1492 Capital Management LLC lessened its stake in shares of Verona Pharma plc (NASDAQ:VRNA - Free Report) by 37.9% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 100,002 shares of the company's stock after selling 61,053 shares during the quarter. Verona Pharma comprises about 2.2% of 1492 Capital Management LLC's holdings, making the stock its 15th biggest holding. 1492 Capital Management LLC owned 0.13% of Verona Pharma worth $4,644,000 as of its most recent filing with the Securities and Exchange Commission.

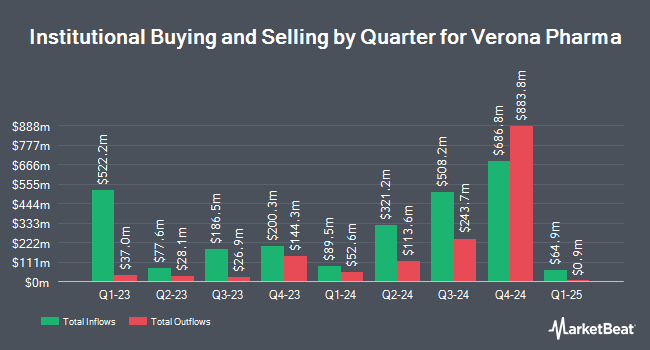

Other large investors also recently bought and sold shares of the company. Wellington Management Group LLP increased its holdings in shares of Verona Pharma by 61.0% in the fourth quarter. Wellington Management Group LLP now owns 3,025,241 shares of the company's stock valued at $140,492,000 after purchasing an additional 1,146,609 shares during the period. Franklin Resources Inc. purchased a new stake in Verona Pharma in the 3rd quarter valued at approximately $16,103,000. Jennison Associates LLC increased its position in Verona Pharma by 8.5% during the 4th quarter. Jennison Associates LLC now owns 1,889,542 shares of the company's stock worth $87,750,000 after purchasing an additional 148,656 shares during the period. Atika Capital Management LLC raised its stake in shares of Verona Pharma by 194.4% during the 4th quarter. Atika Capital Management LLC now owns 212,000 shares of the company's stock worth $9,845,000 after buying an additional 140,000 shares in the last quarter. Finally, Springhill Fund Asset Management HK Co Ltd acquired a new stake in shares of Verona Pharma in the 4th quarter valued at approximately $6,290,000. Institutional investors and hedge funds own 85.88% of the company's stock.

Insiders Place Their Bets

In other Verona Pharma news, insider Kathleen A. Rickard sold 79,264 shares of the company's stock in a transaction that occurred on Wednesday, March 12th. The stock was sold at an average price of $8.35, for a total transaction of $661,854.40. Following the sale, the insider now owns 2,608,976 shares in the company, valued at $21,784,949.60. This represents a 2.95 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through this link. 4.80% of the stock is owned by company insiders.

Wall Street Analyst Weigh In

VRNA has been the topic of several research analyst reports. Cantor Fitzgerald initiated coverage on shares of Verona Pharma in a research report on Monday. They set an "overweight" rating and a $80.00 target price on the stock. Truist Financial reaffirmed a "buy" rating and set a $57.00 price objective (up from $44.00) on shares of Verona Pharma in a report on Wednesday, January 8th. Roth Mkm initiated coverage on shares of Verona Pharma in a research report on Friday, January 10th. They issued a "buy" rating and a $68.00 price objective on the stock. Canaccord Genuity Group raised their price objective on shares of Verona Pharma from $44.00 to $72.00 and gave the stock a "buy" rating in a research note on Wednesday, February 12th. Finally, Wells Fargo & Company boosted their target price on shares of Verona Pharma from $74.00 to $93.00 and gave the company an "overweight" rating in a research note on Friday, February 28th. Six analysts have rated the stock with a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Buy" and an average target price of $75.43.

Read Our Latest Analysis on VRNA

Verona Pharma Stock Up 2.0 %

Shares of Verona Pharma stock traded up $1.25 during trading hours on Wednesday, hitting $63.26. 482,668 shares of the company's stock traded hands, compared to its average volume of 1,214,757. Verona Pharma plc has a twelve month low of $11.39 and a twelve month high of $70.40. The company has a market cap of $5.11 billion, a PE ratio of -32.95 and a beta of 0.16. The company has a quick ratio of 12.88, a current ratio of 13.03 and a debt-to-equity ratio of 0.93. The stock has a 50 day simple moving average of $62.38 and a 200-day simple moving average of $50.00.

Verona Pharma Profile

(

Free Report)

Verona Pharma plc, a clinical stage biopharmaceutical company, focuses on development and commercialization of therapies for the treatment of respiratory diseases with unmet medical needs. The company's product candidate is ensifentrine, an inhaled and dual inhibitor of the phosphodiesterase (PDE) 3 and PDE4 enzymes that acts as both a bronchodilator and an anti-inflammatory agent in a single compound, which is in Phase 3 clinical trials for the treatment of chronic obstructive pulmonary disease, asthma, and cystic fibrosis.

See Also

Before you consider Verona Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verona Pharma wasn't on the list.

While Verona Pharma currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.