Dynamic Technology Lab Private Ltd bought a new stake in shares of SJW Group (NYSE:SJW - Free Report) in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund bought 10,666 shares of the utilities provider's stock, valued at approximately $620,000.

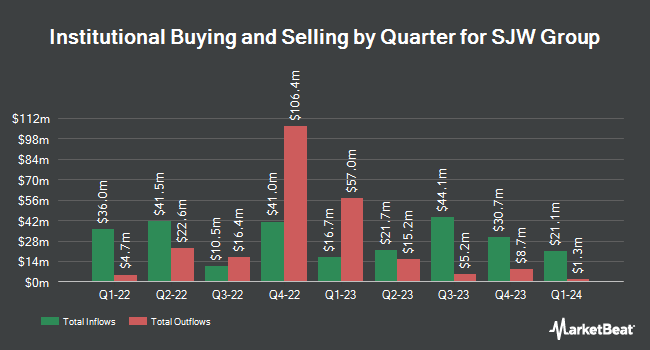

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in SJW. Nuance Investments LLC lifted its position in SJW Group by 17.5% during the second quarter. Nuance Investments LLC now owns 1,565,428 shares of the utilities provider's stock valued at $84,877,000 after purchasing an additional 233,601 shares during the period. Millennium Management LLC raised its position in shares of SJW Group by 2,491.2% in the second quarter. Millennium Management LLC now owns 113,781 shares of the utilities provider's stock worth $6,169,000 after acquiring an additional 109,390 shares during the period. Assenagon Asset Management S.A. raised its position in shares of SJW Group by 29.4% in the third quarter. Assenagon Asset Management S.A. now owns 212,299 shares of the utilities provider's stock worth $12,337,000 after acquiring an additional 48,200 shares during the period. IQ EQ FUND MANAGEMENT IRELAND Ltd raised its position in shares of SJW Group by 144.6% in the second quarter. IQ EQ FUND MANAGEMENT IRELAND Ltd now owns 64,359 shares of the utilities provider's stock worth $3,490,000 after acquiring an additional 38,044 shares during the period. Finally, Cubist Systematic Strategies LLC raised its position in shares of SJW Group by 445.4% in the second quarter. Cubist Systematic Strategies LLC now owns 45,946 shares of the utilities provider's stock worth $2,491,000 after acquiring an additional 37,521 shares during the period. 84.29% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on SJW. StockNews.com downgraded shares of SJW Group from a "hold" rating to a "sell" rating in a research report on Tuesday, October 29th. Wells Fargo & Company decreased their price objective on shares of SJW Group from $63.00 to $61.00 and set an "equal weight" rating for the company in a research report on Tuesday, October 29th. Finally, Bank of America began coverage on shares of SJW Group in a research report on Friday, September 20th. They issued a "neutral" rating and a $65.00 price objective for the company.

Read Our Latest Report on SJW

SJW Group Price Performance

Shares of SJW stock traded up $0.44 on Friday, reaching $55.72. 96,968 shares of the company were exchanged, compared to its average volume of 190,956. The company has a market cap of $1.82 billion, a price-to-earnings ratio of 20.19, a P/E/G ratio of 3.32 and a beta of 0.63. The business has a 50-day moving average price of $56.75 and a 200 day moving average price of $56.98. The company has a debt-to-equity ratio of 1.25, a quick ratio of 0.77 and a current ratio of 0.77. SJW Group has a 1 year low of $51.17 and a 1 year high of $70.43.

SJW Group Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Monday, December 2nd. Stockholders of record on Monday, November 4th will be paid a dividend of $0.40 per share. The ex-dividend date is Monday, November 4th. This represents a $1.60 dividend on an annualized basis and a dividend yield of 2.87%. SJW Group's dividend payout ratio is currently 57.97%.

About SJW Group

(

Free Report)

SJW Group, through its subsidiaries, provides water utility and other related services in the United States. It operates in Water Utility Services and Real Estate Services segments. The company engages in the production, purchase, storage, purification, distribution, wholesale, and retail sale of water and wastewater services; and supplies groundwater from wells, surface water from watershed run-off and diversion, reclaimed water, and imported water purchased from the Santa Clara Valley Water District.

Read More

Before you consider SJW Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SJW Group wasn't on the list.

While SJW Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.