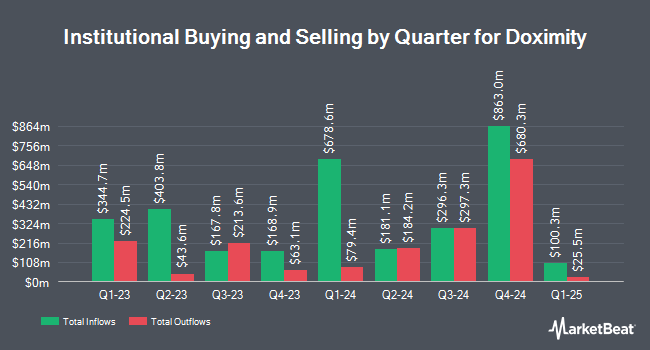

Fountainhead AM LLC bought a new stake in shares of Doximity, Inc. (NASDAQ:DOCS - Free Report) in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor bought 16,292 shares of the company's stock, valued at approximately $710,000.

Other large investors also recently modified their holdings of the company. Blair William & Co. IL lifted its stake in Doximity by 31.7% during the first quarter. Blair William & Co. IL now owns 90,600 shares of the company's stock worth $2,438,000 after purchasing an additional 21,787 shares during the last quarter. Federated Hermes Inc. boosted its stake in Doximity by 1,824.5% in the second quarter. Federated Hermes Inc. now owns 279,634 shares of the company's stock valued at $7,821,000 after buying an additional 265,104 shares in the last quarter. AXA S.A. raised its stake in Doximity by 40.2% during the second quarter. AXA S.A. now owns 216,392 shares of the company's stock worth $6,052,000 after acquiring an additional 61,992 shares in the last quarter. Acadian Asset Management LLC boosted its stake in shares of Doximity by 128.7% in the 1st quarter. Acadian Asset Management LLC now owns 96,442 shares of the company's stock valued at $2,590,000 after purchasing an additional 54,281 shares in the last quarter. Finally, Nisa Investment Advisors LLC grew its holdings in shares of Doximity by 15,714.3% during the 2nd quarter. Nisa Investment Advisors LLC now owns 11,070 shares of the company's stock valued at $310,000 after purchasing an additional 11,000 shares during the last quarter. 87.19% of the stock is owned by institutional investors and hedge funds.

Doximity Stock Performance

DOCS traded up $3.00 during mid-day trading on Monday, reaching $61.25. 5,349,238 shares of the stock were exchanged, compared to its average volume of 1,710,653. Doximity, Inc. has a 1 year low of $22.96 and a 1 year high of $61.75. The stock has a market capitalization of $11.37 billion, a PE ratio of 70.40, a price-to-earnings-growth ratio of 7.00 and a beta of 1.30. The company has a 50 day moving average price of $42.04 and a two-hundred day moving average price of $33.44.

Doximity (NASDAQ:DOCS - Get Free Report) last posted its quarterly earnings data on Thursday, August 8th. The company reported $0.22 EPS for the quarter, beating the consensus estimate of $0.16 by $0.06. Doximity had a net margin of 33.69% and a return on equity of 20.17%. The firm had revenue of $126.68 million during the quarter, compared to analyst estimates of $119.88 million. Sell-side analysts expect that Doximity, Inc. will post 0.8 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of analysts have weighed in on DOCS shares. Evercore ISI raised their target price on shares of Doximity from $34.00 to $45.00 and gave the company an "in-line" rating in a research report on Tuesday, October 8th. Needham & Company LLC raised Doximity from a "hold" rating to a "buy" rating and set a $38.00 target price for the company in a report on Friday, August 9th. Canaccord Genuity Group raised their target price on Doximity from $37.00 to $40.00 and gave the stock a "buy" rating in a research report on Tuesday, August 20th. Robert W. Baird upped their price target on Doximity from $41.00 to $45.00 and gave the company an "outperform" rating in a research report on Tuesday, September 17th. Finally, Wells Fargo & Company raised Doximity from an "underweight" rating to an "equal weight" rating and lifted their price objective for the stock from $19.00 to $41.00 in a research note on Friday. One equities research analyst has rated the stock with a sell rating, seven have given a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $45.69.

Check Out Our Latest Stock Analysis on Doximity

Doximity Profile

(

Free Report)

Doximity, Inc operates a cloud-based digital platform for medical professionals in the United States. The company's platform provides its members with tools built for medical professionals, enabling them to collaborate with their colleagues, coordinate patient care, conduct virtual patient visits, stay up to date with the latest medical news and research, and manage their careers.

Read More

Before you consider Doximity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Doximity wasn't on the list.

While Doximity currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.