Virtu Financial LLC acquired a new stake in Kimberly-Clark Co. (NYSE:KMB - Free Report) in the 4th quarter, according to the company in its most recent disclosure with the SEC. The fund acquired 12,274 shares of the company's stock, valued at approximately $1,608,000.

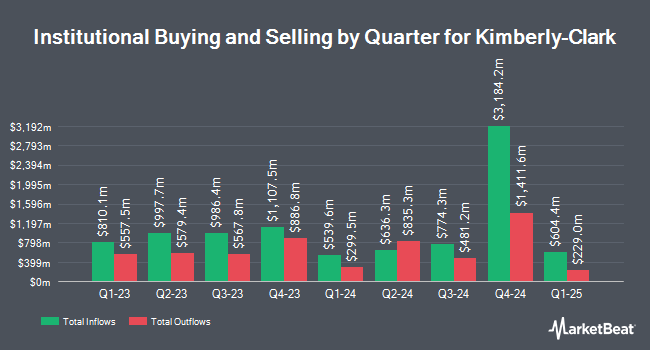

A number of other large investors have also recently bought and sold shares of the business. State Street Corp boosted its position in Kimberly-Clark by 5.9% during the third quarter. State Street Corp now owns 19,304,396 shares of the company's stock worth $2,768,367,000 after purchasing an additional 1,083,824 shares during the period. Charles Schwab Investment Management Inc. raised its stake in shares of Kimberly-Clark by 5.3% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 10,589,967 shares of the company's stock valued at $1,387,709,000 after buying an additional 529,223 shares in the last quarter. Geode Capital Management LLC lifted its stake in Kimberly-Clark by 2.8% during the third quarter. Geode Capital Management LLC now owns 7,675,506 shares of the company's stock worth $1,092,388,000 after purchasing an additional 206,671 shares during the period. Bank of New York Mellon Corp grew its stake in shares of Kimberly-Clark by 1.0% in the 4th quarter. Bank of New York Mellon Corp now owns 3,040,747 shares of the company's stock valued at $398,459,000 after purchasing an additional 30,312 shares during the period. Finally, Nordea Investment Management AB raised its holdings in shares of Kimberly-Clark by 20.4% in the 4th quarter. Nordea Investment Management AB now owns 2,740,525 shares of the company's stock worth $358,625,000 after buying an additional 464,615 shares in the last quarter. 76.29% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

KMB has been the topic of a number of analyst reports. JPMorgan Chase & Co. lowered their price target on Kimberly-Clark from $140.00 to $124.00 and set an "underweight" rating on the stock in a research report on Thursday, January 16th. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $165.00 target price on shares of Kimberly-Clark in a report on Friday, January 24th. StockNews.com raised shares of Kimberly-Clark from a "hold" rating to a "buy" rating in a report on Thursday, March 6th. Citigroup dropped their price objective on shares of Kimberly-Clark from $125.00 to $118.00 and set a "sell" rating for the company in a report on Wednesday, January 15th. Finally, Wells Fargo & Company reduced their target price on Kimberly-Clark from $140.00 to $130.00 and set an "equal weight" rating on the stock in a report on Tuesday, January 7th. Two investment analysts have rated the stock with a sell rating, eight have issued a hold rating and six have issued a buy rating to the company's stock. According to MarketBeat, Kimberly-Clark has a consensus rating of "Hold" and a consensus target price of $143.64.

Read Our Latest Report on Kimberly-Clark

Kimberly-Clark Trading Down 0.6 %

NYSE:KMB traded down $0.87 on Tuesday, hitting $136.95. 1,061,117 shares of the stock were exchanged, compared to its average volume of 2,037,734. The stock has a market capitalization of $45.42 billion, a price-to-earnings ratio of 18.14, a P/E/G ratio of 4.46 and a beta of 0.36. The company has a debt-to-equity ratio of 7.05, a quick ratio of 0.54 and a current ratio of 0.80. Kimberly-Clark Co. has a 52 week low of $123.84 and a 52 week high of $150.45. The company's 50-day moving average price is $135.09 and its 200 day moving average price is $136.11.

Kimberly-Clark (NYSE:KMB - Get Free Report) last announced its quarterly earnings data on Tuesday, January 28th. The company reported $1.50 earnings per share for the quarter, meeting the consensus estimate of $1.50. Kimberly-Clark had a net margin of 12.69% and a return on equity of 201.43%. On average, equities research analysts forecast that Kimberly-Clark Co. will post 7.5 earnings per share for the current year.

Kimberly-Clark Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, April 2nd. Investors of record on Friday, March 7th will be paid a dividend of $1.26 per share. The ex-dividend date of this dividend is Friday, March 7th. This is a boost from Kimberly-Clark's previous quarterly dividend of $1.22. This represents a $5.04 dividend on an annualized basis and a dividend yield of 3.68%. Kimberly-Clark's payout ratio is 66.75%.

Insider Activity at Kimberly-Clark

In other news, VP Andrew Drexler sold 10,838 shares of the stock in a transaction on Friday, February 28th. The shares were sold at an average price of $141.00, for a total transaction of $1,528,158.00. Following the completion of the sale, the vice president now owns 7,720 shares of the company's stock, valued at $1,088,520. This represents a 58.40 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. 0.64% of the stock is currently owned by corporate insiders.

Kimberly-Clark Profile

(

Free Report)

Kimberly-Clark Corporation, together with its subsidiaries, manufactures and markets personal care and consumer tissue products in the United States. It operates through three segments: Personal Care, Consumer Tissue, and K-C Professional. The company's Personal Care segment offers disposable diapers, training and youth pants, swimpants, baby wipes, feminine and incontinence care products, reusable underwear, and other related products under the Huggies, Pull-Ups, Little Swimmers, GoodNites, DryNites, Sweety, Kotex, U by Kotex, Intimus, Thinx, Poise, Depend, Plenitud, Softex, and other brand names.

Recommended Stories

Before you consider Kimberly-Clark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kimberly-Clark wasn't on the list.

While Kimberly-Clark currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report