Trust Point Inc. purchased a new position in Masimo Co. (NASDAQ:MASI - Free Report) during the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor purchased 1,390 shares of the medical equipment provider's stock, valued at approximately $230,000.

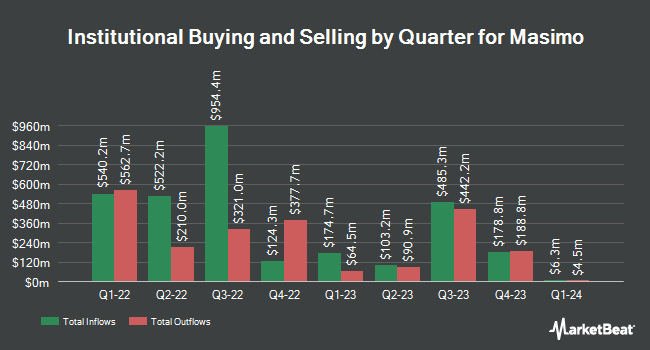

A number of other hedge funds have also modified their holdings of MASI. Greenleaf Trust purchased a new position in Masimo in the fourth quarter valued at about $208,000. KBC Group NV lifted its holdings in shares of Masimo by 1,393.9% during the 4th quarter. KBC Group NV now owns 19,122 shares of the medical equipment provider's stock valued at $3,161,000 after buying an additional 17,842 shares during the last quarter. Blue Trust Inc. grew its stake in shares of Masimo by 56.3% in the 4th quarter. Blue Trust Inc. now owns 197 shares of the medical equipment provider's stock valued at $33,000 after buying an additional 71 shares in the last quarter. B.O.S.S. Retirement Advisors LLC acquired a new position in Masimo in the fourth quarter worth approximately $881,000. Finally, apricus wealth LLC bought a new position in Masimo during the fourth quarter valued at approximately $215,000. 85.96% of the stock is owned by institutional investors and hedge funds.

Masimo Stock Performance

Shares of NASDAQ MASI traded up $2.25 during trading hours on Monday, hitting $178.41. 429,092 shares of the company's stock were exchanged, compared to its average volume of 472,484. The company's 50-day moving average price is $171.63 and its 200-day moving average price is $147.36. Masimo Co. has a 1-year low of $101.61 and a 1-year high of $183.14. The stock has a market capitalization of $9.55 billion, a price-to-earnings ratio of 123.04 and a beta of 1.02. The company has a debt-to-equity ratio of 0.50, a current ratio of 2.01 and a quick ratio of 1.11.

Wall Street Analysts Forecast Growth

Several research analysts have recently commented on MASI shares. Raymond James increased their price target on shares of Masimo from $170.00 to $194.00 and gave the stock an "outperform" rating in a research note on Friday, December 27th. BTIG Research increased their target price on shares of Masimo from $166.00 to $170.00 and gave the stock a "buy" rating in a research report on Monday, October 14th. Piper Sandler boosted their price target on Masimo from $180.00 to $210.00 and gave the stock an "overweight" rating in a research report on Wednesday, December 18th. Needham & Company LLC reissued a "hold" rating on shares of Masimo in a report on Wednesday, January 22nd. Finally, Wells Fargo & Company boosted their target price on Masimo from $171.00 to $193.00 and gave the stock an "overweight" rating in a report on Wednesday, December 11th. Two equities research analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $191.40.

Check Out Our Latest Analysis on MASI

Masimo Profile

(

Free Report)

Masimo Corporation develops, manufactures, and markets various patient monitoring technologies, and automation and connectivity solutions worldwide. The company offers masimo signal extraction technology (SET) pulse oximetry with measure-through motion and low perfusion pulse oximetry monitoring to address the primary limitations of conventional pulse oximetry; Masimo rainbow SET platform, including rainbow SET Pulse CO-Oximetry products that allows noninvasive monitoring of carboxyhemoglobin, methemoglobin, hemoglobin concentration, fractional arterial oxygen saturation, oxygen content, pleth variability index, rainbow pleth variability index, respiration rate from the pleth, and oxygen reserve index, as well as acoustic respiration monitoring, SedLine brain function monitoring, NomoLine capnography and gas monitoring, and regional oximetry.

Featured Stories

Before you consider Masimo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Masimo wasn't on the list.

While Masimo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.