Monimus Capital Management LP purchased a new position in Huntington Ingalls Industries, Inc. (NYSE:HII - Free Report) during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund purchased 15,371 shares of the aerospace company's stock, valued at approximately $2,905,000. Huntington Ingalls Industries comprises approximately 2.7% of Monimus Capital Management LP's portfolio, making the stock its 16th largest position.

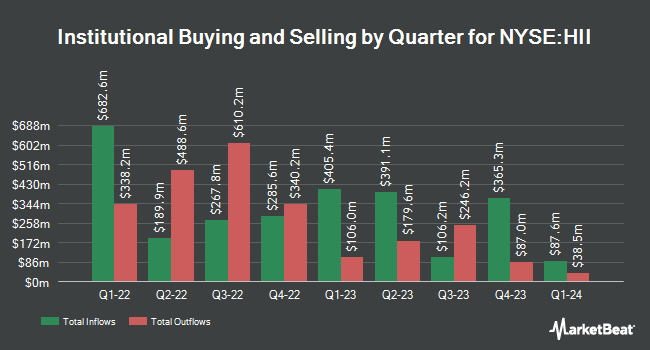

Other large investors have also recently made changes to their positions in the company. Assetmark Inc. boosted its position in shares of Huntington Ingalls Industries by 316.9% during the 3rd quarter. Assetmark Inc. now owns 346 shares of the aerospace company's stock valued at $91,000 after acquiring an additional 263 shares during the last quarter. Apollon Wealth Management LLC increased its holdings in shares of Huntington Ingalls Industries by 16.1% during the 3rd quarter. Apollon Wealth Management LLC now owns 1,097 shares of the aerospace company's stock worth $290,000 after buying an additional 152 shares during the last quarter. Sumitomo Mitsui Trust Group Inc. increased its holdings in shares of Huntington Ingalls Industries by 2.3% during the 3rd quarter. Sumitomo Mitsui Trust Group Inc. now owns 97,456 shares of the aerospace company's stock worth $25,765,000 after buying an additional 2,149 shares during the last quarter. Victory Capital Management Inc. lifted its holdings in Huntington Ingalls Industries by 1.9% in the third quarter. Victory Capital Management Inc. now owns 29,748 shares of the aerospace company's stock valued at $7,865,000 after acquiring an additional 561 shares during the last quarter. Finally, CIBC Asset Management Inc raised its position in Huntington Ingalls Industries by 7.8% in the third quarter. CIBC Asset Management Inc now owns 5,753 shares of the aerospace company's stock valued at $1,521,000 after purchasing an additional 414 shares during the period. 90.46% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In related news, CAO Nicolas G. Schuck sold 750 shares of the firm's stock in a transaction that occurred on Thursday, March 6th. The stock was sold at an average price of $189.56, for a total value of $142,170.00. Following the completion of the transaction, the chief accounting officer now directly owns 2,884 shares of the company's stock, valued at $546,691.04. This trade represents a 20.64 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Thomas C. Schievelbein bought 2,120 shares of the stock in a transaction on Thursday, February 13th. The stock was purchased at an average cost of $164.82 per share, for a total transaction of $349,418.40. Following the acquisition, the director now directly owns 7,967 shares of the company's stock, valued at $1,313,120.94. The trade was a 36.26 % increase in their position. The disclosure for this purchase can be found here. 0.72% of the stock is owned by insiders.

Wall Street Analyst Weigh In

HII has been the subject of several research analyst reports. Barclays lowered their target price on shares of Huntington Ingalls Industries from $220.00 to $200.00 and set an "equal weight" rating for the company in a research note on Monday, February 10th. The Goldman Sachs Group cut their price objective on Huntington Ingalls Industries from $188.00 to $145.00 and set a "sell" rating on the stock in a report on Monday, February 10th. Two investment analysts have rated the stock with a sell rating, eight have issued a hold rating and one has issued a buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus price target of $221.22.

Get Our Latest Stock Analysis on HII

Huntington Ingalls Industries Stock Down 0.5 %

Shares of HII traded down $1.10 during mid-day trading on Wednesday, reaching $207.47. The company's stock had a trading volume of 518,792 shares, compared to its average volume of 457,907. The company's 50 day moving average is $187.06 and its 200 day moving average is $211.96. Huntington Ingalls Industries, Inc. has a 12-month low of $158.88 and a 12-month high of $294.81. The company has a debt-to-equity ratio of 0.58, a current ratio of 1.08 and a quick ratio of 1.01. The stock has a market cap of $8.14 billion, a PE ratio of 14.86, a price-to-earnings-growth ratio of 1.15 and a beta of 0.49.

Huntington Ingalls Industries (NYSE:HII - Get Free Report) last released its quarterly earnings results on Thursday, February 6th. The aerospace company reported $3.15 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $3.28 by ($0.13). Huntington Ingalls Industries had a return on equity of 12.81% and a net margin of 4.77%. Equities analysts anticipate that Huntington Ingalls Industries, Inc. will post 13.99 EPS for the current fiscal year.

Huntington Ingalls Industries Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, March 14th. Investors of record on Friday, February 28th were issued a dividend of $1.35 per share. This represents a $5.40 annualized dividend and a dividend yield of 2.60%. The ex-dividend date of this dividend was Friday, February 28th. Huntington Ingalls Industries's dividend payout ratio is presently 38.68%.

Huntington Ingalls Industries Company Profile

(

Free Report)

Huntington Ingalls Industries, Inc designs, builds, overhauls, and repairs military ships in the United States. It operates through three segments: Ingalls, Newport News, and Mission Technologies. The company is involved in the design and construction of non-nuclear ships comprising amphibious assault ships; expeditionary warfare ships; surface combatants; and national security cutters for the U.S.

See Also

Before you consider Huntington Ingalls Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huntington Ingalls Industries wasn't on the list.

While Huntington Ingalls Industries currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.