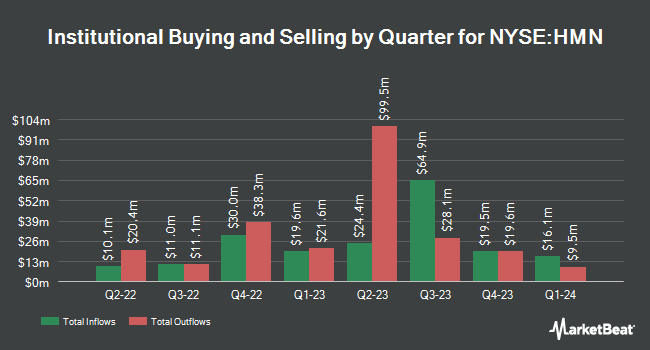

Summit Global Investments purchased a new stake in Horace Mann Educators Co. (NYSE:HMN - Free Report) in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor purchased 19,271 shares of the insurance provider's stock, valued at approximately $674,000.

Other hedge funds also recently modified their holdings of the company. Louisiana State Employees Retirement System boosted its stake in shares of Horace Mann Educators by 2.0% during the second quarter. Louisiana State Employees Retirement System now owns 20,600 shares of the insurance provider's stock valued at $672,000 after purchasing an additional 400 shares in the last quarter. Texas Permanent School Fund Corp grew its holdings in Horace Mann Educators by 1.3% during the 1st quarter. Texas Permanent School Fund Corp now owns 35,740 shares of the insurance provider's stock worth $1,322,000 after acquiring an additional 464 shares during the last quarter. Natixis Advisors LLC increased its position in Horace Mann Educators by 2.2% in the 2nd quarter. Natixis Advisors LLC now owns 22,333 shares of the insurance provider's stock valued at $729,000 after acquiring an additional 473 shares during the period. Bessemer Group Inc. raised its stake in shares of Horace Mann Educators by 228.9% during the first quarter. Bessemer Group Inc. now owns 694 shares of the insurance provider's stock valued at $27,000 after acquiring an additional 483 shares during the last quarter. Finally, GAMMA Investing LLC grew its position in shares of Horace Mann Educators by 142.1% in the 3rd quarter. GAMMA Investing LLC now owns 920 shares of the insurance provider's stock valued at $32,000 after buying an additional 540 shares during the last quarter. Institutional investors and hedge funds own 99.28% of the company's stock.

Insider Activity at Horace Mann Educators

In related news, CEO Marita Zuraitis sold 4,000 shares of the stock in a transaction on Friday, November 1st. The shares were sold at an average price of $37.24, for a total transaction of $148,960.00. Following the transaction, the chief executive officer now owns 292,336 shares of the company's stock, valued at approximately $10,886,592.64. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 3.80% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

HMN has been the topic of several analyst reports. Raymond James assumed coverage on Horace Mann Educators in a report on Tuesday, August 6th. They issued a "strong-buy" rating and a $42.00 target price on the stock. Keefe, Bruyette & Woods decreased their price objective on shares of Horace Mann Educators from $40.00 to $39.00 and set an "outperform" rating for the company in a research report on Tuesday, August 13th. Finally, Piper Sandler boosted their target price on shares of Horace Mann Educators from $36.00 to $42.00 and gave the company a "neutral" rating in a report on Wednesday. Three analysts have rated the stock with a hold rating, one has issued a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $41.00.

Get Our Latest Report on HMN

Horace Mann Educators Stock Performance

Shares of HMN stock traded down $0.91 on Friday, hitting $40.79. 512,861 shares of the stock were exchanged, compared to its average volume of 249,676. The company has a current ratio of 0.09, a quick ratio of 0.08 and a debt-to-equity ratio of 0.42. The firm has a market capitalization of $1.66 billion, a PE ratio of 16.25 and a beta of 0.27. Horace Mann Educators Co. has a one year low of $31.53 and a one year high of $43.26. The firm's 50 day moving average is $36.04 and its two-hundred day moving average is $34.90.

Horace Mann Educators (NYSE:HMN - Get Free Report) last posted its earnings results on Monday, November 4th. The insurance provider reported $0.76 earnings per share for the quarter, beating analysts' consensus estimates of $0.72 by $0.04. Horace Mann Educators had a return on equity of 8.14% and a net margin of 6.55%. The business had revenue of $412.10 million during the quarter, compared to analyst estimates of $293.87 million. During the same quarter in the previous year, the firm earned $0.44 EPS. The company's quarterly revenue was up 8.8% compared to the same quarter last year. Sell-side analysts expect that Horace Mann Educators Co. will post 2.63 earnings per share for the current fiscal year.

Horace Mann Educators Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Monday, September 30th. Stockholders of record on Monday, September 16th were issued a $0.34 dividend. This represents a $1.36 dividend on an annualized basis and a dividend yield of 3.33%. The ex-dividend date of this dividend was Monday, September 16th. Horace Mann Educators's payout ratio is 54.18%.

Horace Mann Educators Company Profile

(

Free Report)

Horace Mann Educators Corporation, together with its subsidiaries, operates as an insurance holding company in the United States. The company operates through Property & Casualty, Life & Retirement, and Supplemental & Group Benefits segments. Its Property & Casualty segment offers insurance products, including private passenger auto insurance, residential home insurance, and personal umbrella insurance; and provides auto coverages including liability and collision, and property coverage for homeowners and renters.

Recommended Stories

Before you consider Horace Mann Educators, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Horace Mann Educators wasn't on the list.

While Horace Mann Educators currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.