LSV Asset Management bought a new stake in Magnera Corp (NYSE:MAGN - Free Report) in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund bought 1,011,667 shares of the company's stock, valued at approximately $18,382,000. LSV Asset Management owned about 28.90% of Magnera as of its most recent filing with the Securities and Exchange Commission.

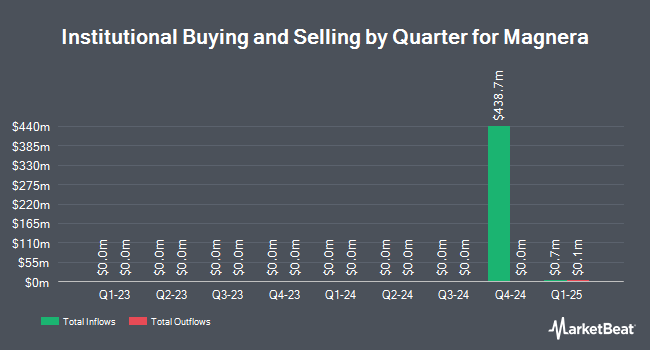

A number of other hedge funds have also recently added to or reduced their stakes in the company. Vanguard Group Inc. purchased a new stake in Magnera in the fourth quarter valued at approximately $52,408,000. Loomis Sayles & Co. L P acquired a new position in shares of Magnera in the 4th quarter valued at $10,969,000. Geode Capital Management LLC purchased a new stake in Magnera in the 4th quarter valued at $6,491,000. DG Capital Management LLC acquired a new stake in Magnera during the 4th quarter worth $6,340,000. Finally, Russell Investments Group Ltd. purchased a new position in Magnera during the 4th quarter worth $2,702,000. Hedge funds and other institutional investors own 76.92% of the company's stock.

Insider Transactions at Magnera

In related news, CEO Curt Begle purchased 23,786 shares of the stock in a transaction that occurred on Tuesday, February 11th. The stock was purchased at an average cost of $21.08 per share, for a total transaction of $501,408.88. Following the acquisition, the chief executive officer now owns 24,066 shares in the company, valued at approximately $507,311.28. This trade represents a 8,495.00 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Carl J. Rickertsen purchased 20,000 shares of Magnera stock in a transaction that occurred on Thursday, February 27th. The shares were bought at an average cost of $20.33 per share, for a total transaction of $406,600.00. Following the completion of the transaction, the director now directly owns 21,306 shares in the company, valued at $433,150.98. This represents a 1,531.39 % increase in their position. The disclosure for this purchase can be found here. Insiders own 2.26% of the company's stock.

Analyst Ratings Changes

MAGN has been the subject of several recent research reports. Wells Fargo & Company increased their target price on shares of Magnera from $22.00 to $24.00 and gave the stock an "overweight" rating in a research note on Friday, February 7th. Vertical Research initiated coverage on Magnera in a research report on Wednesday, March 19th. They set a "hold" rating and a $21.00 price objective for the company.

Check Out Our Latest Stock Analysis on Magnera

Magnera Stock Down 0.7 %

NYSE MAGN traded down $0.11 during mid-day trading on Tuesday, hitting $15.15. The stock had a trading volume of 176,199 shares, compared to its average volume of 497,641. The stock has a 50 day moving average price of $19.02. The firm has a market cap of $536.31 million, a P/E ratio of -0.83 and a beta of 1.76. Magnera Corp has a 52-week low of $13.11 and a 52-week high of $26.78. The company has a current ratio of 2.45, a quick ratio of 1.52 and a debt-to-equity ratio of 1.80.

Magnera (NYSE:MAGN - Get Free Report) last released its quarterly earnings results on Thursday, February 6th. The company reported ($1.69) earnings per share for the quarter. Magnera had a negative return on equity of 10.62% and a negative net margin of 6.97%. During the same period in the previous year, the company posted ($0.25) EPS.

Magnera Profile

(

Free Report)

Magnera's purpose is to better the world with new possibilities made real. By continuously co-creating and innovating with our partners, we develop original material solutions that make a brighter future possible. With a breadth of technologies and a passion for what we create, Magnera's solutions propel our customers' goals forward and solve end-users' problems, every day.

Featured Articles

Before you consider Magnera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Magnera wasn't on the list.

While Magnera currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.