ING Groep NV purchased a new position in shares of Simpson Manufacturing Co., Inc. (NYSE:SSD - Free Report) during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor purchased 20,000 shares of the construction company's stock, valued at approximately $3,825,000.

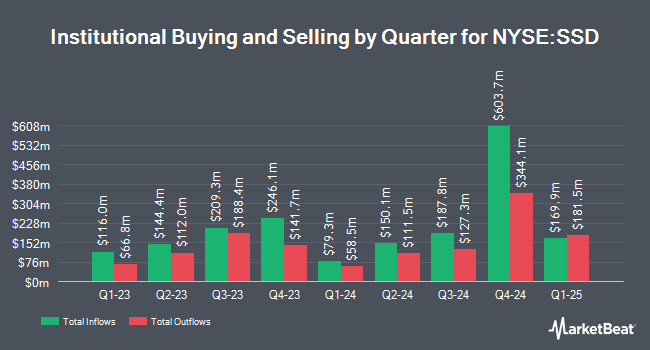

Other institutional investors have also recently made changes to their positions in the company. Russell Investments Group Ltd. grew its holdings in Simpson Manufacturing by 117.0% during the 1st quarter. Russell Investments Group Ltd. now owns 14,901 shares of the construction company's stock worth $3,057,000 after acquiring an additional 8,035 shares in the last quarter. ProShare Advisors LLC lifted its holdings in shares of Simpson Manufacturing by 4.7% during the first quarter. ProShare Advisors LLC now owns 9,799 shares of the construction company's stock worth $2,011,000 after purchasing an additional 442 shares during the period. State Board of Administration of Florida Retirement System boosted its holdings in shares of Simpson Manufacturing by 24.8% in the 1st quarter. State Board of Administration of Florida Retirement System now owns 15,301 shares of the construction company's stock valued at $3,139,000 after acquiring an additional 3,040 shares during the last quarter. Vanguard Group Inc. boosted its holdings in Simpson Manufacturing by 6.6% in the first quarter. Vanguard Group Inc. now owns 4,487,095 shares of the construction company's stock valued at $920,662,000 after purchasing an additional 278,283 shares during the last quarter. Finally, Edgestream Partners L.P. purchased a new stake in shares of Simpson Manufacturing in the first quarter worth about $794,000. Hedge funds and other institutional investors own 93.68% of the company's stock.

Insider Buying and Selling

In other Simpson Manufacturing news, CEO Michael Olosky sold 6,871 shares of the company's stock in a transaction dated Monday, August 26th. The shares were sold at an average price of $187.41, for a total value of $1,287,694.11. Following the transaction, the chief executive officer now owns 19,534 shares of the company's stock, valued at $3,660,866.94. This represents a 26.02 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, EVP Michael Andersen sold 1,500 shares of the stock in a transaction that occurred on Monday, August 26th. The stock was sold at an average price of $187.46, for a total transaction of $281,190.00. Following the transaction, the executive vice president now directly owns 8,438 shares of the company's stock, valued at $1,581,787.48. The trade was a 15.09 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 8,871 shares of company stock worth $1,658,259. 0.42% of the stock is owned by corporate insiders.

Analyst Ratings Changes

Separately, Robert W. Baird raised their price target on shares of Simpson Manufacturing from $202.00 to $218.00 and gave the company an "outperform" rating in a research report on Monday, October 21st.

Read Our Latest Stock Report on SSD

Simpson Manufacturing Price Performance

Shares of SSD stock traded down $2.20 on Friday, reaching $180.37. 121,256 shares of the company were exchanged, compared to its average volume of 280,646. The business has a 50-day moving average price of $185.76 and a 200 day moving average price of $178.28. Simpson Manufacturing Co., Inc. has a 1 year low of $152.93 and a 1 year high of $218.38. The company has a market cap of $7.60 billion, a price-to-earnings ratio of 23.83 and a beta of 1.32. The company has a debt-to-equity ratio of 0.24, a quick ratio of 1.99 and a current ratio of 3.53.

Simpson Manufacturing (NYSE:SSD - Get Free Report) last announced its earnings results on Monday, October 21st. The construction company reported $2.21 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.40 by ($0.19). The business had revenue of $587.15 million for the quarter, compared to analyst estimates of $589.00 million. Simpson Manufacturing had a return on equity of 18.29% and a net margin of 14.51%. The company's revenue for the quarter was up 1.2% compared to the same quarter last year. During the same period last year, the firm earned $2.43 EPS. Equities research analysts forecast that Simpson Manufacturing Co., Inc. will post 7.55 earnings per share for the current fiscal year.

Simpson Manufacturing Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Thursday, January 23rd. Shareholders of record on Thursday, January 2nd will be paid a $0.28 dividend. This represents a $1.12 dividend on an annualized basis and a yield of 0.62%. The ex-dividend date of this dividend is Thursday, January 2nd. Simpson Manufacturing's dividend payout ratio (DPR) is 14.80%.

Simpson Manufacturing Company Profile

(

Free Report)

Simpson Manufacturing Co, Inc, through its subsidiaries, designs, engineers, manufactures, and sells structural solutions for wood, concrete, and steel connections. The company offers wood construction products, including connectors, truss plates, fastening systems, fasteners and shearwalls, and pre-fabricated lateral systems for use in light-frame construction; and concrete construction products comprising adhesives, specialty chemicals, mechanical anchors, carbide drill bits, powder actuated tools, fiber-reinforced materials, and other repair products for use in concrete, masonry, and steel construction, as well as grouts, coatings, sealers, mortars, fiberglass and fiber-reinforced polymer systems, and asphalt products for use in concrete construction repair, and strengthening and protection products.

Further Reading

Before you consider Simpson Manufacturing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simpson Manufacturing wasn't on the list.

While Simpson Manufacturing currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.