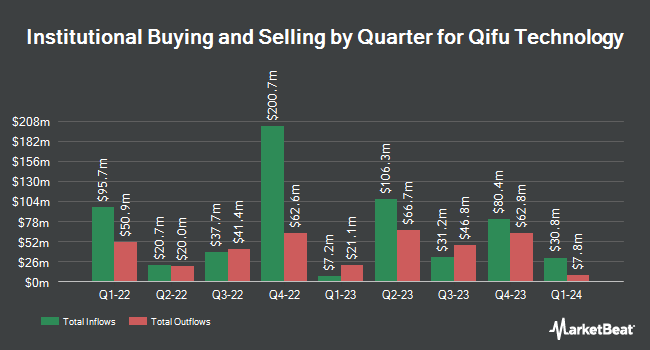

HighTower Advisors LLC bought a new stake in shares of Qifu Technology, Inc. (NASDAQ:QFIN - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor bought 14,661 shares of the company's stock, valued at approximately $563,000.

A number of other institutional investors and hedge funds have also recently modified their holdings of QFIN. Jones Financial Companies Lllp bought a new stake in shares of Qifu Technology during the fourth quarter valued at approximately $29,000. Wilmington Savings Fund Society FSB bought a new stake in Qifu Technology during the 3rd quarter worth approximately $30,000. Advisors Preferred LLC bought a new position in Qifu Technology during the 4th quarter valued at $41,000. Point72 DIFC Ltd bought a new position in shares of Qifu Technology during the third quarter valued at about $43,000. Finally, Global Retirement Partners LLC boosted its stake in shares of Qifu Technology by 80.2% in the 4th quarter. Global Retirement Partners LLC now owns 1,164 shares of the company's stock worth $45,000 after buying an additional 518 shares during the last quarter. 74.81% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Separately, Bank of America lifted their price objective on shares of Qifu Technology from $50.66 to $52.70 and gave the stock a "buy" rating in a research report on Wednesday, March 26th.

Check Out Our Latest Report on Qifu Technology

Qifu Technology Stock Performance

NASDAQ QFIN traded up $1.58 on Wednesday, hitting $45.87. 1,546,947 shares of the stock traded hands, compared to its average volume of 1,437,177. The firm has a market capitalization of $7.23 billion, a price-to-earnings ratio of 9.29, a PEG ratio of 0.32 and a beta of 0.59. The business's fifty day moving average is $42.62 and its two-hundred day moving average is $37.20. Qifu Technology, Inc. has a 12 month low of $17.76 and a 12 month high of $48.94.

Qifu Technology (NASDAQ:QFIN - Get Free Report) last posted its quarterly earnings results on Sunday, March 16th. The company reported $1.82 earnings per share for the quarter, topping the consensus estimate of $1.68 by $0.14. Qifu Technology had a return on equity of 24.39% and a net margin of 31.82%. The company had revenue of $613.89 million during the quarter, compared to the consensus estimate of $581.67 million. Analysts expect that Qifu Technology, Inc. will post 5.71 EPS for the current fiscal year.

Qifu Technology Increases Dividend

The firm also recently declared a semi-annual dividend, which will be paid on Monday, June 2nd. Stockholders of record on Wednesday, April 23rd will be given a $0.70 dividend. The ex-dividend date of this dividend is Wednesday, April 23rd. This represents a dividend yield of 2.5%. This is a positive change from Qifu Technology's previous semi-annual dividend of $0.60. Qifu Technology's payout ratio is 23.79%.

Qifu Technology Profile

(

Free Report)

Qifu Technology, Inc, through its subsidiaries, operates credit-tech platform under the 360 Jietiao brand in the People's Republic of China. It provides credit-driven services that matches borrowers with financial institutions to conduct customer acquisition, initial and credit screening, advanced risk assessment, credit assessment, fund matching, and other post-facilitation services; and platform services, including loan facilitation and post-facilitation services to financial institution partners under intelligence credit engine, referral services, and risk management software-as-a-service.

See Also

Before you consider Qifu Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Qifu Technology wasn't on the list.

While Qifu Technology currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.