American Trust bought a new stake in shares of D.R. Horton, Inc. (NYSE:DHI - Free Report) during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm bought 17,815 shares of the construction company's stock, valued at approximately $3,399,000.

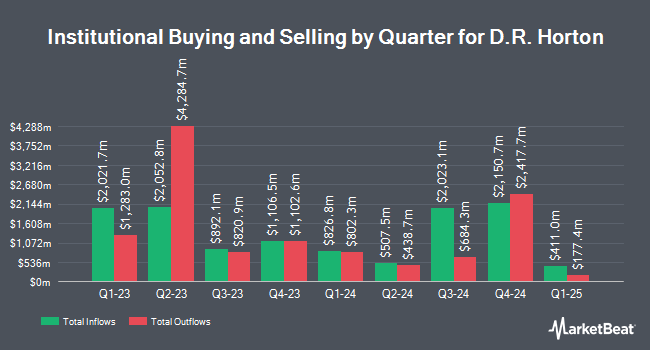

Several other institutional investors also recently bought and sold shares of the stock. Bfsg LLC increased its stake in D.R. Horton by 70.5% during the second quarter. Bfsg LLC now owns 179 shares of the construction company's stock valued at $25,000 after acquiring an additional 74 shares during the period. Coastline Trust Co bought a new stake in D.R. Horton during the 3rd quarter worth approximately $26,000. Signature Resources Capital Management LLC bought a new stake in D.R. Horton during the 2nd quarter worth approximately $31,000. Rakuten Securities Inc. grew its position in D.R. Horton by 216.7% during the 3rd quarter. Rakuten Securities Inc. now owns 171 shares of the construction company's stock worth $33,000 after acquiring an additional 117 shares during the last quarter. Finally, Wolff Wiese Magana LLC grew its position in D.R. Horton by 1,306.7% during the 3rd quarter. Wolff Wiese Magana LLC now owns 211 shares of the construction company's stock worth $40,000 after acquiring an additional 196 shares during the last quarter. 90.63% of the stock is currently owned by institutional investors.

D.R. Horton Trading Down 0.9 %

Shares of DHI traded down $1.34 during trading hours on Friday, reaching $149.87. The stock had a trading volume of 4,632,089 shares, compared to its average volume of 2,513,076. The company has a quick ratio of 1.61, a current ratio of 7.32 and a debt-to-equity ratio of 0.23. D.R. Horton, Inc. has a 52 week low of $133.02 and a 52 week high of $199.85. The firm has a 50-day moving average of $171.71 and a 200 day moving average of $168.74. The company has a market cap of $48.13 billion, a P/E ratio of 10.53, a P/E/G ratio of 0.57 and a beta of 1.71.

D.R. Horton (NYSE:DHI - Get Free Report) last announced its quarterly earnings data on Tuesday, October 29th. The construction company reported $3.92 earnings per share for the quarter, missing the consensus estimate of $4.17 by ($0.25). The company had revenue of $10 billion during the quarter, compared to the consensus estimate of $10.22 billion. D.R. Horton had a net margin of 12.93% and a return on equity of 19.24%. D.R. Horton's revenue was down 4.7% on a year-over-year basis. During the same quarter in the previous year, the business earned $4.45 EPS. On average, sell-side analysts expect that D.R. Horton, Inc. will post 14.17 earnings per share for the current fiscal year.

D.R. Horton Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Tuesday, November 19th. Investors of record on Tuesday, November 12th were paid a $0.40 dividend. This is an increase from D.R. Horton's previous quarterly dividend of $0.30. This represents a $1.60 annualized dividend and a yield of 1.07%. The ex-dividend date was Tuesday, November 12th. D.R. Horton's dividend payout ratio (DPR) is 11.14%.

Insider Activity at D.R. Horton

In other D.R. Horton news, Director Barbara K. Allen sold 5,650 shares of the firm's stock in a transaction that occurred on Thursday, November 21st. The shares were sold at an average price of $163.10, for a total transaction of $921,515.00. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. 1.74% of the stock is currently owned by company insiders.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently commented on DHI shares. Raymond James lowered D.R. Horton from an "outperform" rating to a "market perform" rating in a research report on Thursday, November 7th. Evercore ISI reduced their price objective on D.R. Horton from $218.00 to $204.00 and set an "outperform" rating on the stock in a report on Wednesday, October 30th. Keefe, Bruyette & Woods downgraded D.R. Horton from an "outperform" rating to a "market perform" rating and reduced their price objective for the stock from $200.00 to $183.00 in a report on Tuesday. Royal Bank of Canada reduced their price objective on D.R. Horton from $154.00 to $145.00 and set an "underperform" rating on the stock in a report on Wednesday, October 30th. Finally, UBS Group reduced their price objective on D.R. Horton from $217.00 to $214.00 and set a "buy" rating on the stock in a report on Wednesday, October 30th. Two research analysts have rated the stock with a sell rating, eight have given a hold rating and seven have assigned a buy rating to the stock. According to MarketBeat.com, D.R. Horton has an average rating of "Hold" and an average target price of $180.60.

Read Our Latest Analysis on DHI

D.R. Horton Company Profile

(

Free Report)

D.R. Horton, Inc operates as a homebuilding company in East, North, Southeast, South Central, Southwest, and Northwest regions in the United States. It engages in the acquisition and development of land; and construction and sale of residential homes in 118 markets across 33 states under the names of D.R.

Read More

Before you consider D.R. Horton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and D.R. Horton wasn't on the list.

While D.R. Horton currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.