CWA Asset Management Group LLC bought a new position in Suncor Energy Inc. (NYSE:SU - Free Report) TSE: SU during the third quarter, according to the company in its most recent 13F filing with the SEC. The fund bought 17,976 shares of the oil and gas producer's stock, valued at approximately $664,000.

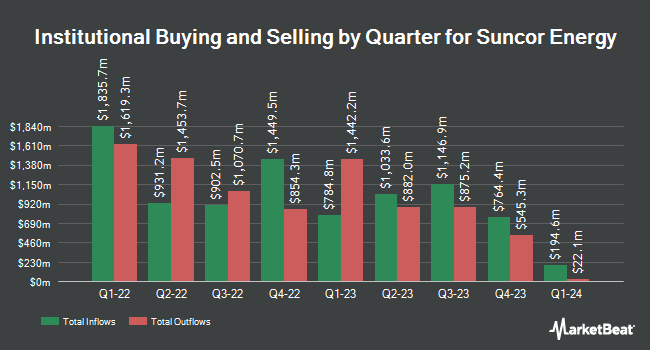

Several other institutional investors have also recently made changes to their positions in SU. Fiera Capital Corp boosted its stake in Suncor Energy by 11.6% in the 3rd quarter. Fiera Capital Corp now owns 1,550,252 shares of the oil and gas producer's stock worth $57,295,000 after purchasing an additional 161,306 shares in the last quarter. Easterly Investment Partners LLC increased its position in Suncor Energy by 3.2% during the 3rd quarter. Easterly Investment Partners LLC now owns 254,114 shares of the oil and gas producer's stock valued at $9,382,000 after buying an additional 7,835 shares in the last quarter. Principal Financial Group Inc. boosted its holdings in shares of Suncor Energy by 23.0% in the 3rd quarter. Principal Financial Group Inc. now owns 6,939,573 shares of the oil and gas producer's stock valued at $256,429,000 after acquiring an additional 1,296,142 shares during the last quarter. Harvest Portfolios Group Inc. increased its stake in shares of Suncor Energy by 6.5% in the 3rd quarter. Harvest Portfolios Group Inc. now owns 113,557 shares of the oil and gas producer's stock valued at $4,191,000 after purchasing an additional 6,971 shares in the last quarter. Finally, River Road Asset Management LLC lifted its holdings in Suncor Energy by 89.0% in the 3rd quarter. River Road Asset Management LLC now owns 743,421 shares of the oil and gas producer's stock valued at $27,447,000 after purchasing an additional 350,113 shares in the last quarter. Hedge funds and other institutional investors own 67.37% of the company's stock.

Suncor Energy Stock Down 1.9 %

Shares of SU stock traded down $0.72 during trading hours on Tuesday, hitting $38.11. 6,734,929 shares of the company's stock traded hands, compared to its average volume of 4,225,141. Suncor Energy Inc. has a 12-month low of $29.45 and a 12-month high of $41.94. The stock has a market cap of $48.09 billion, a price-to-earnings ratio of 9.01, a PEG ratio of 2.78 and a beta of 1.12. The stock's fifty day simple moving average is $38.30 and its two-hundred day simple moving average is $38.74. The company has a quick ratio of 0.93, a current ratio of 1.46 and a debt-to-equity ratio of 0.26.

Analysts Set New Price Targets

A number of research analysts have recently weighed in on SU shares. StockNews.com upgraded Suncor Energy from a "hold" rating to a "buy" rating in a research report on Thursday, November 7th. TD Securities upgraded Suncor Energy from a "hold" rating to a "buy" rating in a research note on Wednesday, August 7th. Wolfe Research assumed coverage on shares of Suncor Energy in a research report on Thursday, July 18th. They issued an "outperform" rating and a $68.00 target price for the company. Finally, BMO Capital Markets upgraded shares of Suncor Energy from a "market perform" rating to an "outperform" rating in a report on Wednesday, August 7th. Two research analysts have rated the stock with a hold rating and six have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $56.40.

Check Out Our Latest Analysis on SU

About Suncor Energy

(

Free Report)

Suncor Energy Inc operates as an integrated energy company in Canada, the United States, and internationally. It operates through Oil Sands; Exploration and Production; and Refining and Marketing segments. The Oil Sands segment explores, develops, and produces bitumen, synthetic crude oil, and related products.

Further Reading

Before you consider Suncor Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Suncor Energy wasn't on the list.

While Suncor Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.