Dai ichi Life Insurance Company Ltd purchased a new stake in Intapp, Inc. (NASDAQ:INTA - Free Report) during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 148,813 shares of the company's stock, valued at approximately $7,118,000. Dai ichi Life Insurance Company Ltd owned approximately 0.19% of Intapp at the end of the most recent reporting period.

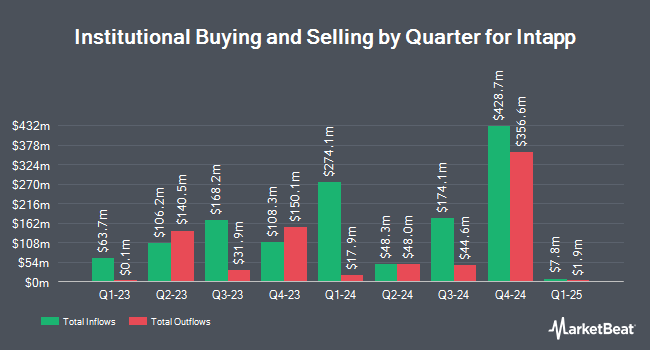

A number of other hedge funds and other institutional investors also recently bought and sold shares of INTA. Sei Investments Co. boosted its stake in shares of Intapp by 13.4% during the 1st quarter. Sei Investments Co. now owns 13,858 shares of the company's stock worth $475,000 after acquiring an additional 1,638 shares in the last quarter. Vanguard Group Inc. increased its position in shares of Intapp by 42.7% in the first quarter. Vanguard Group Inc. now owns 5,014,640 shares of the company's stock valued at $172,002,000 after buying an additional 1,501,091 shares in the last quarter. American International Group Inc. raised its stake in shares of Intapp by 42.6% during the 1st quarter. American International Group Inc. now owns 19,642 shares of the company's stock worth $674,000 after buying an additional 5,864 shares during the last quarter. Advisors Asset Management Inc. boosted its position in shares of Intapp by 239.1% in the 1st quarter. Advisors Asset Management Inc. now owns 824 shares of the company's stock worth $28,000 after buying an additional 581 shares in the last quarter. Finally, California State Teachers Retirement System grew its stake in Intapp by 48.3% in the 1st quarter. California State Teachers Retirement System now owns 43,412 shares of the company's stock valued at $1,489,000 after acquiring an additional 14,138 shares during the last quarter. Institutional investors and hedge funds own 89.96% of the company's stock.

Intapp Price Performance

INTA stock traded down $1.17 during trading on Wednesday, reaching $60.15. 329,434 shares of the stock traded hands, compared to its average volume of 640,332. The business's 50 day moving average price is $51.85 and its 200-day moving average price is $42.69. The firm has a market capitalization of $4.66 billion, a PE ratio of -207.41 and a beta of 0.64. Intapp, Inc. has a 52-week low of $30.36 and a 52-week high of $61.37.

Intapp (NASDAQ:INTA - Get Free Report) last announced its quarterly earnings results on Monday, November 4th. The company reported $0.21 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.13 by $0.08. Intapp had a negative return on equity of 2.08% and a negative net margin of 4.74%. The firm had revenue of $118.81 million during the quarter, compared to the consensus estimate of $117.88 million. During the same period in the prior year, the firm earned ($0.20) EPS. The firm's quarterly revenue was up 17.0% compared to the same quarter last year. On average, equities research analysts predict that Intapp, Inc. will post -0.14 earnings per share for the current year.

Insider Buying and Selling

In other Intapp news, insider Thad Jampol sold 31,666 shares of the firm's stock in a transaction that occurred on Thursday, September 19th. The stock was sold at an average price of $49.09, for a total transaction of $1,554,483.94. Following the completion of the sale, the insider now owns 772,412 shares in the company, valued at $37,917,705.08. This trade represents a 3.94 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, COO Donald F. Coleman sold 58,003 shares of the company's stock in a transaction on Friday, September 20th. The shares were sold at an average price of $49.31, for a total transaction of $2,860,127.93. Following the completion of the sale, the chief operating officer now directly owns 668,239 shares in the company, valued at $32,950,865.09. This represents a 7.99 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 390,215 shares of company stock valued at $21,267,180 in the last quarter. Company insiders own 13.02% of the company's stock.

Wall Street Analyst Weigh In

INTA has been the topic of several research reports. Stifel Nicolaus increased their price target on shares of Intapp from $45.00 to $60.00 and gave the company a "buy" rating in a research report on Monday, September 23rd. JPMorgan Chase & Co. lifted their price objective on Intapp from $52.00 to $58.00 and gave the stock an "overweight" rating in a research report on Tuesday, November 5th. Citigroup upped their target price on shares of Intapp from $52.00 to $63.00 and gave the company a "buy" rating in a report on Wednesday, September 25th. Piper Sandler reiterated an "overweight" rating and set a $60.00 price target (up from $46.00) on shares of Intapp in a report on Tuesday, November 5th. Finally, Bank of America reduced their price objective on shares of Intapp from $52.00 to $48.00 and set a "buy" rating on the stock in a research note on Wednesday, August 14th. Two research analysts have rated the stock with a hold rating and nine have issued a buy rating to the stock. According to data from MarketBeat, Intapp presently has an average rating of "Moderate Buy" and an average target price of $53.55.

View Our Latest Stock Report on Intapp

Intapp Profile

(

Free Report)

Intapp, Inc, through its subsidiary, Integration Appliance, Inc, provides industry-specific cloud-based software solutions for the professional and financial services industry in the United States, the United Kingdom, and internationally. Its solutions include DealCloud, a deal and relationship management solution that manages financial services firms' market relationships, prospective clients and investments, current engagements and deal processes, and operations and compliance activities; collaboration and content solutions, including Intapp documents, an engagement-centric document management system, and Intapp workspaces; risk and compliance management solutions, such as Intapp conflicts, Intapp intake, Intapp terms, Intapp walls, and Intapp employee compliance; and operational and financial management solutions comprising Intapp Billstream, a cloud-based automated proforma invoice solution, Intapp time, and Intapp terms.

Recommended Stories

Before you consider Intapp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intapp wasn't on the list.

While Intapp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report