Intech Investment Management LLC purchased a new stake in shares of CBIZ, Inc. (NYSE:CBZ - Free Report) during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor purchased 10,090 shares of the business services provider's stock, valued at approximately $679,000.

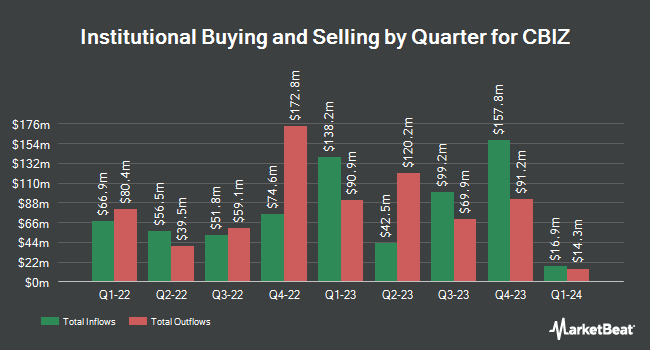

Other institutional investors and hedge funds also recently made changes to their positions in the company. Burgundy Asset Management Ltd. boosted its stake in CBIZ by 1.8% in the 2nd quarter. Burgundy Asset Management Ltd. now owns 2,220,013 shares of the business services provider's stock worth $164,503,000 after purchasing an additional 40,215 shares during the period. Allspring Global Investments Holdings LLC lifted its holdings in shares of CBIZ by 1.0% in the third quarter. Allspring Global Investments Holdings LLC now owns 1,125,766 shares of the business services provider's stock worth $75,753,000 after buying an additional 11,401 shares in the last quarter. Premier Fund Managers Ltd boosted its position in shares of CBIZ by 14.0% in the third quarter. Premier Fund Managers Ltd now owns 813,698 shares of the business services provider's stock valued at $54,375,000 after acquiring an additional 100,000 shares during the period. Public Employees Retirement Association of Colorado grew its stake in CBIZ by 12.2% during the second quarter. Public Employees Retirement Association of Colorado now owns 340,124 shares of the business services provider's stock valued at $25,203,000 after acquiring an additional 37,028 shares in the last quarter. Finally, Artemis Investment Management LLP increased its holdings in CBIZ by 22.8% during the 3rd quarter. Artemis Investment Management LLP now owns 332,534 shares of the business services provider's stock worth $22,376,000 after acquiring an additional 61,754 shares during the period. Institutional investors own 87.44% of the company's stock.

Analysts Set New Price Targets

A number of research firms have recently commented on CBZ. StockNews.com lowered shares of CBIZ from a "hold" rating to a "sell" rating in a research report on Wednesday, November 20th. Sidoti raised CBIZ from a "neutral" rating to a "buy" rating and raised their price target for the company from $80.00 to $86.00 in a report on Monday, August 12th.

View Our Latest Analysis on CBIZ

CBIZ Price Performance

NYSE CBZ traded up $0.14 during trading hours on Friday, reaching $82.58. 153,635 shares of the stock traded hands, compared to its average volume of 329,886. The company has a debt-to-equity ratio of 0.36, a current ratio of 1.49 and a quick ratio of 1.49. The stock has a 50 day simple moving average of $71.49 and a two-hundred day simple moving average of $73.30. CBIZ, Inc. has a 1 year low of $57.19 and a 1 year high of $86.36. The company has a market cap of $4.14 billion, a price-to-earnings ratio of 34.99 and a beta of 0.91.

CBIZ (NYSE:CBZ - Get Free Report) last issued its earnings results on Tuesday, October 29th. The business services provider reported $0.84 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.76 by $0.08. The business had revenue of $438.90 million during the quarter, compared to analyst estimates of $440.16 million. CBIZ had a return on equity of 15.12% and a net margin of 7.08%. CBIZ's revenue for the quarter was up 6.9% on a year-over-year basis. During the same quarter in the prior year, the firm earned $0.66 earnings per share. On average, analysts predict that CBIZ, Inc. will post 2.65 EPS for the current fiscal year.

CBIZ Company Profile

(

Free Report)

CBIZ, Inc provides financial, insurance, and advisory services in the United States and Canada. It operates through Financial Services, Benefits and Insurance Services, and National Practices segments. The Financial Services segment offers accounting and tax, financial advisory, valuation, risk and advisory, and government healthcare consulting services.

Featured Stories

Before you consider CBIZ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CBIZ wasn't on the list.

While CBIZ currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.