Erste Asset Management GmbH purchased a new stake in shares of Jones Lang LaSalle Incorporated (NYSE:JLL - Free Report) in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund purchased 15,899 shares of the financial services provider's stock, valued at approximately $4,231,000.

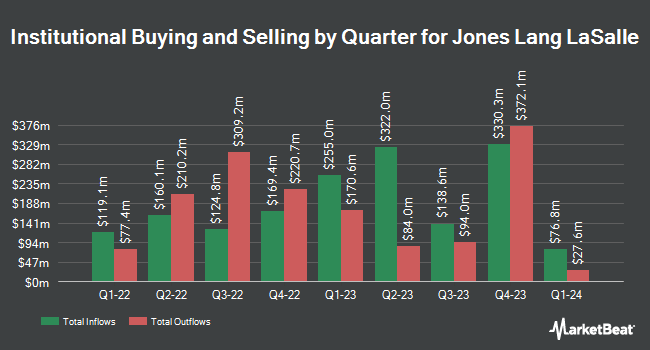

Other large investors have also made changes to their positions in the company. Huntington National Bank boosted its stake in shares of Jones Lang LaSalle by 22.9% during the 3rd quarter. Huntington National Bank now owns 204 shares of the financial services provider's stock worth $55,000 after acquiring an additional 38 shares in the last quarter. Massmutual Trust Co. FSB ADV boosted its position in Jones Lang LaSalle by 37.5% during the third quarter. Massmutual Trust Co. FSB ADV now owns 143 shares of the financial services provider's stock worth $39,000 after purchasing an additional 39 shares during the period. CIBC Asset Management Inc grew its holdings in Jones Lang LaSalle by 3.5% during the third quarter. CIBC Asset Management Inc now owns 1,375 shares of the financial services provider's stock valued at $371,000 after purchasing an additional 47 shares during the last quarter. Parallel Advisors LLC grew its holdings in Jones Lang LaSalle by 3.1% during the second quarter. Parallel Advisors LLC now owns 1,625 shares of the financial services provider's stock valued at $334,000 after purchasing an additional 49 shares during the last quarter. Finally, First Bank & Trust grew its holdings in Jones Lang LaSalle by 2.5% during the third quarter. First Bank & Trust now owns 2,251 shares of the financial services provider's stock valued at $607,000 after purchasing an additional 54 shares during the last quarter. Institutional investors own 94.80% of the company's stock.

Wall Street Analyst Weigh In

JLL has been the topic of several analyst reports. Keefe, Bruyette & Woods increased their price target on Jones Lang LaSalle from $280.00 to $292.00 and gave the company a "market perform" rating in a report on Tuesday, November 12th. Wolfe Research upgraded Jones Lang LaSalle from a "peer perform" rating to an "outperform" rating and set a $353.00 price target on the stock in a report on Monday, November 25th. Finally, StockNews.com upgraded Jones Lang LaSalle from a "buy" rating to a "strong-buy" rating in a report on Friday, September 13th. One investment analyst has rated the stock with a hold rating, four have assigned a buy rating and two have assigned a strong buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Buy" and an average price target of $271.50.

View Our Latest Stock Analysis on JLL

Jones Lang LaSalle Stock Performance

Shares of JLL traded up $0.58 during mid-day trading on Tuesday, hitting $278.73. The company's stock had a trading volume of 222,068 shares, compared to its average volume of 286,689. Jones Lang LaSalle Incorporated has a one year low of $159.52 and a one year high of $288.50. The company has a debt-to-equity ratio of 0.16, a quick ratio of 2.29 and a current ratio of 2.29. The firm has a market capitalization of $13.22 billion, a PE ratio of 28.21 and a beta of 1.34. The stock's 50-day moving average is $267.94 and its two-hundred day moving average is $241.56.

Jones Lang LaSalle (NYSE:JLL - Get Free Report) last issued its earnings results on Wednesday, November 6th. The financial services provider reported $3.50 EPS for the quarter, topping the consensus estimate of $2.67 by $0.83. The firm had revenue of $5.87 billion during the quarter, compared to analysts' expectations of $5.62 billion. Jones Lang LaSalle had a return on equity of 8.95% and a net margin of 2.12%. Jones Lang LaSalle's quarterly revenue was up 14.8% compared to the same quarter last year. During the same period last year, the business earned $2.01 earnings per share. As a group, sell-side analysts anticipate that Jones Lang LaSalle Incorporated will post 13.37 EPS for the current year.

About Jones Lang LaSalle

(

Free Report)

Jones Lang LaSalle Incorporated operates as a commercial real estate and investment management company. It engages in the buying, building, occupying, managing, and investing in a commercial, industrial, hotel, residential, and retail properties in Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Recommended Stories

Before you consider Jones Lang LaSalle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jones Lang LaSalle wasn't on the list.

While Jones Lang LaSalle currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.