New Age Alpha Advisors LLC bought a new position in shares of Bruker Co. (NASDAQ:BRKR - Free Report) during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 10,314 shares of the medical research company's stock, valued at approximately $605,000.

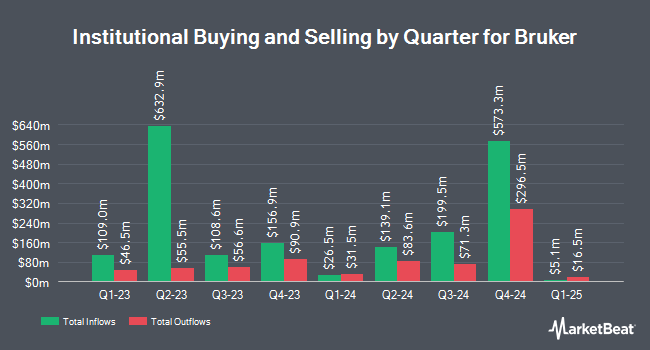

A number of other hedge funds have also made changes to their positions in BRKR. State Street Corp grew its stake in Bruker by 9.6% in the 3rd quarter. State Street Corp now owns 3,627,300 shares of the medical research company's stock valued at $250,501,000 after acquiring an additional 318,808 shares during the last quarter. RTW Investments LP grew its position in shares of Bruker by 1.1% in the third quarter. RTW Investments LP now owns 3,481,119 shares of the medical research company's stock valued at $240,406,000 after purchasing an additional 37,024 shares during the last quarter. Geode Capital Management LLC grew its position in shares of Bruker by 10.8% in the third quarter. Geode Capital Management LLC now owns 1,993,468 shares of the medical research company's stock valued at $137,702,000 after purchasing an additional 193,580 shares during the last quarter. Vaughan Nelson Investment Management L.P. increased its stake in shares of Bruker by 140.3% during the 4th quarter. Vaughan Nelson Investment Management L.P. now owns 1,141,762 shares of the medical research company's stock worth $66,930,000 after purchasing an additional 666,617 shares in the last quarter. Finally, Norges Bank acquired a new position in shares of Bruker during the 4th quarter worth approximately $63,378,000. Hedge funds and other institutional investors own 79.52% of the company's stock.

Bruker Trading Down 3.2 %

Shares of NASDAQ BRKR traded down $1.20 during trading on Friday, hitting $36.46. 4,101,408 shares of the company traded hands, compared to its average volume of 1,402,128. The company has a quick ratio of 0.77, a current ratio of 1.60 and a debt-to-equity ratio of 1.15. The firm has a market capitalization of $5.53 billion, a P/E ratio of 47.97, a P/E/G ratio of 2.16 and a beta of 1.18. The company has a 50-day moving average price of $48.64 and a 200-day moving average price of $56.07. Bruker Co. has a 1 year low of $34.10 and a 1 year high of $91.34.

Bruker (NASDAQ:BRKR - Get Free Report) last posted its quarterly earnings results on Thursday, February 13th. The medical research company reported $0.76 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.75 by $0.01. Bruker had a return on equity of 21.01% and a net margin of 3.36%. On average, equities analysts predict that Bruker Co. will post 2.69 EPS for the current year.

Bruker Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, March 28th. Shareholders of record on Monday, March 17th were given a dividend of $0.05 per share. The ex-dividend date was Monday, March 17th. This represents a $0.20 dividend on an annualized basis and a yield of 0.55%. Bruker's dividend payout ratio (DPR) is 26.32%.

Analyst Ratings Changes

Several equities analysts have weighed in on BRKR shares. Barclays dropped their price target on Bruker from $69.00 to $65.00 and set an "overweight" rating for the company in a research report on Monday, February 10th. UBS Group initiated coverage on shares of Bruker in a research note on Tuesday, December 10th. They issued a "neutral" rating and a $66.00 target price for the company. Guggenheim reaffirmed a "buy" rating on shares of Bruker in a research note on Monday, February 24th. Stifel Nicolaus cut their price objective on shares of Bruker from $70.00 to $57.00 and set a "hold" rating for the company in a research report on Friday, February 14th. Finally, Bank of America upped their price objective on shares of Bruker from $78.00 to $80.00 and gave the company a "buy" rating in a research note on Friday, December 13th. Six analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $70.50.

Read Our Latest Stock Report on BRKR

Bruker Profile

(

Free Report)

Bruker Corporation, together with its subsidiaries, develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally. The company operates through four segments: Bruker Scientific Instruments (BSI) BioSpin, BSI CALID, BSI Nano, and Bruker Energy & Supercon Technologies.

Further Reading

Before you consider Bruker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bruker wasn't on the list.

While Bruker currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.