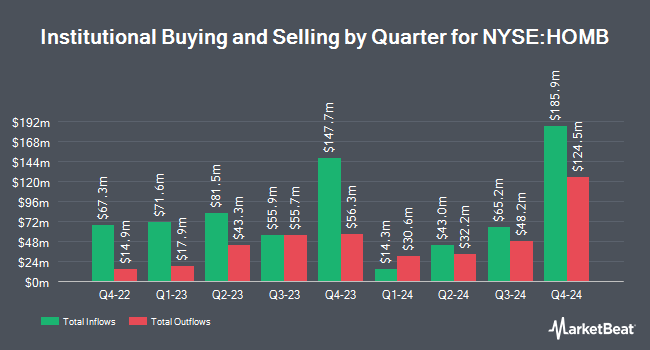

LMR Partners LLP bought a new position in shares of Home Bancshares, Inc. (Conway, AR) (NYSE:HOMB - Free Report) during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm bought 18,195 shares of the financial services provider's stock, valued at approximately $493,000.

Several other institutional investors and hedge funds have also recently modified their holdings of HOMB. Thrivent Financial for Lutherans lifted its stake in shares of Home Bancshares, Inc. (Conway, AR) by 0.6% during the 3rd quarter. Thrivent Financial for Lutherans now owns 85,865 shares of the financial services provider's stock worth $2,326,000 after purchasing an additional 481 shares during the last quarter. Natixis Advisors LLC lifted its position in shares of Home Bancshares, Inc. (Conway, AR) by 4.6% during the third quarter. Natixis Advisors LLC now owns 160,438 shares of the financial services provider's stock valued at $4,347,000 after buying an additional 7,079 shares during the last quarter. Victory Capital Management Inc. boosted its holdings in shares of Home Bancshares, Inc. (Conway, AR) by 5.4% in the 3rd quarter. Victory Capital Management Inc. now owns 277,485 shares of the financial services provider's stock valued at $7,517,000 after buying an additional 14,305 shares in the last quarter. Aptus Capital Advisors LLC grew its position in shares of Home Bancshares, Inc. (Conway, AR) by 25.1% in the 3rd quarter. Aptus Capital Advisors LLC now owns 187,437 shares of the financial services provider's stock worth $5,078,000 after buying an additional 37,549 shares during the last quarter. Finally, Aigen Investment Management LP bought a new position in shares of Home Bancshares, Inc. (Conway, AR) during the 3rd quarter worth approximately $215,000. Institutional investors own 67.31% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts have weighed in on the company. Royal Bank of Canada reissued a "sector perform" rating and issued a $28.00 price target on shares of Home Bancshares, Inc. (Conway, AR) in a report on Friday, October 18th. Stephens lifted their target price on shares of Home Bancshares, Inc. (Conway, AR) from $30.00 to $31.00 and gave the stock an "overweight" rating in a research note on Friday, October 18th. StockNews.com raised shares of Home Bancshares, Inc. (Conway, AR) from a "sell" rating to a "hold" rating in a report on Wednesday, November 6th. Finally, Piper Sandler boosted their price objective on shares of Home Bancshares, Inc. (Conway, AR) from $30.00 to $31.00 and gave the company an "overweight" rating in a report on Friday, October 18th. Three equities research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and an average price target of $28.25.

Read Our Latest Stock Analysis on Home Bancshares, Inc. (Conway, AR)

Insider Buying and Selling at Home Bancshares, Inc. (Conway, AR)

In other news, Director Jack Engelkes sold 25,000 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $30.12, for a total transaction of $753,000.00. Following the completion of the sale, the director now owns 199,195 shares in the company, valued at $5,999,753.40. This trade represents a 11.15 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director James Pat Hickman sold 63,997 shares of the stock in a transaction that occurred on Monday, November 18th. The stock was sold at an average price of $30.77, for a total value of $1,969,187.69. Following the completion of the transaction, the director now owns 175,500 shares of the company's stock, valued at $5,400,135. The trade was a 26.72 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 90,997 shares of company stock valued at $2,782,548 over the last quarter. 7.66% of the stock is currently owned by insiders.

Home Bancshares, Inc. (Conway, AR) Stock Performance

NYSE HOMB traded down $0.26 during mid-day trading on Wednesday, reaching $30.48. 651,444 shares of the stock were exchanged, compared to its average volume of 983,358. The company has a market capitalization of $6.06 billion, a P/E ratio of 15.63 and a beta of 1.05. The company has a debt-to-equity ratio of 0.44, a quick ratio of 0.91 and a current ratio of 0.91. The business's 50 day moving average is $27.67 and its 200-day moving average is $26.10. Home Bancshares, Inc. has a 1 year low of $21.70 and a 1 year high of $31.33.

Home Bancshares, Inc. (Conway, AR) (NYSE:HOMB - Get Free Report) last announced its quarterly earnings results on Wednesday, October 16th. The financial services provider reported $0.50 earnings per share for the quarter, missing the consensus estimate of $0.53 by ($0.03). The business had revenue of $258.00 million during the quarter, compared to analysts' expectations of $258.90 million. Home Bancshares, Inc. (Conway, AR) had a net margin of 26.69% and a return on equity of 10.33%. Home Bancshares, Inc. (Conway, AR)'s revenue for the quarter was up 5.2% on a year-over-year basis. During the same quarter in the prior year, the firm earned $0.47 EPS. On average, equities research analysts forecast that Home Bancshares, Inc. will post 2.04 EPS for the current fiscal year.

Home Bancshares, Inc. (Conway, AR) Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, December 4th. Investors of record on Wednesday, November 13th will be given a dividend of $0.195 per share. The ex-dividend date is Wednesday, November 13th. This represents a $0.78 annualized dividend and a dividend yield of 2.56%. Home Bancshares, Inc. (Conway, AR)'s dividend payout ratio (DPR) is presently 40.21%.

About Home Bancshares, Inc. (Conway, AR)

(

Free Report)

Home Bancshares, Inc (Conway, AR) operates as the bank holding company for Centennial Bank that provides commercial and retail banking, and related financial services to businesses, real estate developers and investors, individuals, and municipalities. Its deposit products include checking, savings, and money market accounts, as well as certificates of deposit.

Featured Articles

Before you consider Home Bancshares, Inc. (Conway, AR), you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Home Bancshares, Inc. (Conway, AR) wasn't on the list.

While Home Bancshares, Inc. (Conway, AR) currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report