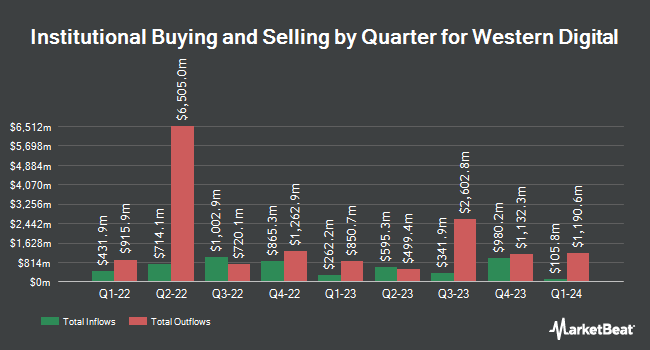

Neo Ivy Capital Management bought a new stake in shares of Western Digital Co. (NASDAQ:WDC - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor bought 10,542 shares of the data storage provider's stock, valued at approximately $720,000.

Other institutional investors and hedge funds also recently modified their holdings of the company. Sequoia Financial Advisors LLC lifted its position in shares of Western Digital by 12.5% in the 2nd quarter. Sequoia Financial Advisors LLC now owns 3,897 shares of the data storage provider's stock valued at $295,000 after acquiring an additional 433 shares in the last quarter. Wealth Enhancement Advisory Services LLC raised its position in shares of Western Digital by 21.1% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 7,896 shares of the data storage provider's stock valued at $598,000 after purchasing an additional 1,374 shares during the period. ORG Partners LLC lifted its stake in shares of Western Digital by 225.5% in the second quarter. ORG Partners LLC now owns 1,569 shares of the data storage provider's stock worth $120,000 after buying an additional 1,087 shares during the last quarter. SteelPeak Wealth LLC bought a new position in shares of Western Digital in the second quarter worth about $238,000. Finally, Swedbank AB raised its stake in Western Digital by 95.9% during the 2nd quarter. Swedbank AB now owns 243,812 shares of the data storage provider's stock valued at $18,474,000 after purchasing an additional 119,372 shares during the last quarter. Institutional investors and hedge funds own 92.51% of the company's stock.

Western Digital Price Performance

Shares of NASDAQ WDC traded down $3.91 during trading on Thursday, reaching $65.99. The company had a trading volume of 9,876,272 shares, compared to its average volume of 6,015,451. Western Digital Co. has a 52 week low of $48.96 and a 52 week high of $81.55. The business's 50 day moving average price is $67.69 and its 200-day moving average price is $68.92. The stock has a market cap of $22.81 billion, a PE ratio of 38.82 and a beta of 1.42. The company has a debt-to-equity ratio of 0.49, a quick ratio of 0.91 and a current ratio of 1.47.

Western Digital (NASDAQ:WDC - Get Free Report) last posted its quarterly earnings data on Thursday, October 24th. The data storage provider reported $1.78 earnings per share for the quarter, topping the consensus estimate of $1.55 by $0.23. The firm had revenue of $4.10 billion during the quarter, compared to analysts' expectations of $4.12 billion. Western Digital had a net margin of 4.81% and a return on equity of 8.57%. Western Digital's revenue was up 48.9% on a year-over-year basis. During the same quarter in the previous year, the company posted ($1.97) EPS. Analysts expect that Western Digital Co. will post 6.56 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of brokerages recently commented on WDC. Barclays upped their target price on Western Digital from $80.00 to $90.00 and gave the company an "overweight" rating in a research note on Friday, October 25th. Benchmark reaffirmed a "buy" rating and set a $92.00 price objective on shares of Western Digital in a report on Friday, October 25th. Evercore ISI reiterated an "outperform" rating and set a $85.00 target price on shares of Western Digital in a research report on Thursday, August 15th. Citigroup cut their price target on shares of Western Digital from $87.00 to $85.00 and set a "buy" rating for the company in a research note on Tuesday, December 3rd. Finally, The Goldman Sachs Group decreased their price objective on Western Digital from $79.00 to $72.00 and set a "neutral" rating on the stock in a report on Thursday, October 24th. Six investment analysts have rated the stock with a hold rating and sixteen have given a buy rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $87.71.

Check Out Our Latest Stock Report on WDC

Insider Activity at Western Digital

In other Western Digital news, SVP Gene M. Zamiska sold 658 shares of the firm's stock in a transaction that occurred on Tuesday, November 26th. The shares were sold at an average price of $69.99, for a total value of $46,053.42. Following the transaction, the senior vice president now directly owns 28,863 shares of the company's stock, valued at approximately $2,020,121.37. This trade represents a 2.23 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO David Goeckeler sold 75,000 shares of the company's stock in a transaction on Thursday, September 26th. The shares were sold at an average price of $70.32, for a total transaction of $5,274,000.00. Following the sale, the chief executive officer now owns 896,630 shares of the company's stock, valued at $63,051,021.60. The trade was a 7.72 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 184,107 shares of company stock worth $13,042,381 over the last 90 days. Insiders own 0.30% of the company's stock.

Western Digital Profile

(

Free Report)

Western Digital Corporation develops, manufactures, and sells data storage devices and solutions in the United States, China, Hong Kong, Europe, the Middle East, Africa, rest of Asia, and internationally. It offers client devices, including hard disk drives (HDDs) and solid state drives (SSDs) for desktop and notebook personal computers (PCs), gaming consoles, and set top boxes; and flash-based embedded storage products for mobile phones, tablets, notebook PCs, and other portable and wearable devices, as well as automotive, Internet of Things, industrial, and connected home applications.

Read More

Before you consider Western Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Western Digital wasn't on the list.

While Western Digital currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.