10x Genomics (NASDAQ:TXG - Free Report) had its price target lowered by Barclays from $19.00 to $18.00 in a research note released on Monday,Benzinga reports. The firm currently has an overweight rating on the stock.

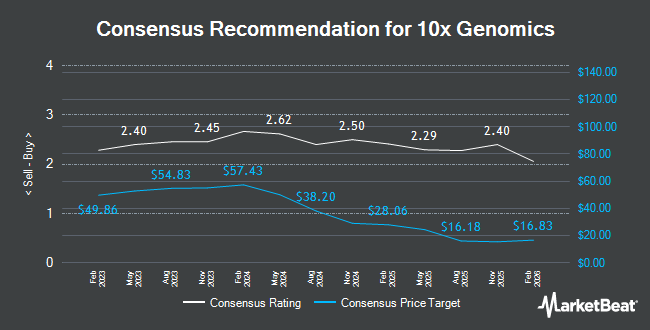

A number of other research analysts have also weighed in on the company. UBS Group reduced their target price on 10x Genomics from $25.00 to $20.00 and set a "neutral" rating for the company in a report on Wednesday, October 30th. Citigroup reduced their target price on 10x Genomics from $35.00 to $23.00 and set a "buy" rating for the company in a report on Wednesday, October 30th. JPMorgan Chase & Co. reduced their target price on 10x Genomics from $20.00 to $14.00 and set a "neutral" rating for the company in a report on Wednesday, October 30th. Morgan Stanley reduced their target price on 10x Genomics from $30.00 to $28.00 and set an "overweight" rating for the company in a report on Monday, January 13th. Finally, The Goldman Sachs Group reduced their target price on 10x Genomics from $16.00 to $14.00 and set a "sell" rating for the company in a report on Wednesday, October 30th. One analyst has rated the stock with a sell rating, nine have given a hold rating and seven have assigned a buy rating to the stock. Based on data from MarketBeat.com, 10x Genomics presently has an average rating of "Hold" and a consensus price target of $20.57.

Read Our Latest Stock Analysis on 10x Genomics

10x Genomics Trading Up 3.1 %

Shares of TXG stock traded up $0.37 on Monday, hitting $12.31. 4,354,670 shares of the stock were exchanged, compared to its average volume of 2,516,614. The firm has a market capitalization of $1.49 billion, a PE ratio of -8.05 and a beta of 1.85. 10x Genomics has a one year low of $10.80 and a one year high of $51.22. The firm's 50 day moving average is $14.68 and its two-hundred day moving average is $17.37.

10x Genomics (NASDAQ:TXG - Get Free Report) last posted its earnings results on Wednesday, February 12th. The company reported ($0.40) earnings per share for the quarter, missing analysts' consensus estimates of ($0.32) by ($0.08). 10x Genomics had a negative net margin of 28.93% and a negative return on equity of 25.07%. On average, sell-side analysts expect that 10x Genomics will post -1.43 earnings per share for the current year.

Institutional Trading of 10x Genomics

A number of hedge funds have recently bought and sold shares of TXG. Signaturefd LLC lifted its position in 10x Genomics by 424.6% in the 4th quarter. Signaturefd LLC now owns 1,794 shares of the company's stock worth $26,000 after buying an additional 1,452 shares during the last quarter. GAMMA Investing LLC lifted its position in 10x Genomics by 451.8% in the 3rd quarter. GAMMA Investing LLC now owns 1,545 shares of the company's stock worth $35,000 after buying an additional 1,265 shares during the last quarter. Capital Performance Advisors LLP bought a new stake in 10x Genomics in the 3rd quarter worth approximately $35,000. Blue Trust Inc. lifted its position in 10x Genomics by 136.5% in the 3rd quarter. Blue Trust Inc. now owns 1,776 shares of the company's stock worth $40,000 after buying an additional 1,025 shares during the last quarter. Finally, Sound Income Strategies LLC bought a new stake in 10x Genomics in the 3rd quarter worth approximately $46,000. Institutional investors own 84.68% of the company's stock.

10x Genomics Company Profile

(

Get Free Report)

10x Genomics, Inc, a life science technology company, develops and sells instruments, consumables, and software for analyzing biological systems in the America, Europe, the Middle East, Africa, China, and the Asia Pacific. The company provides chromium, chromium connect, and chromium controller instruments, microfluidic chips, slides, reagents, and other consumables products.

See Also

Before you consider 10x Genomics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 10x Genomics wasn't on the list.

While 10x Genomics currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.