Norges Bank bought a new stake in shares of The Boston Beer Company, Inc. (NYSE:SAM - Free Report) in the 4th quarter, according to its most recent 13F filing with the SEC. The firm bought 102,478 shares of the company's stock, valued at approximately $30,741,000. Norges Bank owned approximately 0.89% of Boston Beer at the end of the most recent quarter.

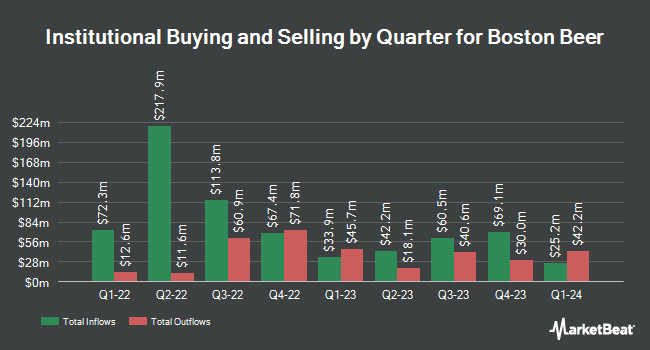

A number of other institutional investors and hedge funds have also recently bought and sold shares of the stock. Blue Trust Inc. lifted its position in Boston Beer by 405.6% during the 4th quarter. Blue Trust Inc. now owns 91 shares of the company's stock worth $26,000 after acquiring an additional 73 shares in the last quarter. EverSource Wealth Advisors LLC boosted its stake in Boston Beer by 2,225.0% in the fourth quarter. EverSource Wealth Advisors LLC now owns 93 shares of the company's stock valued at $28,000 after acquiring an additional 89 shares during the period. GAMMA Investing LLC increased its position in Boston Beer by 59.3% in the fourth quarter. GAMMA Investing LLC now owns 129 shares of the company's stock worth $39,000 after buying an additional 48 shares during the period. Point72 Asia Singapore Pte. Ltd. bought a new stake in Boston Beer in the 3rd quarter valued at about $49,000. Finally, First Horizon Advisors Inc. grew its holdings in Boston Beer by 42.1% in the 4th quarter. First Horizon Advisors Inc. now owns 172 shares of the company's stock worth $52,000 after buying an additional 51 shares in the last quarter. Hedge funds and other institutional investors own 81.13% of the company's stock.

Boston Beer Price Performance

SAM traded up $2.54 during trading on Friday, hitting $245.51. 145,917 shares of the stock traded hands, compared to its average volume of 171,873. The Boston Beer Company, Inc. has a twelve month low of $215.10 and a twelve month high of $339.77. The company has a market cap of $2.76 billion, a price-to-earnings ratio of 36.10, a PEG ratio of 1.23 and a beta of 1.26. The business has a 50 day moving average price of $235.25 and a 200 day moving average price of $271.49.

Analysts Set New Price Targets

SAM has been the subject of a number of research analyst reports. Citigroup raised shares of Boston Beer from a "neutral" rating to a "buy" rating and upped their price target for the company from $265.00 to $280.00 in a report on Thursday, March 20th. Morgan Stanley cut their price objective on Boston Beer from $290.00 to $270.00 and set an "equal weight" rating for the company in a report on Wednesday, February 26th. StockNews.com lowered shares of Boston Beer from a "buy" rating to a "hold" rating in a research note on Wednesday, March 5th. Berenberg Bank began coverage on Boston Beer in a research report on Wednesday, April 2nd. They set a "hold" rating and a $281.10 target price for the company. Finally, UBS Group dropped their price objective on Boston Beer from $315.00 to $290.00 and set a "neutral" rating on the stock in a research note on Thursday, January 16th. Ten research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company. According to data from MarketBeat, the company presently has an average rating of "Hold" and an average target price of $295.51.

Get Our Latest Stock Report on Boston Beer

Boston Beer Company Profile

(

Free Report)

The Boston Beer Company, Inc produces and sells alcohol beverages primarily in the United States. The company's flagship beer is Samuel Adams Boston Lager. It offers various beers, hard ciders, flavored malt beverages, and hard seltzers under the Samuel Adams, Twisted Tea, Truly, Angry Orchard, Dogfish Head, Angel City, and Coney Island brand names.

Featured Articles

Before you consider Boston Beer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boston Beer wasn't on the list.

While Boston Beer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.