Colonial River Investments LLC bought a new position in shares of Axon Enterprise, Inc. (NASDAQ:AXON - Free Report) during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm bought 1,491 shares of the biotechnology company's stock, valued at approximately $596,000.

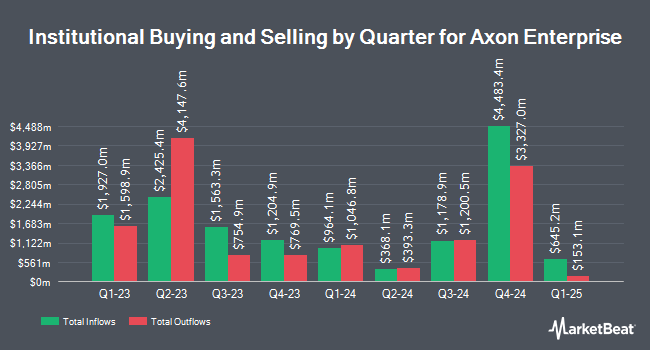

A number of other hedge funds and other institutional investors have also recently bought and sold shares of AXON. Empirical Finance LLC grew its position in Axon Enterprise by 11.2% in the 1st quarter. Empirical Finance LLC now owns 1,023 shares of the biotechnology company's stock valued at $320,000 after buying an additional 103 shares during the last quarter. Envestnet Portfolio Solutions Inc. lifted its holdings in Axon Enterprise by 11.8% in the first quarter. Envestnet Portfolio Solutions Inc. now owns 4,468 shares of the biotechnology company's stock valued at $1,398,000 after acquiring an additional 471 shares during the period. Empowered Funds LLC acquired a new stake in Axon Enterprise in the first quarter valued at $340,000. Oppenheimer & Co. Inc. lifted its holdings in Axon Enterprise by 5.1% in the first quarter. Oppenheimer & Co. Inc. now owns 3,802 shares of the biotechnology company's stock valued at $1,190,000 after acquiring an additional 183 shares during the period. Finally, Concurrent Investment Advisors LLC acquired a new stake in Axon Enterprise in the first quarter valued at $216,000. 79.08% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other Axon Enterprise news, Director Michael Garnreiter sold 1,000 shares of the company's stock in a transaction that occurred on Tuesday, October 15th. The stock was sold at an average price of $437.98, for a total value of $437,980.00. Following the transaction, the director now directly owns 26,259 shares of the company's stock, valued at $11,500,916.82. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. In related news, President Joshua Isner sold 25,811 shares of the company's stock in a transaction on Tuesday, September 10th. The stock was sold at an average price of $359.84, for a total transaction of $9,287,830.24. Following the completion of the transaction, the president now directly owns 228,166 shares in the company, valued at $82,103,253.44. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Michael Garnreiter sold 1,000 shares of the company's stock in a transaction on Tuesday, October 15th. The stock was sold at an average price of $437.98, for a total value of $437,980.00. Following the transaction, the director now owns 26,259 shares of the company's stock, valued at approximately $11,500,916.82. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 369,172 shares of company stock worth $136,270,842 in the last 90 days. 6.10% of the stock is owned by company insiders.

Analyst Upgrades and Downgrades

AXON has been the subject of several research reports. Bank of America initiated coverage on Axon Enterprise in a research note on Wednesday, July 17th. They set a "buy" rating and a $380.00 price target for the company. Needham & Company LLC lifted their price target on Axon Enterprise from $525.00 to $600.00 and gave the stock a "buy" rating in a research note on Friday. Jefferies Financial Group initiated coverage on Axon Enterprise in a research note on Wednesday, July 17th. They set a "buy" rating and a $385.00 price target for the company. The Goldman Sachs Group lifted their price target on Axon Enterprise from $385.00 to $441.00 and gave the stock a "buy" rating in a research note on Wednesday, October 23rd. Finally, Northland Securities lifted their price target on Axon Enterprise from $330.00 to $365.00 and gave the stock an "outperform" rating in a research note on Thursday, August 8th. Two research analysts have rated the stock with a hold rating and twelve have given a buy rating to the company. According to MarketBeat, Axon Enterprise has an average rating of "Moderate Buy" and a consensus price target of $412.42.

Read Our Latest Stock Report on AXON

Axon Enterprise Trading Up 28.7 %

Shares of NASDAQ:AXON traded up $134.43 during trading on Friday, reaching $603.18. 3,966,980 shares of the stock were exchanged, compared to its average volume of 488,426. The company has a debt-to-equity ratio of 0.35, a quick ratio of 2.52 and a current ratio of 2.88. Axon Enterprise, Inc. has a 12-month low of $212.88 and a 12-month high of $611.88. The firm has a market cap of $45.58 billion, a price-to-earnings ratio of 155.86, a price-to-earnings-growth ratio of 15.15 and a beta of 0.94. The firm's 50-day moving average price is $414.16 and its 200 day moving average price is $347.27.

About Axon Enterprise

(

Free Report)

Axon Enterprise, Inc develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally. It operates through two segments, Software and Sensors, and TASER. The company also offers hardware and cloud-based software solutions that enable law enforcement to capture, securely store, manage, share, and analyze video and other digital evidence.

Featured Stories

Before you consider Axon Enterprise, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axon Enterprise wasn't on the list.

While Axon Enterprise currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.