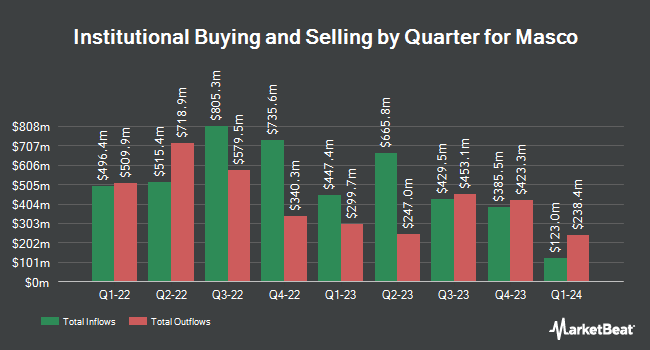

Inceptionr LLC bought a new position in Masco Co. (NYSE:MAS - Free Report) in the 4th quarter, according to the company in its most recent filing with the SEC. The institutional investor bought 11,406 shares of the construction company's stock, valued at approximately $828,000.

Several other institutional investors have also recently made changes to their positions in MAS. State Street Corp grew its stake in Masco by 1.9% in the 3rd quarter. State Street Corp now owns 10,294,294 shares of the construction company's stock valued at $864,103,000 after purchasing an additional 194,297 shares during the period. Van ECK Associates Corp increased its holdings in Masco by 10.2% during the fourth quarter. Van ECK Associates Corp now owns 3,250,400 shares of the construction company's stock worth $235,881,000 after buying an additional 299,520 shares during the last quarter. Nordea Investment Management AB boosted its stake in Masco by 21.0% in the fourth quarter. Nordea Investment Management AB now owns 2,997,839 shares of the construction company's stock valued at $218,063,000 after acquiring an additional 520,555 shares during the last quarter. Empower Advisory Group LLC grew its position in shares of Masco by 2.0% during the 4th quarter. Empower Advisory Group LLC now owns 1,016,079 shares of the construction company's stock valued at $73,737,000 after acquiring an additional 20,129 shares during the period. Finally, Victory Capital Management Inc. increased its stake in shares of Masco by 8.6% during the 3rd quarter. Victory Capital Management Inc. now owns 922,566 shares of the construction company's stock worth $77,440,000 after purchasing an additional 73,405 shares during the last quarter. Institutional investors own 93.91% of the company's stock.

Insider Transactions at Masco

In related news, CEO Keith J. Allman sold 21,723 shares of the stock in a transaction on Wednesday, February 26th. The shares were sold at an average price of $76.36, for a total transaction of $1,658,768.28. Following the transaction, the chief executive officer now owns 60,267 shares of the company's stock, valued at approximately $4,601,988.12. This trade represents a 26.49 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 1.10% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have weighed in on the company. Royal Bank of Canada reissued a "sector perform" rating and set a $74.00 price objective on shares of Masco in a report on Wednesday, February 12th. UBS Group decreased their price objective on Masco from $94.00 to $91.00 and set a "buy" rating for the company in a report on Wednesday, February 12th. Jefferies Financial Group downgraded shares of Masco from a "buy" rating to a "hold" rating and dropped their price objective for the company from $96.00 to $89.00 in a report on Monday, December 16th. Zelman & Associates upgraded shares of Masco to a "strong-buy" rating in a research note on Friday, January 17th. Finally, Wells Fargo & Company lowered their price target on shares of Masco from $85.00 to $82.00 and set an "equal weight" rating on the stock in a research report on Tuesday, February 4th. Nine research analysts have rated the stock with a hold rating, six have issued a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $86.32.

Read Our Latest Report on MAS

Masco Price Performance

Shares of NYSE:MAS traded down $2.54 on Tuesday, hitting $71.37. The company's stock had a trading volume of 1,968,332 shares, compared to its average volume of 1,551,630. Masco Co. has a 1 year low of $63.81 and a 1 year high of $86.70. The company has a debt-to-equity ratio of 20.74, a current ratio of 1.75 and a quick ratio of 1.15. The company has a market capitalization of $15.13 billion, a PE ratio of 18.98, a PEG ratio of 1.94 and a beta of 1.24. The company has a 50-day simple moving average of $76.18 and a 200 day simple moving average of $78.73.

Masco (NYSE:MAS - Get Free Report) last announced its earnings results on Tuesday, February 11th. The construction company reported $0.89 earnings per share for the quarter, beating analysts' consensus estimates of $0.88 by $0.01. Masco had a net margin of 10.50% and a return on equity of 838.32%. During the same period in the prior year, the company earned $0.83 EPS. Sell-side analysts forecast that Masco Co. will post 4.34 EPS for the current fiscal year.

Masco Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Monday, March 10th. Shareholders of record on Friday, February 21st were paid a dividend of $0.31 per share. The ex-dividend date of this dividend was Friday, February 21st. This represents a $1.24 annualized dividend and a yield of 1.74%. This is a positive change from Masco's previous quarterly dividend of $0.29. Masco's payout ratio is 32.98%.

Masco Company Profile

(

Free Report)

Masco Corporation designs, manufactures, and distributes home improvement and building products in North America, Europe, and internationally. The company's Plumbing Products segment offers faucets, showerheads, handheld showers, valves, bath hardware and accessories, bathing units, shower bases and enclosures, sinks, toilets, acrylic tubs, shower trays, spas, exercise pools, and fitness systems; brass, copper, and composite plumbing system components; connected water products; thermoplastic solutions, extruded plastic profiles, specialized fabrications, and PEX tubing products; and other non-decorative plumbing products.

See Also

Before you consider Masco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Masco wasn't on the list.

While Masco currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report