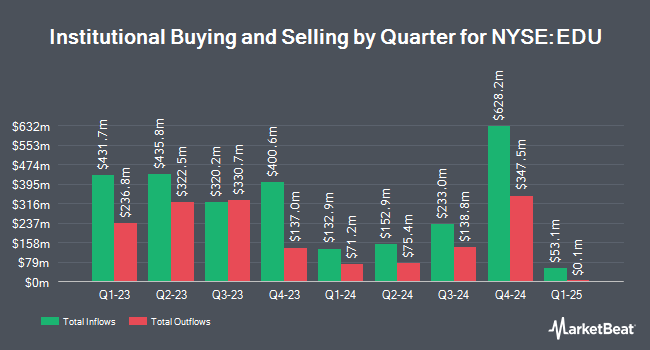

Centiva Capital LP acquired a new stake in shares of New Oriental Education & Technology Group Inc. (NYSE:EDU - Free Report) during the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund acquired 16,629 shares of the company's stock, valued at approximately $1,261,000.

Other hedge funds have also recently added to or reduced their stakes in the company. Ridgewood Investments LLC acquired a new stake in New Oriental Education & Technology Group during the 2nd quarter valued at $43,000. Ashton Thomas Private Wealth LLC acquired a new position in shares of New Oriental Education & Technology Group during the second quarter valued at $50,000. Blue Trust Inc. raised its holdings in New Oriental Education & Technology Group by 782.4% during the 2nd quarter. Blue Trust Inc. now owns 803 shares of the company's stock worth $62,000 after purchasing an additional 712 shares during the last quarter. Zurcher Kantonalbank Zurich Cantonalbank boosted its stake in New Oriental Education & Technology Group by 14.2% in the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 1,658 shares of the company's stock valued at $126,000 after acquiring an additional 206 shares during the last quarter. Finally, Hancock Whitney Corp bought a new stake in New Oriental Education & Technology Group in the second quarter valued at about $212,000.

Wall Street Analysts Forecast Growth

Several equities research analysts have issued reports on EDU shares. StockNews.com upgraded New Oriental Education & Technology Group from a "sell" rating to a "hold" rating in a report on Thursday, October 24th. Morgan Stanley set a $83.00 target price on New Oriental Education & Technology Group in a report on Thursday, October 17th.

Check Out Our Latest Stock Analysis on New Oriental Education & Technology Group

New Oriental Education & Technology Group Price Performance

New Oriental Education & Technology Group stock traded down $0.75 during mid-day trading on Thursday, reaching $63.34. 1,943,607 shares of the company were exchanged, compared to its average volume of 1,849,259. The company has a fifty day simple moving average of $65.15 and a 200-day simple moving average of $69.16. The firm has a market cap of $10.75 billion, a PE ratio of 26.94 and a beta of 0.46. New Oriental Education & Technology Group Inc. has a 12 month low of $54.00 and a 12 month high of $98.20.

New Oriental Education & Technology Group (NYSE:EDU - Get Free Report) last posted its quarterly earnings data on Wednesday, October 23rd. The company reported $1.60 earnings per share for the quarter, topping the consensus estimate of $1.33 by $0.27. New Oriental Education & Technology Group had a net margin of 8.38% and a return on equity of 9.43%. The business had revenue of $1.44 billion during the quarter, compared to analysts' expectations of $1.45 billion. During the same quarter in the prior year, the business posted $0.99 earnings per share. New Oriental Education & Technology Group's revenue was up 30.5% compared to the same quarter last year. Sell-side analysts anticipate that New Oriental Education & Technology Group Inc. will post 2.94 earnings per share for the current year.

New Oriental Education & Technology Group Company Profile

(

Free Report)

New Oriental Education & Technology Group Inc provides private educational services under the New Oriental brand in the People's Republic of China. The company operates through four segments: Educational Services and Test Preparation Courses; Online Education and Other Services; Overseas Study Consulting Services; and Educational Materials and Distribution.

Recommended Stories

Before you consider New Oriental Education & Technology Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and New Oriental Education & Technology Group wasn't on the list.

While New Oriental Education & Technology Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.