Nwam LLC bought a new position in The Walt Disney Company (NYSE:DIS - Free Report) during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund bought 15,435 shares of the entertainment giant's stock, valued at approximately $1,485,000.

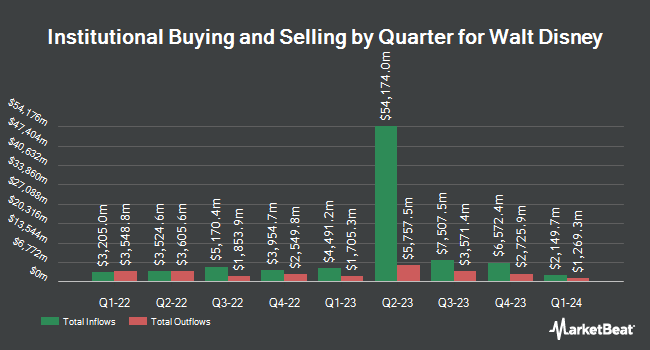

A number of other hedge funds and other institutional investors have also bought and sold shares of the business. William B. Walkup & Associates Inc. bought a new stake in Walt Disney in the second quarter valued at $32,000. Mascoma Wealth Management LLC increased its position in shares of Walt Disney by 38.0% during the second quarter. Mascoma Wealth Management LLC now owns 443 shares of the entertainment giant's stock valued at $44,000 after buying an additional 122 shares during the period. First PREMIER Bank boosted its position in shares of Walt Disney by 98.1% during the third quarter. First PREMIER Bank now owns 517 shares of the entertainment giant's stock valued at $50,000 after purchasing an additional 256 shares in the last quarter. Iron Horse Wealth Management LLC grew its stake in Walt Disney by 148.7% in the second quarter. Iron Horse Wealth Management LLC now owns 557 shares of the entertainment giant's stock worth $55,000 after purchasing an additional 333 shares during the period. Finally, Livelsberger Financial Advisory bought a new position in Walt Disney in the third quarter worth $57,000. Institutional investors own 65.71% of the company's stock.

Walt Disney Trading Up 0.8 %

Shares of NYSE:DIS traded up $0.93 during trading on Friday, reaching $115.65. The company's stock had a trading volume of 10,098,038 shares, compared to its average volume of 12,343,244. The firm's 50 day simple moving average is $98.09 and its two-hundred day simple moving average is $96.78. The company has a current ratio of 0.73, a quick ratio of 0.67 and a debt-to-equity ratio of 0.37. The Walt Disney Company has a 12 month low of $83.91 and a 12 month high of $123.74. The stock has a market capitalization of $209.44 billion, a PE ratio of 42.68, a price-to-earnings-growth ratio of 2.13 and a beta of 1.40.

Insider Activity

In related news, CEO Robert A. Iger sold 372,412 shares of the business's stock in a transaction on Friday, November 22nd. The stock was sold at an average price of $114.57, for a total transaction of $42,667,242.84. Following the completion of the transaction, the chief executive officer now owns 226,767 shares in the company, valued at $25,980,695.19. The trade was a 62.15 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, EVP Brent Woodford sold 5,000 shares of the company's stock in a transaction dated Wednesday, November 20th. The stock was sold at an average price of $113.62, for a total transaction of $568,100.00. Following the completion of the transaction, the executive vice president now owns 44,055 shares in the company, valued at $5,005,529.10. This represents a 10.19 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 0.10% of the company's stock.

Analyst Upgrades and Downgrades

Several equities research analysts recently commented on the stock. Piper Sandler started coverage on shares of Walt Disney in a research note on Wednesday, October 16th. They set a "neutral" rating and a $95.00 price objective on the stock. Bank of America raised their price target on Walt Disney from $120.00 to $140.00 and gave the company a "buy" rating in a report on Friday, November 15th. Raymond James reaffirmed a "market perform" rating on shares of Walt Disney in a report on Tuesday, October 1st. Deutsche Bank Aktiengesellschaft increased their price target on shares of Walt Disney from $115.00 to $131.00 and gave the company a "buy" rating in a report on Friday, November 15th. Finally, Sanford C. Bernstein boosted their price target on Walt Disney from $115.00 to $120.00 and gave the stock an "outperform" rating in a research note on Friday, November 15th. Five analysts have rated the stock with a hold rating, eighteen have issued a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, Walt Disney presently has an average rating of "Moderate Buy" and a consensus price target of $123.83.

Get Our Latest Stock Report on DIS

About Walt Disney

(

Free Report)

The Walt Disney Company operates as an entertainment company worldwide. It operates through three segments: Entertainment, Sports, and Experiences. The company produces and distributes film and television video streaming content under the ABC Television Network, Disney, Freeform, FX, Fox, National Geographic, and Star brand television channels, as well as ABC television stations and A+E television networks; and produces original content under the ABC Signature, Disney Branded Television, FX Productions, Lucasfilm, Marvel, National Geographic Studios, Pixar, Searchlight Pictures, Twentieth Century Studios, 20th Television, and Walt Disney Pictures banners.

Further Reading

Before you consider Walt Disney, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walt Disney wasn't on the list.

While Walt Disney currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.