Wellington Management Group LLP bought a new stake in Hayward Holdings, Inc. (NYSE:HAYW - Free Report) during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The firm bought 1,329,270 shares of the company's stock, valued at approximately $20,391,000. Wellington Management Group LLP owned about 0.62% of Hayward as of its most recent filing with the Securities & Exchange Commission.

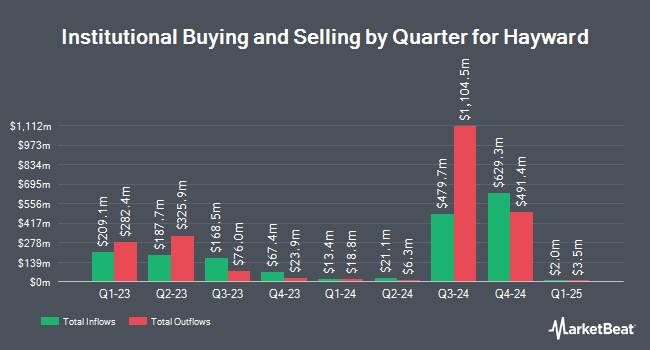

A number of other large investors have also modified their holdings of HAYW. Equitable Trust Co. increased its position in shares of Hayward by 2.3% during the 3rd quarter. Equitable Trust Co. now owns 33,843 shares of the company's stock valued at $519,000 after purchasing an additional 749 shares during the period. Zurcher Kantonalbank Zurich Cantonalbank boosted its stake in shares of Hayward by 2.8% during the 2nd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 28,642 shares of the company's stock worth $352,000 after acquiring an additional 784 shares in the last quarter. CIBC Asset Management Inc raised its position in shares of Hayward by 5.4% during the third quarter. CIBC Asset Management Inc now owns 15,412 shares of the company's stock worth $236,000 after purchasing an additional 784 shares during the period. Arizona State Retirement System lifted its holdings in shares of Hayward by 2.2% during the second quarter. Arizona State Retirement System now owns 41,998 shares of the company's stock valued at $517,000 after purchasing an additional 887 shares during the last quarter. Finally, Louisiana State Employees Retirement System boosted its position in shares of Hayward by 2.2% in the 2nd quarter. Louisiana State Employees Retirement System now owns 63,800 shares of the company's stock valued at $785,000 after purchasing an additional 1,400 shares during the period.

Hayward Stock Performance

HAYW stock traded down $0.27 during midday trading on Friday, hitting $16.25. The stock had a trading volume of 2,151,603 shares, compared to its average volume of 1,543,524. The company has a current ratio of 2.62, a quick ratio of 1.69 and a debt-to-equity ratio of 0.70. The stock has a 50-day simple moving average of $15.75 and a 200 day simple moving average of $14.45. Hayward Holdings, Inc. has a 52 week low of $11.81 and a 52 week high of $16.87. The firm has a market capitalization of $3.50 billion, a price-to-earnings ratio of 38.67, a P/E/G ratio of 2.28 and a beta of 1.16.

Hayward (NYSE:HAYW - Get Free Report) last issued its quarterly earnings data on Tuesday, October 29th. The company reported $0.11 earnings per share for the quarter, topping the consensus estimate of $0.10 by $0.01. Hayward had a net margin of 9.47% and a return on equity of 9.93%. The firm had revenue of $227.57 million for the quarter, compared to analysts' expectations of $222.88 million. During the same period in the prior year, the firm earned $0.08 earnings per share. The company's quarterly revenue was up 3.3% compared to the same quarter last year. As a group, equities research analysts anticipate that Hayward Holdings, Inc. will post 0.61 earnings per share for the current year.

Wall Street Analyst Weigh In

Several research analysts have recently weighed in on the stock. Robert W. Baird lifted their target price on shares of Hayward from $19.00 to $20.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 30th. Stifel Nicolaus raised their price objective on shares of Hayward from $15.50 to $16.00 and gave the company a "hold" rating in a research report on Monday, October 28th. KeyCorp upped their price target on Hayward from $17.00 to $18.00 and gave the stock an "overweight" rating in a research note on Wednesday, October 30th. Finally, The Goldman Sachs Group raised their price objective on Hayward from $14.00 to $16.00 and gave the company a "neutral" rating in a research note on Wednesday, October 30th. Four analysts have rated the stock with a hold rating and one has issued a buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and an average target price of $16.80.

Get Our Latest Analysis on HAYW

Insiders Place Their Bets

In other news, CEO Kevin Holleran sold 100,000 shares of the company's stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $15.96, for a total value of $1,596,000.00. Following the completion of the sale, the chief executive officer now directly owns 522,799 shares of the company's stock, valued at $8,343,872.04. This represents a 16.06 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, CFO Eifion Jones sold 75,000 shares of Hayward stock in a transaction on Friday, November 8th. The stock was sold at an average price of $16.11, for a total transaction of $1,208,250.00. Following the transaction, the chief financial officer now directly owns 258,903 shares in the company, valued at approximately $4,170,927.33. This represents a 22.46 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 3.25% of the company's stock.

Hayward Company Profile

(

Free Report)

Hayward Holdings, Inc designs, manufactures, and markets a portfolio of pool equipment and associated automation systems in North America, Europe, and internationally. The company offers pool equipment, including pumps, filters, robotics, suction and pressure cleaners, gas heaters and heat pumps, water features and landscape lighting, water sanitizers, salt chlorine generators, safety equipment, and in-floor automated cleaning systems, as well as LED illumination solutions.

See Also

Before you consider Hayward, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hayward wasn't on the list.

While Hayward currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.