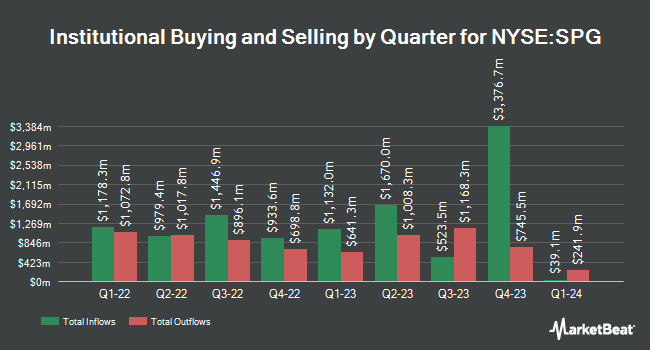

Weiss Asset Management LP purchased a new position in Simon Property Group, Inc. (NYSE:SPG - Free Report) in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 116,616 shares of the real estate investment trust's stock, valued at approximately $19,710,000.

Other hedge funds have also recently made changes to their positions in the company. Wealth Enhancement Advisory Services LLC grew its position in Simon Property Group by 11.9% during the second quarter. Wealth Enhancement Advisory Services LLC now owns 34,054 shares of the real estate investment trust's stock valued at $5,169,000 after buying an additional 3,626 shares during the period. Red Cedar Investment Management LLC grew its position in shares of Simon Property Group by 153.2% during the 3rd quarter. Red Cedar Investment Management LLC now owns 17,591 shares of the real estate investment trust's stock valued at $2,973,000 after acquiring an additional 10,644 shares during the period. TTP Investments Inc. increased its stake in shares of Simon Property Group by 42.0% in the 3rd quarter. TTP Investments Inc. now owns 34,290 shares of the real estate investment trust's stock worth $5,796,000 after purchasing an additional 10,147 shares in the last quarter. Forte Capital LLC ADV bought a new position in Simon Property Group in the 3rd quarter worth $630,000. Finally, Radnor Capital Management LLC bought a new position in Simon Property Group in the 3rd quarter worth $1,602,000. 93.01% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

SPG has been the subject of a number of analyst reports. Mizuho upped their price target on Simon Property Group from $158.00 to $182.00 and gave the stock a "neutral" rating in a research report on Wednesday. Scotiabank lifted their price target on shares of Simon Property Group from $152.00 to $169.00 and gave the company a "sector perform" rating in a report on Monday, August 26th. Stifel Nicolaus reissued a "hold" rating and issued a $159.00 price objective (up from $157.50) on shares of Simon Property Group in a research note on Thursday, September 12th. Evercore ISI upgraded shares of Simon Property Group from an "in-line" rating to an "outperform" rating and lifted their target price for the company from $160.00 to $172.00 in a research note on Monday, September 16th. Finally, Truist Financial upped their target price on shares of Simon Property Group from $147.00 to $158.00 and gave the stock a "hold" rating in a report on Wednesday, August 28th. Seven equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $165.44.

Get Our Latest Research Report on SPG

Insider Buying and Selling at Simon Property Group

In related news, Director Allan B. Hubbard acquired 370 shares of the stock in a transaction dated Monday, September 30th. The stock was acquired at an average cost of $167.30 per share, with a total value of $61,901.00. Following the purchase, the director now directly owns 34,301 shares of the company's stock, valued at approximately $5,738,557.30. This trade represents a 1.09 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. 8.50% of the stock is owned by company insiders.

Simon Property Group Price Performance

Shares of SPG traded up $1.81 during midday trading on Friday, hitting $183.69. 779,895 shares of the company traded hands, compared to its average volume of 1,440,221. The stock has a market cap of $59.93 billion, a price-to-earnings ratio of 24.22, a PEG ratio of 10.55 and a beta of 1.75. The firm has a 50 day moving average of $175.34 and a 200-day moving average of $162.19. The company has a debt-to-equity ratio of 8.20, a quick ratio of 2.00 and a current ratio of 2.00. Simon Property Group, Inc. has a 52 week low of $129.08 and a 52 week high of $186.00.

Simon Property Group (NYSE:SPG - Get Free Report) last announced its quarterly earnings results on Friday, November 1st. The real estate investment trust reported $1.46 EPS for the quarter, missing analysts' consensus estimates of $3.00 by ($1.54). The firm had revenue of $1.48 billion for the quarter, compared to the consensus estimate of $1.32 billion. Simon Property Group had a net margin of 43.36% and a return on equity of 76.21%. Simon Property Group's quarterly revenue was up 4.9% on a year-over-year basis. During the same period in the previous year, the company posted $3.20 earnings per share. On average, analysts forecast that Simon Property Group, Inc. will post 12.78 EPS for the current fiscal year.

Simon Property Group Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, December 30th. Shareholders of record on Monday, December 9th will be given a dividend of $2.10 per share. The ex-dividend date of this dividend is Monday, December 9th. This represents a $8.40 annualized dividend and a yield of 4.57%. This is a positive change from Simon Property Group's previous quarterly dividend of $2.05. Simon Property Group's dividend payout ratio (DPR) is 109.19%.

About Simon Property Group

(

Free Report)

Simon Property Group, Inc NYSE: SPG is a self-administered and self-managed real estate investment trust (REIT). Simon Property Group, L.P., or the Operating Partnership, is our majority-owned partnership subsidiary that owns all of our real estate properties and other assets. In this package, the terms Simon, we, our, or the Company refer to Simon Property Group, Inc, the Operating Partnership, and its subsidiaries.

Featured Articles

Before you consider Simon Property Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simon Property Group wasn't on the list.

While Simon Property Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.