Resona Asset Management Co. Ltd. bought a new position in Credicorp Ltd. (NYSE:BAP - Free Report) during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor bought 16,479 shares of the bank's stock, valued at approximately $3,016,000.

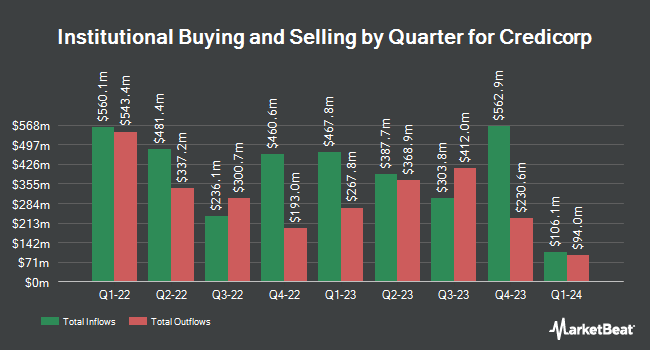

A number of other hedge funds have also recently added to or reduced their stakes in the company. Headlands Technologies LLC acquired a new stake in Credicorp in the 4th quarter worth approximately $38,000. MassMutual Private Wealth & Trust FSB raised its stake in shares of Credicorp by 37.8% in the fourth quarter. MassMutual Private Wealth & Trust FSB now owns 226 shares of the bank's stock valued at $41,000 after purchasing an additional 62 shares in the last quarter. R Squared Ltd acquired a new stake in shares of Credicorp during the 4th quarter valued at about $172,000. Aprio Wealth Management LLC acquired a new stake in Credicorp during the fourth quarter valued at approximately $200,000. Finally, Callan Family Office LLC bought a new stake in shares of Credicorp in the 4th quarter valued at approximately $204,000. Institutional investors and hedge funds own 89.81% of the company's stock.

Wall Street Analyst Weigh In

Separately, Bank of America cut Credicorp from a "buy" rating to a "neutral" rating and cut their price objective for the company from $209.00 to $208.00 in a report on Monday, December 16th.

Get Our Latest Report on Credicorp

Credicorp Price Performance

NYSE BAP traded up $1.06 on Tuesday, hitting $185.34. 52,719 shares of the company were exchanged, compared to its average volume of 255,504. Credicorp Ltd. has a 1-year low of $153.27 and a 1-year high of $200.00. The firm has a 50 day moving average of $184.81 and a two-hundred day moving average of $185.62. The company has a current ratio of 1.02, a quick ratio of 1.07 and a debt-to-equity ratio of 0.68. The company has a market cap of $14.74 billion, a P/E ratio of 10.05, a P/E/G ratio of 0.56 and a beta of 0.99.

Credicorp (NYSE:BAP - Get Free Report) last announced its earnings results on Monday, February 10th. The bank reported $3.76 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $4.42 by ($0.66). Credicorp had a return on equity of 16.25% and a net margin of 20.94%. On average, equities analysts predict that Credicorp Ltd. will post 21.9 EPS for the current year.

About Credicorp

(

Free Report)

Credicorp Ltd. provides various financial, insurance, and health services and products primarily in Peru and internationally. It operates through Universal Banking, Insurance and Pensions, Microfinance, and Investment Banking and Equity Management segments. The Universal Banking segment grants various credits and financial instruments to individuals and legal entities; and various deposits and current accounts.

Featured Stories

Before you consider Credicorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Credicorp wasn't on the list.

While Credicorp currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.