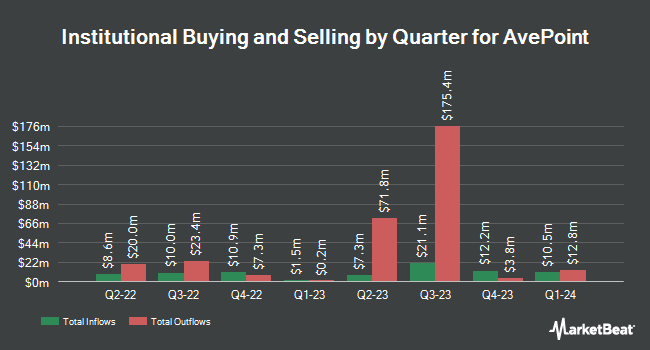

Sheets Smith Investment Management acquired a new stake in shares of AvePoint, Inc. (NASDAQ:AVPT - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 102,310 shares of the company's stock, valued at approximately $1,689,000. AvePoint comprises 1.4% of Sheets Smith Investment Management's portfolio, making the stock its 18th largest holding. Sheets Smith Investment Management owned approximately 0.05% of AvePoint as of its most recent SEC filing.

A number of other hedge funds also recently added to or reduced their stakes in AVPT. Global Retirement Partners LLC purchased a new stake in AvePoint in the 4th quarter valued at approximately $25,000. National Bank of Canada FI acquired a new stake in shares of AvePoint in the 3rd quarter valued at approximately $29,000. Heck Capital Advisors LLC purchased a new stake in shares of AvePoint in the fourth quarter valued at approximately $29,000. R Squared Ltd acquired a new position in AvePoint during the fourth quarter worth $45,000. Finally, Principal Securities Inc. raised its position in AvePoint by 12,961.9% in the fourth quarter. Principal Securities Inc. now owns 2,743 shares of the company's stock worth $45,000 after acquiring an additional 2,722 shares in the last quarter. 44.49% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several brokerages have commented on AVPT. William Blair restated an "outperform" rating on shares of AvePoint in a research report on Tuesday, March 4th. Citigroup decreased their price objective on shares of AvePoint from $18.00 to $16.00 and set a "neutral" rating on the stock in a report on Tuesday, March 11th. Two research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. Based on data from MarketBeat.com, AvePoint has an average rating of "Moderate Buy" and a consensus target price of $15.75.

Read Our Latest Stock Report on AvePoint

Insider Transactions at AvePoint

In other AvePoint news, insider Brian Michael Brown sold 35,000 shares of the firm's stock in a transaction dated Monday, March 24th. The shares were sold at an average price of $15.40, for a total transaction of $539,000.00. Following the completion of the transaction, the insider now directly owns 1,347,145 shares in the company, valued at approximately $20,746,033. This trade represents a 2.53 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Corporate insiders own 26.19% of the company's stock.

AvePoint Price Performance

AVPT traded down $0.16 during trading on Friday, reaching $14.62. 1,486,636 shares of the stock were exchanged, compared to its average volume of 1,196,059. The company has a market capitalization of $2.95 billion, a price-to-earnings ratio of -292.34 and a beta of 1.11. AvePoint, Inc. has a 1 year low of $7.52 and a 1 year high of $19.90. The business's 50 day moving average price is $16.90 and its two-hundred day moving average price is $15.61.

About AvePoint

(

Free Report)

AvePoint, Inc provides cloud-native data management software platform in North America, Europe, Middle East, Africa, and Asia Pacific. It also offers software-as-a-service solutions and productivity applications. The company offers modularity and cloud services architecture to address critical challenges and the management of data to organizations that leverage third-party cloud vendors, including Microsoft, Salesforce, Google, AWS, Box, DropBox, and others; license and support; and maintenance services.

Featured Articles

Before you consider AvePoint, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AvePoint wasn't on the list.

While AvePoint currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.