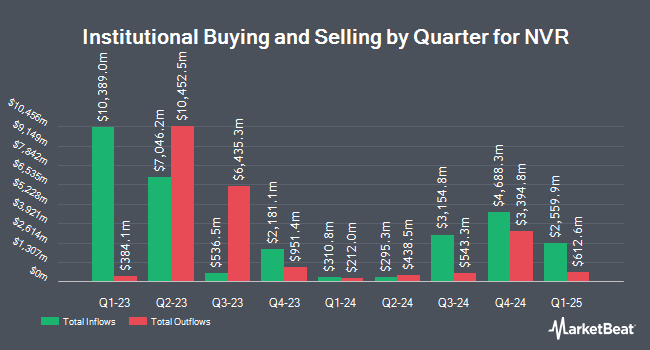

Martingale Asset Management L P purchased a new position in shares of NVR, Inc. (NYSE:NVR - Free Report) in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund purchased 186 shares of the construction company's stock, valued at approximately $1,825,000.

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. International Assets Investment Management LLC increased its holdings in shares of NVR by 1,100,012.1% during the third quarter. International Assets Investment Management LLC now owns 363,037 shares of the construction company's stock worth $3,562,046,000 after buying an additional 363,004 shares in the last quarter. Smead Capital Management Inc. increased its holdings in NVR by 3.5% during the 3rd quarter. Smead Capital Management Inc. now owns 36,218 shares of the construction company's stock worth $355,365,000 after purchasing an additional 1,223 shares in the last quarter. Jennison Associates LLC bought a new stake in NVR during the 3rd quarter worth about $348,545,000. Marshfield Associates raised its stake in shares of NVR by 0.3% during the 2nd quarter. Marshfield Associates now owns 32,719 shares of the construction company's stock worth $248,290,000 after purchasing an additional 96 shares in the last quarter. Finally, Dimensional Fund Advisors LP grew its holdings in NVR by 3.2% during the second quarter. Dimensional Fund Advisors LP now owns 29,199 shares of the construction company's stock worth $221,595,000 after purchasing an additional 906 shares during the period. 83.67% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several analysts have recently issued reports on the company. Bank of America reduced their target price on NVR from $10,800.00 to $10,600.00 and set a "buy" rating on the stock in a report on Wednesday, October 23rd. Seaport Res Ptn downgraded NVR from a "strong-buy" rating to a "hold" rating in a research note on Sunday, November 10th. UBS Group raised their price target on shares of NVR from $8,450.00 to $9,450.00 and gave the company a "neutral" rating in a research report on Wednesday, October 23rd. Finally, StockNews.com downgraded shares of NVR from a "buy" rating to a "hold" rating in a research report on Thursday, November 7th. Four equities research analysts have rated the stock with a hold rating and one has given a buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Hold" and a consensus price target of $8,783.33.

Read Our Latest Stock Analysis on NVR

NVR Stock Performance

NYSE:NVR traded down $55.58 during mid-day trading on Monday, hitting $9,180.00. 22,463 shares of the company traded hands, compared to its average volume of 19,375. The stock's fifty day moving average price is $9,395.27 and its 200-day moving average price is $8,656.49. The firm has a market cap of $28.09 billion, a price-to-earnings ratio of 18.88, a price-to-earnings-growth ratio of 1.98 and a beta of 1.20. NVR, Inc. has a one year low of $6,286.46 and a one year high of $9,964.77. The company has a quick ratio of 3.54, a current ratio of 6.21 and a debt-to-equity ratio of 0.21.

NVR (NYSE:NVR - Get Free Report) last issued its quarterly earnings results on Tuesday, October 22nd. The construction company reported $130.50 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $131.00 by ($0.50). NVR had a return on equity of 38.20% and a net margin of 16.51%. The business had revenue of $2.68 billion for the quarter, compared to the consensus estimate of $2.71 billion. During the same period in the prior year, the business posted $125.26 earnings per share. NVR's revenue was up 6.6% on a year-over-year basis. Research analysts anticipate that NVR, Inc. will post 494.48 earnings per share for the current fiscal year.

Insider Buying and Selling at NVR

In other NVR news, CAO Matthew B. Kelpy sold 125 shares of the company's stock in a transaction dated Thursday, October 24th. The shares were sold at an average price of $9,507.30, for a total value of $1,188,412.50. Following the transaction, the chief accounting officer now directly owns 230 shares in the company, valued at approximately $2,186,679. This represents a 35.21 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director David A. Preiser sold 250 shares of the stock in a transaction that occurred on Friday, November 8th. The stock was sold at an average price of $9,302.64, for a total transaction of $2,325,660.00. Following the sale, the director now directly owns 239 shares of the company's stock, valued at approximately $2,223,330.96. This trade represents a 51.12 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 775 shares of company stock valued at $7,294,073 over the last ninety days. Corporate insiders own 7.00% of the company's stock.

NVR Company Profile

(

Free Report)

NVR, Inc operates as a homebuilder in the United States. The company operates through, Homebuilding and Mortgage Banking segments. It engages in the construction and sale of single-family detached homes, townhomes, and condominium buildings under the Ryan Homes, NVHomes, and Heartland Homes names. The company markets its Ryan Homes products to first-time and first-time move-up buyers; and NVHomes and Heartland Homes products to move-up and luxury buyers.

Featured Stories

Before you consider NVR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVR wasn't on the list.

While NVR currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.