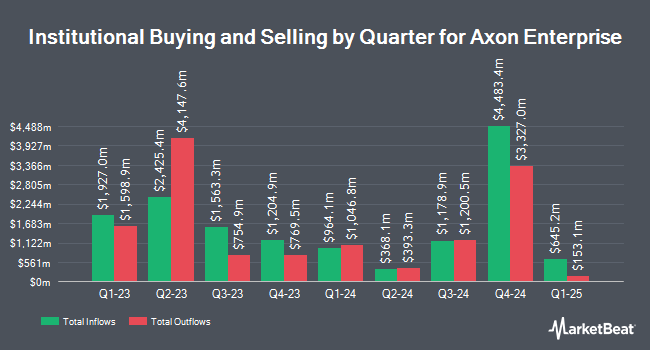

Axxcess Wealth Management LLC purchased a new stake in shares of Axon Enterprise, Inc. (NASDAQ:AXON - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 2,037 shares of the biotechnology company's stock, valued at approximately $814,000.

Other hedge funds have also modified their holdings of the company. Blue Trust Inc. raised its stake in shares of Axon Enterprise by 987.5% during the second quarter. Blue Trust Inc. now owns 87 shares of the biotechnology company's stock worth $27,000 after buying an additional 79 shares during the last quarter. Quent Capital LLC raised its position in shares of Axon Enterprise by 1,875.0% during the 3rd quarter. Quent Capital LLC now owns 79 shares of the biotechnology company's stock valued at $32,000 after acquiring an additional 75 shares during the last quarter. Asset Dedication LLC acquired a new position in shares of Axon Enterprise in the 2nd quarter valued at $47,000. Friedenthal Financial bought a new position in shares of Axon Enterprise in the 3rd quarter worth $51,000. Finally, Cullen Frost Bankers Inc. acquired a new stake in shares of Axon Enterprise during the second quarter worth $59,000. 79.08% of the stock is owned by institutional investors.

Axon Enterprise Stock Up 1.0 %

AXON traded up $6.11 during trading on Wednesday, reaching $601.29. 850,627 shares of the stock were exchanged, compared to its average volume of 549,467. The company has a debt-to-equity ratio of 0.32, a quick ratio of 2.63 and a current ratio of 2.96. The stock's 50 day moving average price is $423.98 and its two-hundred day moving average price is $351.79. Axon Enterprise, Inc. has a twelve month low of $220.51 and a twelve month high of $624.84. The stock has a market cap of $45.85 billion, a P/E ratio of 155.37, a price-to-earnings-growth ratio of 14.95 and a beta of 0.94.

Analyst Upgrades and Downgrades

A number of brokerages have issued reports on AXON. Craig Hallum raised their target price on Axon Enterprise from $370.00 to $376.00 and gave the stock a "buy" rating in a report on Wednesday, August 7th. Needham & Company LLC lifted their price objective on shares of Axon Enterprise from $525.00 to $600.00 and gave the stock a "buy" rating in a research note on Friday, November 8th. Bank of America assumed coverage on shares of Axon Enterprise in a research note on Wednesday, July 17th. They issued a "buy" rating and a $380.00 target price for the company. Jefferies Financial Group started coverage on shares of Axon Enterprise in a research report on Wednesday, July 17th. They set a "buy" rating and a $385.00 price target on the stock. Finally, Northland Securities upped their price objective on shares of Axon Enterprise from $365.00 to $550.00 and gave the company an "outperform" rating in a research report on Monday. Two analysts have rated the stock with a hold rating and twelve have issued a buy rating to the stock. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $427.83.

Check Out Our Latest Stock Report on Axon Enterprise

Insider Activity

In other Axon Enterprise news, CEO Patrick W. Smith sold 80,300 shares of the company's stock in a transaction that occurred on Friday, August 23rd. The stock was sold at an average price of $371.78, for a total value of $29,853,934.00. Following the sale, the chief executive officer now owns 3,015,366 shares in the company, valued at $1,121,052,771.48. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. In other Axon Enterprise news, President Joshua Isner sold 20,000 shares of Axon Enterprise stock in a transaction on Tuesday, November 12th. The shares were sold at an average price of $606.15, for a total transaction of $12,123,000.00. Following the completion of the transaction, the president now directly owns 208,166 shares of the company's stock, valued at $126,179,820.90. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CEO Patrick W. Smith sold 80,300 shares of the stock in a transaction dated Friday, August 23rd. The shares were sold at an average price of $371.78, for a total transaction of $29,853,934.00. Following the completion of the transaction, the chief executive officer now directly owns 3,015,366 shares in the company, valued at $1,121,052,771.48. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 389,172 shares of company stock valued at $148,393,842 in the last quarter. Company insiders own 6.10% of the company's stock.

About Axon Enterprise

(

Free Report)

Axon Enterprise, Inc develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally. It operates through two segments, Software and Sensors, and TASER. The company also offers hardware and cloud-based software solutions that enable law enforcement to capture, securely store, manage, share, and analyze video and other digital evidence.

Featured Stories

Before you consider Axon Enterprise, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axon Enterprise wasn't on the list.

While Axon Enterprise currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.