FORA Capital LLC acquired a new stake in Trupanion, Inc. (NASDAQ:TRUP - Free Report) in the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund acquired 12,869 shares of the financial services provider's stock, valued at approximately $540,000.

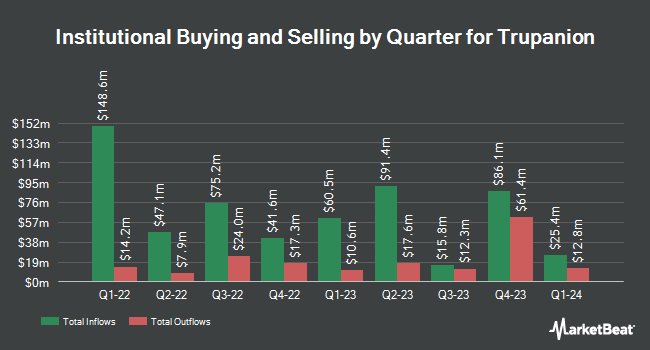

A number of other institutional investors and hedge funds have also recently made changes to their positions in TRUP. Vanguard Group Inc. grew its position in Trupanion by 0.9% during the first quarter. Vanguard Group Inc. now owns 3,673,791 shares of the financial services provider's stock worth $101,433,000 after buying an additional 32,485 shares in the last quarter. CANADA LIFE ASSURANCE Co raised its stake in Trupanion by 2.0% in the first quarter. CANADA LIFE ASSURANCE Co now owns 43,060 shares of the financial services provider's stock valued at $1,188,000 after purchasing an additional 830 shares in the last quarter. Price T Rowe Associates Inc. MD lifted its position in Trupanion by 14.6% during the first quarter. Price T Rowe Associates Inc. MD now owns 11,325 shares of the financial services provider's stock worth $313,000 after purchasing an additional 1,441 shares during the period. Bayesian Capital Management LP bought a new stake in Trupanion during the first quarter worth about $253,000. Finally, SG Americas Securities LLC grew its stake in Trupanion by 160.2% during the second quarter. SG Americas Securities LLC now owns 71,012 shares of the financial services provider's stock worth $2,088,000 after buying an additional 43,720 shares in the last quarter.

Wall Street Analysts Forecast Growth

TRUP has been the subject of a number of recent analyst reports. Bank of America upped their price target on shares of Trupanion from $47.00 to $56.00 and gave the stock a "buy" rating in a report on Friday, September 20th. Evercore ISI upgraded Trupanion to a "strong-buy" rating in a research note on Friday, August 9th. Stifel Nicolaus lifted their price target on Trupanion from $30.00 to $40.00 and gave the company a "hold" rating in a research note on Monday, September 23rd. Piper Sandler boosted their price target on Trupanion from $45.00 to $57.00 and gave the stock a "neutral" rating in a report on Thursday, October 31st. Finally, Northland Securities raised their price objective on Trupanion from $45.00 to $50.00 and gave the company a "market perform" rating in a research note on Thursday, October 31st. Three analysts have rated the stock with a hold rating, three have issued a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $44.67.

View Our Latest Research Report on Trupanion

Trupanion Price Performance

TRUP stock traded down $0.19 during midday trading on Friday, reaching $53.31. 288,858 shares of the stock were exchanged, compared to its average volume of 675,556. The company has a debt-to-equity ratio of 0.40, a current ratio of 1.66 and a quick ratio of 1.66. The stock has a market capitalization of $2.26 billion, a PE ratio of -166.59 and a beta of 1.69. Trupanion, Inc. has a 52 week low of $19.69 and a 52 week high of $57.90. The company has a fifty day moving average price of $49.94 and a 200 day moving average price of $40.22.

Trupanion (NASDAQ:TRUP - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The financial services provider reported $0.03 earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.06) by $0.09. Trupanion had a negative return on equity of 4.36% and a negative net margin of 1.08%. The company had revenue of $327.50 million during the quarter, compared to the consensus estimate of $321.79 million. During the same quarter in the prior year, the firm posted ($0.10) earnings per share. The firm's revenue was up 14.6% compared to the same quarter last year. As a group, analysts expect that Trupanion, Inc. will post -0.23 EPS for the current fiscal year.

Insiders Place Their Bets

In related news, CFO Fawwad Qureshi sold 622 shares of Trupanion stock in a transaction on Tuesday, November 26th. The shares were sold at an average price of $52.61, for a total transaction of $32,723.42. Following the completion of the transaction, the chief financial officer now owns 9,867 shares of the company's stock, valued at $519,102.87. This trade represents a 5.93 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, Director Murray B. Low sold 2,000 shares of the company's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $52.67, for a total transaction of $105,340.00. Following the sale, the director now directly owns 131,513 shares in the company, valued at $6,926,789.71. This trade represents a 1.50 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 18,538 shares of company stock valued at $988,741. 5.50% of the stock is currently owned by company insiders.

Trupanion Profile

(

Free Report)

Trupanion, Inc, together with its subsidiaries, provides medical insurance for cats and dogs on a monthly subscription basis in the United States, Canada, Continental Europe, and Australia. The company operates in two segments, Subscription Business and Other Business. It serves pet owners and veterinarians.

See Also

Before you consider Trupanion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trupanion wasn't on the list.

While Trupanion currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.