Natixis Advisors LLC acquired a new stake in shares of Futu Holdings Limited (NASDAQ:FUTU - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 11,503 shares of the company's stock, valued at approximately $1,100,000.

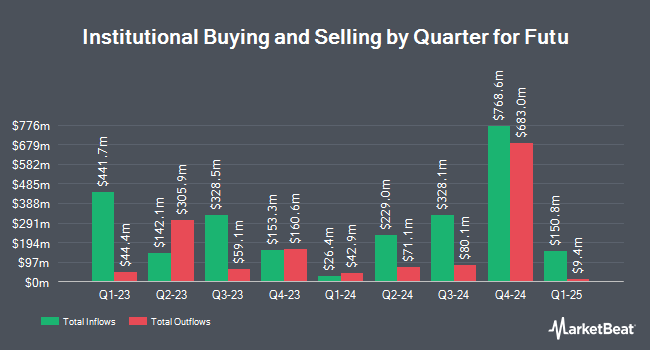

Other institutional investors have also recently added to or reduced their stakes in the company. Allspring Global Investments Holdings LLC purchased a new stake in shares of Futu in the 2nd quarter valued at approximately $50,000. GAMMA Investing LLC grew its position in shares of Futu by 181.5% during the 3rd quarter. GAMMA Investing LLC now owns 594 shares of the company's stock worth $57,000 after buying an additional 383 shares during the period. CWM LLC grew its holdings in Futu by 67.7% during the third quarter. CWM LLC now owns 743 shares of the company's stock valued at $71,000 after purchasing an additional 300 shares during the period. Venturi Wealth Management LLC bought a new position in Futu in the third quarter valued at approximately $92,000. Finally, SG Americas Securities LLC bought a new stake in shares of Futu in the second quarter worth $123,000.

Futu Price Performance

Shares of FUTU stock traded up $2.87 during trading hours on Wednesday, reaching $86.63. 1,331,539 shares of the company traded hands, compared to its average volume of 2,355,996. Futu Holdings Limited has a 12-month low of $43.61 and a 12-month high of $130.50. The company has a market cap of $11.94 billion, a P/E ratio of 20.53, a P/E/G ratio of 0.86 and a beta of 0.75. The firm has a 50-day moving average price of $93.90 and a 200 day moving average price of $75.91.

Wall Street Analysts Forecast Growth

A number of research firms have recently commented on FUTU. Citigroup cut shares of Futu from a "buy" rating to a "neutral" rating and increased their target price for the stock from $79.00 to $95.00 in a report on Tuesday, November 19th. Morgan Stanley upgraded Futu from an "equal weight" rating to an "overweight" rating and increased their target price for the stock from $70.00 to $115.00 in a report on Monday, November 18th. Finally, Bank of America lifted their price objective on shares of Futu from $80.20 to $90.00 and gave the stock a "buy" rating in a report on Friday, September 27th. One equities research analyst has rated the stock with a hold rating and five have assigned a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $87.33.

Get Our Latest Analysis on FUTU

About Futu

(

Free Report)

Futu Holdings Limited provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally. It offers online financial services, including securities and derivative trades brokerage, margin financing and fund distribution services through its Futubull and Moomoo digital platforms.

Featured Articles

Before you consider Futu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Futu wasn't on the list.

While Futu currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.