,017 shares of company stock worth $12,156,222 over the last three months. 13.02% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

Several analysts have weighed in on the stock. Raymond James lifted their price objective on shares of Intapp from $46.00 to $55.00 and gave the stock an "outperform" rating in a research note on Tuesday, November 5th. Citigroup boosted their target price on shares of Intapp from $52.00 to $63.00 and gave the company a "buy" rating in a research report on Wednesday, September 25th. Bank of America reduced their target price on shares of Intapp from $52.00 to $48.00 and set a "buy" rating for the company in a research note on Wednesday, August 14th. UBS Group increased their target price on shares of Intapp from $49.00 to $50.00 and gave the stock a "buy" rating in a research report on Wednesday, August 14th. Finally, Piper Sandler restated an "overweight" rating and issued a $60.00 price objective (up from $46.00) on shares of Intapp in a research report on Tuesday, November 5th. Two investment analysts have rated the stock with a hold rating and nine have assigned a buy rating to the stock. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $53.55.

View Our Latest Stock Report on Intapp

Intapp Company Profile

(

Free Report)

Intapp, Inc, through its subsidiary, Integration Appliance, Inc, provides industry-specific cloud-based software solutions for the professional and financial services industry in the United States, the United Kingdom, and internationally. Its solutions include DealCloud, a deal and relationship management solution that manages financial services firms' market relationships, prospective clients and investments, current engagements and deal processes, and operations and compliance activities; collaboration and content solutions, including Intapp documents, an engagement-centric document management system, and Intapp workspaces; risk and compliance management solutions, such as Intapp conflicts, Intapp intake, Intapp terms, Intapp walls, and Intapp employee compliance; and operational and financial management solutions comprising Intapp Billstream, a cloud-based automated proforma invoice solution, Intapp time, and Intapp terms.

Read More

Before you consider Intapp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intapp wasn't on the list.

While Intapp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.