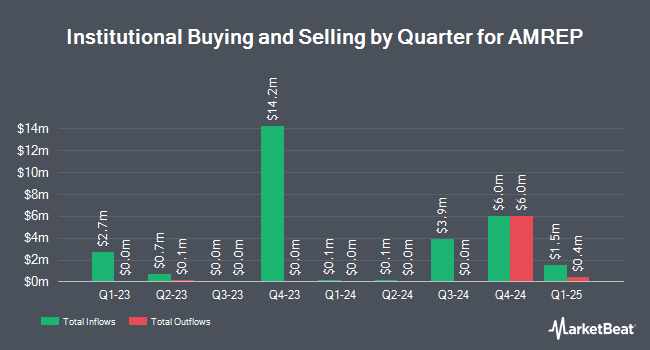

Arrowstreet Capital Limited Partnership bought a new position in AMREP Co. (NYSE:AXR - Free Report) during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm bought 16,152 shares of the business services provider's stock, valued at approximately $507,000. Arrowstreet Capital Limited Partnership owned 0.31% of AMREP at the end of the most recent quarter.

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. JPMorgan Chase & Co. grew its holdings in shares of AMREP by 293.9% during the 4th quarter. JPMorgan Chase & Co. now owns 7,390 shares of the business services provider's stock worth $232,000 after purchasing an additional 5,514 shares during the period. Hillsdale Investment Management Inc. acquired a new stake in shares of AMREP in the fourth quarter worth $261,000. Truffle Hound Capital LLC purchased a new position in shares of AMREP in the 4th quarter valued at $2,041,000. AlphaCentric Advisors LLC acquired a new position in shares of AMREP during the 4th quarter valued at $719,000. Finally, Peapod Lane Capital LLC purchased a new stake in AMREP during the 4th quarter worth $1,411,000. Institutional investors and hedge funds own 59.85% of the company's stock.

AMREP Trading Up 1.6 %

NYSE:AXR traded up $0.35 during mid-day trading on Wednesday, hitting $22.28. The company had a trading volume of 11,078 shares, compared to its average volume of 19,839. AMREP Co. has a 1 year low of $15.88 and a 1 year high of $39.68. The business has a fifty day simple moving average of $23.03 and a 200-day simple moving average of $28.73. The firm has a market capitalization of $117.79 million, a price-to-earnings ratio of 9.69 and a beta of 1.01.

AMREP (NYSE:AXR - Get Free Report) last released its quarterly earnings results on Friday, March 7th. The business services provider reported $0.13 earnings per share for the quarter. AMREP had a return on equity of 10.31% and a net margin of 19.52%. The firm had revenue of $7.52 million during the quarter.

AMREP Profile

(

Free Report)

AMREP Corporation, through its subsidiaries, primarily engages in the real estate business. The company operates through two segments, Land Development and Homebuilding. It sells developed and undeveloped lots to homebuilders, commercial and industrial property developers, and others. In addition, the company owns mineral interests covering an area of approximately 55,000 surface acres of land in Sandoval County, New Mexico; and owns oil, gas, and minerals and mineral interests covering an area of approximately 147 surface acres of land in Brighton, Colorado.

Recommended Stories

Before you consider AMREP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AMREP wasn't on the list.

While AMREP currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.