Fox Run Management L.L.C. bought a new position in shares of Bunge Global SA (NYSE:BG - Free Report) during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor bought 16,274 shares of the basic materials company's stock, valued at approximately $1,265,000.

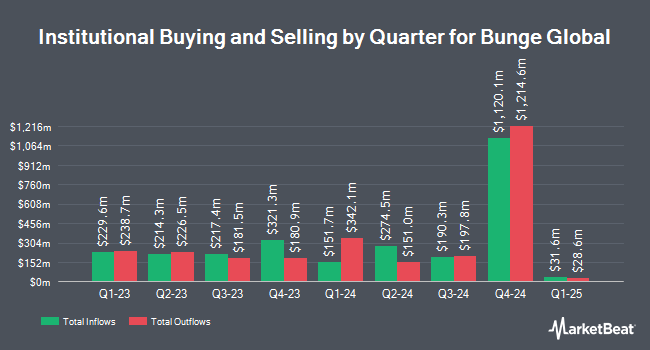

A number of other hedge funds have also recently added to or reduced their stakes in the business. State Street Corp grew its position in Bunge Global by 7.6% during the third quarter. State Street Corp now owns 7,051,601 shares of the basic materials company's stock valued at $681,467,000 after acquiring an additional 500,897 shares during the period. Geode Capital Management LLC raised its stake in shares of Bunge Global by 1.3% in the 3rd quarter. Geode Capital Management LLC now owns 3,422,968 shares of the basic materials company's stock valued at $329,697,000 after acquiring an additional 45,159 shares during the period. Pacer Advisors Inc. lifted its holdings in shares of Bunge Global by 13,459.9% during the 4th quarter. Pacer Advisors Inc. now owns 2,956,459 shares of the basic materials company's stock valued at $229,894,000 after acquiring an additional 2,934,656 shares in the last quarter. Amundi boosted its position in Bunge Global by 24.9% during the 4th quarter. Amundi now owns 2,457,864 shares of the basic materials company's stock worth $190,476,000 after purchasing an additional 490,153 shares during the period. Finally, Charles Schwab Investment Management Inc. raised its position in Bunge Global by 4.0% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 1,502,083 shares of the basic materials company's stock valued at $116,802,000 after purchasing an additional 57,462 shares during the period. 86.23% of the stock is owned by institutional investors and hedge funds.

Bunge Global Stock Up 1.5 %

Shares of BG stock traded up $1.12 during trading hours on Tuesday, hitting $73.84. 399,097 shares of the company were exchanged, compared to its average volume of 1,494,483. The stock has a market capitalization of $9.89 billion, a price-to-earnings ratio of 9.15, a P/E/G ratio of 2.66 and a beta of 0.67. Bunge Global SA has a one year low of $67.40 and a one year high of $114.92. The business's 50-day simple moving average is $74.26 and its two-hundred day simple moving average is $83.52. The company has a debt-to-equity ratio of 0.43, a quick ratio of 1.27 and a current ratio of 2.15.

Bunge Global (NYSE:BG - Get Free Report) last issued its earnings results on Wednesday, February 5th. The basic materials company reported $2.13 EPS for the quarter, missing the consensus estimate of $2.30 by ($0.17). Bunge Global had a return on equity of 11.73% and a net margin of 2.14%. Sell-side analysts predict that Bunge Global SA will post 7.94 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of equities research analysts have recently issued reports on the company. Morgan Stanley lowered their target price on Bunge Global from $90.00 to $74.00 and set an "equal weight" rating for the company in a research note on Tuesday, February 11th. Barclays decreased their price objective on shares of Bunge Global from $95.00 to $85.00 and set an "equal weight" rating for the company in a research report on Thursday, February 6th. Bank of America dropped their target price on Bunge Global from $105.00 to $87.00 and set a "buy" rating on the stock in a research report on Tuesday, February 11th. Finally, Stephens reduced their price target on Bunge Global from $110.00 to $105.00 in a report on Monday, February 3rd. Three analysts have rated the stock with a hold rating, one has issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $93.00.

Check Out Our Latest Analysis on BG

Bunge Global Company Profile

(

Free Report)

Bunge Global SA operates as an agribusiness and food company worldwide. It operates through four segments: Agribusiness, Refined and Specialty Oils, Milling, and Sugar and Bioenergy. The Agribusiness segment purchases, stores, transports, processes, and sells agricultural commodities and commodity products, including oilseeds primarily soybeans, rapeseed, canola, and sunflower seeds, as well as grains comprising wheat and corn; and processes oilseeds into vegetable oils and protein meals.

Read More

Before you consider Bunge Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bunge Global wasn't on the list.

While Bunge Global currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.