Millrace Asset Group Inc. purchased a new position in shares of Rush Street Interactive, Inc. (NYSE:RSI - Free Report) in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm purchased 196,814 shares of the company's stock, valued at approximately $2,135,000. Rush Street Interactive accounts for approximately 2.2% of Millrace Asset Group Inc.'s investment portfolio, making the stock its 10th largest position. Millrace Asset Group Inc. owned 0.09% of Rush Street Interactive as of its most recent filing with the Securities & Exchange Commission.

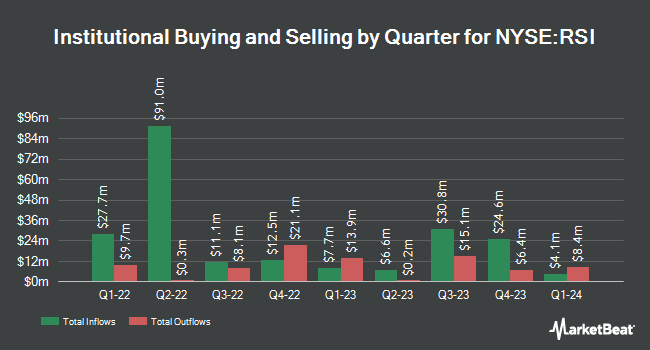

Other hedge funds and other institutional investors have also bought and sold shares of the company. Algert Global LLC boosted its position in Rush Street Interactive by 117.6% during the third quarter. Algert Global LLC now owns 510,361 shares of the company's stock worth $5,537,000 after purchasing an additional 275,788 shares during the period. Charles Schwab Investment Management Inc. boosted its holdings in shares of Rush Street Interactive by 26.4% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 741,862 shares of the company's stock worth $8,049,000 after buying an additional 154,785 shares during the period. Intech Investment Management LLC acquired a new position in Rush Street Interactive in the 3rd quarter valued at about $192,000. Connor Clark & Lunn Investment Management Ltd. raised its holdings in Rush Street Interactive by 72.2% in the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 820,955 shares of the company's stock valued at $8,907,000 after acquiring an additional 344,276 shares during the period. Finally, Caprock Group LLC acquired a new stake in Rush Street Interactive during the third quarter worth approximately $4,178,000. Institutional investors own 24.78% of the company's stock.

Rush Street Interactive Stock Performance

Shares of Rush Street Interactive stock traded up $0.71 on Tuesday, reaching $14.52. 2,920,167 shares of the stock were exchanged, compared to its average volume of 1,694,220. The firm's 50 day moving average is $11.03 and its 200-day moving average is $9.91. The firm has a market cap of $3.28 billion, a PE ratio of -725.50 and a beta of 1.78. Rush Street Interactive, Inc. has a one year low of $3.56 and a one year high of $14.52.

Insider Buying and Selling at Rush Street Interactive

In other Rush Street Interactive news, CEO Richard Todd Schwartz sold 103,905 shares of the company's stock in a transaction dated Friday, November 15th. The stock was sold at an average price of $11.02, for a total value of $1,145,033.10. Following the completion of the transaction, the chief executive officer now owns 1,703,578 shares of the company's stock, valued at $18,773,429.56. This represents a 5.75 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, insider Paul Wierbicki sold 35,000 shares of Rush Street Interactive stock in a transaction dated Monday, November 11th. The shares were sold at an average price of $11.23, for a total value of $393,050.00. Following the sale, the insider now directly owns 139,982 shares in the company, valued at $1,571,997.86. The trade was a 20.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 279,839 shares of company stock valued at $3,145,471. 56.89% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

Several research firms recently issued reports on RSI. Craig Hallum boosted their price target on Rush Street Interactive from $14.00 to $17.00 and gave the company a "buy" rating in a research note on Thursday, October 31st. Oppenheimer upped their price target on shares of Rush Street Interactive from $10.00 to $14.00 and gave the company an "outperform" rating in a research note on Thursday, August 1st. Jefferies Financial Group lifted their price objective on shares of Rush Street Interactive from $15.00 to $16.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Needham & Company LLC increased their target price on shares of Rush Street Interactive from $14.00 to $15.00 and gave the stock a "buy" rating in a research report on Thursday, October 31st. Finally, Wells Fargo & Company lifted their price target on shares of Rush Street Interactive from $11.00 to $13.00 and gave the company an "overweight" rating in a research report on Thursday, August 1st. Two investment analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $12.43.

Read Our Latest Report on RSI

Rush Street Interactive Company Profile

(

Free Report)

Rush Street Interactive, Inc operates as an online casino and sports betting company in the United States, Canada, Mexico, and rest of Latin America. It provides real-money online casino, online and retail sports betting, and social gaming services. In addition, the company offers full suite of games comprising of bricks-and-mortar casinos, table games, and slot machines.

Recommended Stories

Before you consider Rush Street Interactive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rush Street Interactive wasn't on the list.

While Rush Street Interactive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.