Patient Square Capital LP purchased a new position in Intellia Therapeutics, Inc. (NASDAQ:NTLA - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund purchased 128,569 shares of the company's stock, valued at approximately $2,642,000. Intellia Therapeutics comprises 1.0% of Patient Square Capital LP's holdings, making the stock its 8th biggest holding. Patient Square Capital LP owned 0.13% of Intellia Therapeutics as of its most recent SEC filing.

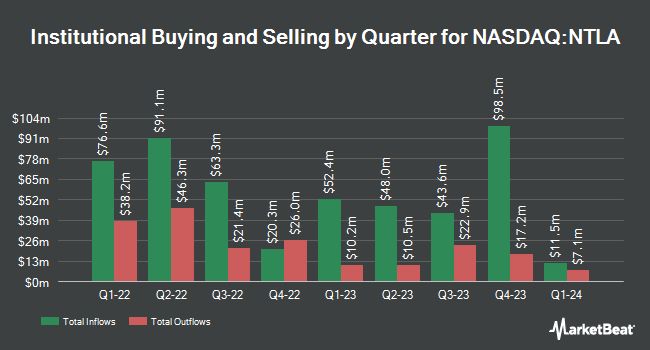

Several other hedge funds have also recently added to or reduced their stakes in NTLA. Blue Trust Inc. grew its position in Intellia Therapeutics by 1,664.3% during the 2nd quarter. Blue Trust Inc. now owns 1,482 shares of the company's stock worth $33,000 after purchasing an additional 1,398 shares in the last quarter. EverSource Wealth Advisors LLC grew its position in Intellia Therapeutics by 763.5% during the 2nd quarter. EverSource Wealth Advisors LLC now owns 1,753 shares of the company's stock worth $39,000 after purchasing an additional 1,550 shares in the last quarter. Eastern Bank purchased a new position in Intellia Therapeutics during the 3rd quarter worth approximately $41,000. First Horizon Advisors Inc. grew its position in Intellia Therapeutics by 22.1% during the 2nd quarter. First Horizon Advisors Inc. now owns 2,604 shares of the company's stock worth $58,000 after purchasing an additional 472 shares in the last quarter. Finally, Values First Advisors Inc. purchased a new position in Intellia Therapeutics during the 3rd quarter worth approximately $54,000. Institutional investors and hedge funds own 88.77% of the company's stock.

Intellia Therapeutics Stock Performance

Shares of NTLA traded down $0.16 during trading hours on Wednesday, reaching $14.49. 1,589,543 shares of the company traded hands, compared to its average volume of 1,747,786. The stock's fifty day moving average is $17.00 and its 200 day moving average is $21.19. The stock has a market cap of $1.48 billion, a P/E ratio of -2.66 and a beta of 1.76. Intellia Therapeutics, Inc. has a 1-year low of $12.82 and a 1-year high of $34.87.

Intellia Therapeutics (NASDAQ:NTLA - Get Free Report) last announced its quarterly earnings data on Thursday, November 7th. The company reported ($1.34) EPS for the quarter, beating analysts' consensus estimates of ($1.37) by $0.03. The company had revenue of $9.10 million for the quarter, compared to analyst estimates of $8.28 million. The firm's quarterly revenue was down 24.1% on a year-over-year basis. During the same period in the prior year, the company posted ($1.38) EPS. On average, equities research analysts predict that Intellia Therapeutics, Inc. will post -5.12 EPS for the current year.

Analysts Set New Price Targets

Several equities analysts have weighed in on NTLA shares. Royal Bank of Canada reiterated an "outperform" rating and set a $54.00 price objective on shares of Intellia Therapeutics in a research report on Thursday, September 19th. William Blair reiterated a "neutral" rating and set a $14.00 price objective on shares of Intellia Therapeutics in a research report on Monday, November 18th. StockNews.com upgraded shares of Intellia Therapeutics to a "sell" rating in a report on Friday, November 8th. Robert W. Baird lowered their price target on shares of Intellia Therapeutics from $24.00 to $18.00 and set a "neutral" rating on the stock in a report on Friday, October 25th. Finally, Barclays lowered their price target on shares of Intellia Therapeutics from $76.00 to $55.00 and set an "overweight" rating on the stock in a report on Friday, November 8th. One equities research analyst has rated the stock with a sell rating, six have given a hold rating, eleven have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $54.94.

Get Our Latest Analysis on NTLA

Insider Activity at Intellia Therapeutics

In other Intellia Therapeutics news, CAO Michael P. Dube sold 2,012 shares of the company's stock in a transaction dated Wednesday, October 2nd. The shares were sold at an average price of $19.01, for a total transaction of $38,248.12. Following the sale, the chief accounting officer now directly owns 47,012 shares of the company's stock, valued at approximately $893,698.12. This represents a 4.10 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. 3.20% of the stock is currently owned by insiders.

Intellia Therapeutics Profile

(

Free Report)

Intellia Therapeutics, Inc, a genome editing company, focuses on the development of curative therapeutics. The company's in vivo programs include NTLA-2001, which is in Phase 1 clinical trial for the treatment of transthyretin amyloidosis; NTLA-2002 for the treatment of hereditary angioedema; and NTLA-3001 for alpha-1 antitrypsin deficiency associated lung disease.

Featured Stories

Before you consider Intellia Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intellia Therapeutics wasn't on the list.

While Intellia Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.