Tandem Investment Partners LLC bought a new stake in Amgen Inc. (NASDAQ:AMGN - Free Report) during the fourth quarter, according to its most recent disclosure with the SEC. The institutional investor bought 1,747 shares of the medical research company's stock, valued at approximately $455,000.

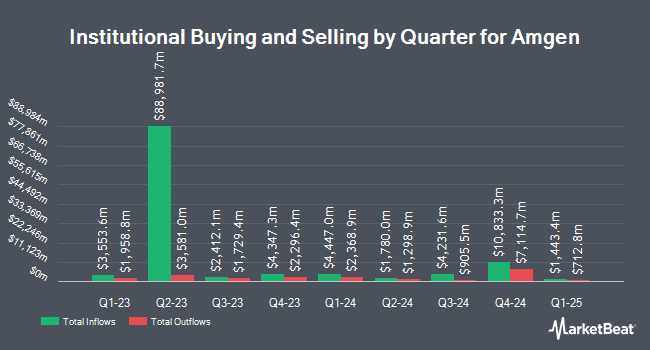

Several other hedge funds have also bought and sold shares of AMGN. Centricity Wealth Management LLC bought a new position in Amgen during the fourth quarter worth $25,000. Legacy Investment Solutions LLC acquired a new stake in shares of Amgen during the 3rd quarter worth about $29,000. Ritter Daniher Financial Advisory LLC DE boosted its holdings in shares of Amgen by 66.2% during the 4th quarter. Ritter Daniher Financial Advisory LLC DE now owns 128 shares of the medical research company's stock worth $33,000 after buying an additional 51 shares during the period. Synergy Investment Management LLC acquired a new position in Amgen in the 4th quarter valued at about $34,000. Finally, Atala Financial Inc bought a new position in Amgen in the 4th quarter valued at about $34,000. 76.50% of the stock is currently owned by institutional investors and hedge funds.

Amgen Price Performance

NASDAQ AMGN traded up $4.57 during trading on Friday, hitting $285.98. 3,466,932 shares of the company's stock were exchanged, compared to its average volume of 2,777,164. The company has a market cap of $153.76 billion, a PE ratio of 37.88, a P/E/G ratio of 2.63 and a beta of 0.59. The company has a current ratio of 1.26, a quick ratio of 0.95 and a debt-to-equity ratio of 9.62. The stock's 50 day moving average price is $304.33 and its two-hundred day moving average price is $295.27. Amgen Inc. has a fifty-two week low of $253.30 and a fifty-two week high of $346.85.

Amgen (NASDAQ:AMGN - Get Free Report) last issued its earnings results on Tuesday, February 4th. The medical research company reported $5.31 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $5.04 by $0.27. Amgen had a return on equity of 176.32% and a net margin of 12.24%. Research analysts expect that Amgen Inc. will post 20.62 EPS for the current year.

Amgen Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, June 6th. Investors of record on Friday, May 16th will be given a dividend of $2.38 per share. This represents a $9.52 annualized dividend and a yield of 3.33%. The ex-dividend date of this dividend is Friday, May 16th. Amgen's dividend payout ratio is currently 126.09%.

Insider Transactions at Amgen

In other news, SVP Nancy A. Grygiel sold 1,589 shares of the firm's stock in a transaction dated Wednesday, February 5th. The stock was sold at an average price of $304.47, for a total value of $483,802.83. Following the completion of the sale, the senior vice president now directly owns 7,210 shares in the company, valued at $2,195,228.70. This trade represents a 18.06 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this link. Also, EVP Jonathan P. Graham sold 25,045 shares of the firm's stock in a transaction that occurred on Friday, February 7th. The shares were sold at an average price of $293.12, for a total value of $7,341,190.40. Following the completion of the sale, the executive vice president now directly owns 28,987 shares of the company's stock, valued at $8,496,669.44. This trade represents a 46.35 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 69,341 shares of company stock worth $20,644,335 over the last ninety days. 0.69% of the stock is owned by insiders.

Wall Street Analyst Weigh In

A number of brokerages have recently issued reports on AMGN. Citigroup restated a "neutral" rating on shares of Amgen in a report on Wednesday, February 5th. UBS Group reiterated a "hold" rating on shares of Amgen in a research report on Wednesday, February 12th. Piper Sandler Companies reissued an "overweight" rating and issued a $310.00 target price on shares of Amgen in a research report on Thursday, January 2nd. Wells Fargo & Company reaffirmed an "equal weight" rating on shares of Amgen in a research report on Wednesday, February 5th. Finally, Piper Sandler lifted their price objective on shares of Amgen from $310.00 to $329.00 and gave the stock an "overweight" rating in a research note on Monday, February 10th. Two equities research analysts have rated the stock with a sell rating, nine have given a hold rating, eleven have assigned a buy rating and two have assigned a strong buy rating to the stock. Based on data from MarketBeat, Amgen presently has an average rating of "Moderate Buy" and an average target price of $315.22.

Get Our Latest Stock Report on Amgen

Amgen Profile

(

Free Report)

Amgen Inc discovers, develops, manufactures, and delivers human therapeutics worldwide. The company's principal products include Enbrel to treat plaque psoriasis, rheumatoid arthritis, and psoriatic arthritis; Otezla for the treatment of adult patients with plaque psoriasis, psoriatic arthritis, and oral ulcers associated with Behçet's disease; Prolia to treat postmenopausal women with osteoporosis; XGEVA for skeletal-related events prevention; Repatha, which reduces the risks of myocardial infarction, stroke, and coronary revascularization; Nplate for the treatment of patients with immune thrombocytopenia; KYPROLIS to treat patients with relapsed or refractory multiple myeloma; Aranesp to treat a lower-than-normal number of red blood cells and anemia; EVENITY for the treatment of osteoporosis in postmenopausal for men and women; Vectibix to treat patients with wild-type RAS metastatic colorectal cancer; BLINCYTO for the treatment of patients with acute lymphoblastic leukemia; TEPEZZA to treat thyroid eye disease; and KRYSTEXXA for the treatment of chronic refractory gout.

Recommended Stories

Before you consider Amgen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amgen wasn't on the list.

While Amgen currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.