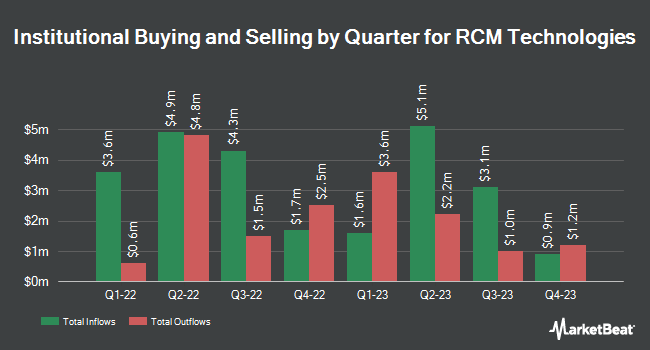

Pacific Ridge Capital Partners LLC purchased a new position in shares of RCM Technologies, Inc. (NASDAQ:RCMT - Free Report) during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 120,386 shares of the business services provider's stock, valued at approximately $2,668,000. Pacific Ridge Capital Partners LLC owned approximately 1.58% of RCM Technologies as of its most recent SEC filing.

Other large investors have also made changes to their positions in the company. State Street Corp increased its holdings in shares of RCM Technologies by 6.7% in the third quarter. State Street Corp now owns 25,555 shares of the business services provider's stock worth $518,000 after acquiring an additional 1,600 shares in the last quarter. JPMorgan Chase & Co. grew its position in shares of RCM Technologies by 16.6% in the 3rd quarter. JPMorgan Chase & Co. now owns 11,539 shares of the business services provider's stock valued at $234,000 after purchasing an additional 1,639 shares during the period. BNP Paribas Financial Markets bought a new stake in RCM Technologies during the 3rd quarter worth approximately $48,000. Klein Pavlis & Peasley Financial Inc. raised its holdings in RCM Technologies by 60.5% during the 4th quarter. Klein Pavlis & Peasley Financial Inc. now owns 20,881 shares of the business services provider's stock worth $463,000 after buying an additional 7,869 shares during the period. Finally, Barclays PLC bought a new position in RCM Technologies in the third quarter valued at approximately $180,000. Institutional investors own 43.20% of the company's stock.

RCM Technologies Stock Down 0.8 %

RCMT stock traded down $0.13 during midday trading on Monday, hitting $15.73. The company's stock had a trading volume of 4,904 shares, compared to its average volume of 52,119. The company's fifty day moving average price is $18.39 and its 200 day moving average price is $20.55. RCM Technologies, Inc. has a twelve month low of $13.18 and a twelve month high of $26.37. The company has a debt-to-equity ratio of 1.06, a current ratio of 1.63 and a quick ratio of 1.63. The stock has a market capitalization of $119.40 million, a P/E ratio of 8.07 and a beta of 0.58.

RCM Technologies (NASDAQ:RCMT - Get Free Report) last released its earnings results on Wednesday, March 12th. The business services provider reported $0.37 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.74 by ($0.37). The company had revenue of $76.91 million for the quarter, compared to the consensus estimate of $79.00 million. RCM Technologies had a return on equity of 58.70% and a net margin of 5.77%.

Analyst Ratings Changes

Several equities research analysts have recently issued reports on the stock. B. Riley raised shares of RCM Technologies to a "strong-buy" rating in a research report on Tuesday, March 18th. Benchmark dropped their price target on RCM Technologies from $37.00 to $30.00 and set a "buy" rating on the stock in a research note on Friday, March 21st.

View Our Latest Research Report on RCM Technologies

RCM Technologies Profile

(

Free Report)

RCM Technologies, Inc provides business and technology solutions in the United States, Canada, Puerto Rico, and Europe. It operates through three segments: Engineering, Specialty Health Care, and Life Sciences and Information Technology. The Engineering segment offers a range of engineering services, including project management engineering and design, engineering analysis, engineer-procure-construct, configuration management, hardware/software validation and verification, quality assurance, technical writing and publications, manufacturing process planning and improvement, and 3D/BIM integrated design.

Featured Stories

Before you consider RCM Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RCM Technologies wasn't on the list.

While RCM Technologies currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.