Hanseatic Management Services Inc. bought a new stake in United Therapeutics Co. (NASDAQ:UTHR - Free Report) in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor bought 1,846 shares of the biotechnology company's stock, valued at approximately $662,000.

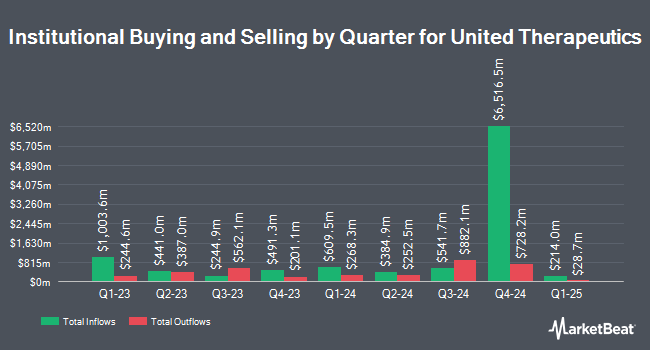

Other institutional investors also recently modified their holdings of the company. Financial Enhancement Group LLC bought a new position in United Therapeutics during the third quarter valued at $6,671,000. HMS Capital Management LLC bought a new position in United Therapeutics during the third quarter valued at $477,000. QRG Capital Management Inc. grew its holdings in United Therapeutics by 6.9% during the third quarter. QRG Capital Management Inc. now owns 16,380 shares of the biotechnology company's stock valued at $5,870,000 after purchasing an additional 1,059 shares during the period. National Pension Service grew its holdings in United Therapeutics by 38.2% during the third quarter. National Pension Service now owns 113,742 shares of the biotechnology company's stock valued at $40,759,000 after purchasing an additional 31,442 shares during the period. Finally, Robeco Institutional Asset Management B.V. grew its holdings in United Therapeutics by 3.6% during the third quarter. Robeco Institutional Asset Management B.V. now owns 196,019 shares of the biotechnology company's stock valued at $70,243,000 after purchasing an additional 6,839 shares during the period. 94.08% of the stock is owned by institutional investors.

Insider Buying and Selling at United Therapeutics

In other United Therapeutics news, COO Michael Benkowitz sold 14,700 shares of the firm's stock in a transaction dated Friday, November 1st. The stock was sold at an average price of $374.46, for a total transaction of $5,504,562.00. Following the sale, the chief operating officer now owns 2,577 shares in the company, valued at $964,983.42. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. In other news, Director Christopher Causey sold 510 shares of the firm's stock in a transaction dated Friday, November 1st. The stock was sold at an average price of $376.63, for a total transaction of $192,081.30. Following the transaction, the director now directly owns 3,675 shares of the company's stock, valued at approximately $1,384,115.25. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, COO Michael Benkowitz sold 14,700 shares of the firm's stock in a transaction dated Friday, November 1st. The shares were sold at an average price of $374.46, for a total value of $5,504,562.00. Following the transaction, the chief operating officer now directly owns 2,577 shares in the company, valued at $964,983.42. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 81,422 shares of company stock worth $29,229,828 over the last 90 days. Corporate insiders own 11.90% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have weighed in on UTHR shares. The Goldman Sachs Group increased their price objective on United Therapeutics from $243.00 to $302.00 and gave the company a "neutral" rating in a report on Friday, November 1st. Jefferies Financial Group increased their target price on United Therapeutics from $315.00 to $432.00 and gave the stock a "buy" rating in a research report on Monday, September 23rd. Wells Fargo & Company increased their target price on United Therapeutics from $350.00 to $380.00 and gave the stock an "overweight" rating in a research report on Tuesday, August 20th. Oppenheimer increased their target price on United Therapeutics from $575.00 to $600.00 and gave the stock an "outperform" rating in a research report on Thursday, October 31st. Finally, Bank of America dropped their target price on United Therapeutics from $303.00 to $280.00 and set an "underperform" rating on the stock in a research report on Thursday, August 1st. One research analyst has rated the stock with a sell rating, two have given a hold rating, twelve have issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, United Therapeutics has a consensus rating of "Moderate Buy" and an average target price of $370.86.

View Our Latest Report on UTHR

United Therapeutics Stock Up 1.3 %

Shares of UTHR stock traded up $5.08 on Thursday, reaching $402.57. The company's stock had a trading volume of 370,193 shares, compared to its average volume of 464,712. United Therapeutics Co. has a 12-month low of $208.62 and a 12-month high of $405.98. The company has a market capitalization of $17.97 billion, a P/E ratio of 17.68, a PEG ratio of 1.08 and a beta of 0.56. The stock's 50 day simple moving average is $358.27 and its 200-day simple moving average is $320.94.

United Therapeutics (NASDAQ:UTHR - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The biotechnology company reported $6.39 earnings per share for the quarter, beating analysts' consensus estimates of $6.16 by $0.23. United Therapeutics had a return on equity of 19.22% and a net margin of 40.31%. The business had revenue of $748.90 million for the quarter, compared to the consensus estimate of $722.62 million. During the same quarter last year, the business posted $5.38 earnings per share. The company's revenue for the quarter was up 22.9% on a year-over-year basis. Research analysts expect that United Therapeutics Co. will post 25.57 EPS for the current year.

About United Therapeutics

(

Free Report)

United Therapeutics Corporation, a biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally. The company offers Tyvaso DPI, an inhaled dry powder via pre-filled and single-use cartridges; Tyvaso, an inhaled solution via ultrasonic nebulizer; Remodulin (treprostinil) injection to treat patients with pulmonary arterial hypertension (PAH) to diminish symptoms associated with exercise; Orenitram, a tablet dosage form of treprostinil, to delay disease progression and improve exercise capacity in PAH patients; and Adcirca, an oral PDE-5 inhibitor to enhance the exercise ability in PAH patients.

See Also

Before you consider United Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Therapeutics wasn't on the list.

While United Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.