DRW Securities LLC acquired a new stake in shares of CMS Energy Co. (NYSE:CMS - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 118,681 shares of the utilities provider's stock, valued at approximately $8,382,000.

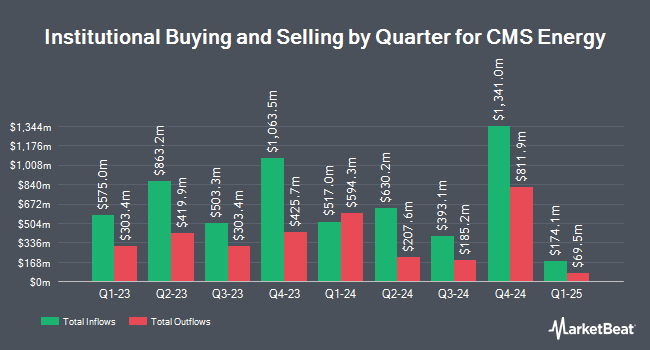

A number of other large investors also recently bought and sold shares of CMS. First Horizon Advisors Inc. raised its position in shares of CMS Energy by 171.9% in the 3rd quarter. First Horizon Advisors Inc. now owns 435 shares of the utilities provider's stock worth $31,000 after acquiring an additional 275 shares in the last quarter. TruNorth Capital Management LLC lifted its position in shares of CMS Energy by 431.3% during the second quarter. TruNorth Capital Management LLC now owns 712 shares of the utilities provider's stock valued at $42,000 after buying an additional 578 shares during the last quarter. Innealta Capital LLC bought a new stake in shares of CMS Energy in the 2nd quarter valued at about $43,000. Covestor Ltd grew its position in shares of CMS Energy by 206.1% in the 3rd quarter. Covestor Ltd now owns 701 shares of the utilities provider's stock worth $50,000 after buying an additional 472 shares during the last quarter. Finally, Values First Advisors Inc. purchased a new stake in CMS Energy during the third quarter valued at approximately $56,000. Institutional investors own 93.57% of the company's stock.

Insider Activity at CMS Energy

In related news, CAO Scott B. Mcintosh sold 936 shares of the stock in a transaction on Thursday, November 21st. The shares were sold at an average price of $68.50, for a total transaction of $64,116.00. Following the completion of the sale, the chief accounting officer now owns 24,417 shares in the company, valued at $1,672,564.50. This represents a 3.69 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, SVP Brandon J. Hofmeister sold 2,000 shares of the company's stock in a transaction dated Monday, November 18th. The shares were sold at an average price of $68.17, for a total transaction of $136,340.00. Following the completion of the sale, the senior vice president now directly owns 64,771 shares of the company's stock, valued at $4,415,439.07. The trade was a 3.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.40% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

Several research analysts recently issued reports on the company. Mizuho lowered CMS Energy from an "outperform" rating to a "neutral" rating and reduced their target price for the company from $76.00 to $72.00 in a research report on Tuesday, October 15th. Morgan Stanley dropped their target price on CMS Energy from $69.00 to $67.00 and set an "equal weight" rating on the stock in a research report on Friday. StockNews.com cut shares of CMS Energy from a "hold" rating to a "sell" rating in a research note on Wednesday, November 20th. KeyCorp raised their target price on shares of CMS Energy from $73.00 to $76.00 and gave the stock an "overweight" rating in a report on Monday, September 30th. Finally, Scotiabank increased their price target on CMS Energy from $66.00 to $75.00 and gave the stock a "sector outperform" rating in a research report on Tuesday, August 20th. One analyst has rated the stock with a sell rating, six have given a hold rating and ten have given a buy rating to the stock. According to data from MarketBeat, CMS Energy has a consensus rating of "Moderate Buy" and an average price target of $70.21.

Check Out Our Latest Stock Analysis on CMS

CMS Energy Trading Down 0.1 %

Shares of NYSE CMS traded down $0.10 during mid-day trading on Monday, reaching $69.42. 988,001 shares of the company's stock were exchanged, compared to its average volume of 2,266,176. The company's 50-day moving average is $69.72 and its 200-day moving average is $65.52. CMS Energy Co. has a 52-week low of $55.10 and a 52-week high of $72.40. The company has a debt-to-equity ratio of 1.86, a quick ratio of 0.83 and a current ratio of 1.23. The firm has a market capitalization of $20.74 billion, a price-to-earnings ratio of 19.97, a PEG ratio of 2.77 and a beta of 0.41.

CMS Energy (NYSE:CMS - Get Free Report) last released its quarterly earnings results on Thursday, October 31st. The utilities provider reported $0.84 EPS for the quarter, topping the consensus estimate of $0.78 by $0.06. CMS Energy had a return on equity of 12.81% and a net margin of 14.01%. The business had revenue of $1.74 billion during the quarter, compared to analyst estimates of $1.88 billion. During the same period last year, the business posted $0.61 earnings per share. The company's quarterly revenue was up 4.2% on a year-over-year basis. Analysts expect that CMS Energy Co. will post 3.33 EPS for the current fiscal year.

CMS Energy Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, November 27th. Stockholders of record on Wednesday, November 13th will be given a dividend of $0.515 per share. The ex-dividend date of this dividend is Wednesday, November 13th. This represents a $2.06 dividend on an annualized basis and a dividend yield of 2.97%. This is a positive change from CMS Energy's previous quarterly dividend of $0.51. CMS Energy's dividend payout ratio is currently 58.86%.

About CMS Energy

(

Free Report)

CMS Energy Corporation operates as an energy company primarily in Michigan. The company operates through three segments: Electric Utility; Gas Utility; and Enterprises. The Electric Utility segment is involved in the generation, purchase, transmission, distribution, and sale of electricity. This segment generates electricity through coal, wind, gas, renewable energy, oil, and nuclear sources.

Further Reading

Before you consider CMS Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CMS Energy wasn't on the list.

While CMS Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.