B. Metzler seel. Sohn & Co. Holding AG bought a new stake in Keysight Technologies, Inc. (NYSE:KEYS - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor bought 20,598 shares of the scientific and technical instruments company's stock, valued at approximately $3,274,000.

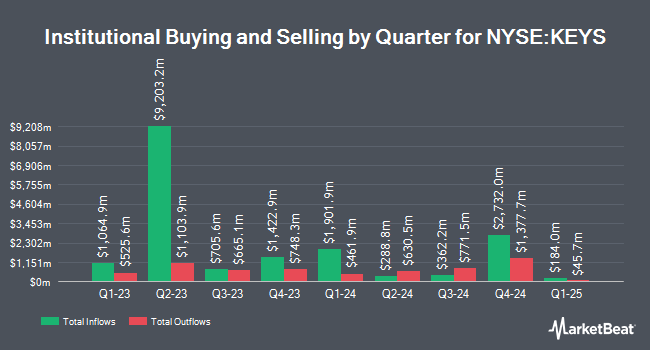

Several other large investors have also recently bought and sold shares of the company. O Shaughnessy Asset Management LLC increased its position in shares of Keysight Technologies by 39.2% in the 1st quarter. O Shaughnessy Asset Management LLC now owns 6,785 shares of the scientific and technical instruments company's stock valued at $1,061,000 after buying an additional 1,912 shares in the last quarter. Natixis grew its stake in Keysight Technologies by 10.9% in the first quarter. Natixis now owns 17,675 shares of the scientific and technical instruments company's stock valued at $2,764,000 after acquiring an additional 1,743 shares during the period. MQS Management LLC bought a new stake in shares of Keysight Technologies in the first quarter worth about $244,000. Advisors Asset Management Inc. raised its position in shares of Keysight Technologies by 32.2% during the first quarter. Advisors Asset Management Inc. now owns 16,350 shares of the scientific and technical instruments company's stock worth $2,557,000 after purchasing an additional 3,982 shares during the period. Finally, Capital Group Investment Management PTE. LTD. bought a new position in shares of Keysight Technologies during the 1st quarter valued at about $476,000. Institutional investors own 84.58% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms recently issued reports on KEYS. Barclays increased their target price on Keysight Technologies from $180.00 to $200.00 and gave the stock an "overweight" rating in a research note on Wednesday. Morgan Stanley raised their price objective on shares of Keysight Technologies from $165.00 to $180.00 and gave the stock an "overweight" rating in a report on Wednesday. JPMorgan Chase & Co. upped their target price on shares of Keysight Technologies from $155.00 to $165.00 and gave the stock a "neutral" rating in a research note on Wednesday, August 21st. Bank of America increased their target price on Keysight Technologies from $150.00 to $160.00 and gave the stock an "underperform" rating in a report on Wednesday. Finally, Robert W. Baird boosted their price target on Keysight Technologies from $163.00 to $180.00 and gave the company an "outperform" rating in a report on Wednesday. One investment analyst has rated the stock with a sell rating, one has issued a hold rating and nine have issued a buy rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $177.30.

Check Out Our Latest Stock Analysis on KEYS

Keysight Technologies Price Performance

Shares of NYSE KEYS opened at $165.48 on Thursday. The company has a debt-to-equity ratio of 0.23, a current ratio of 2.05 and a quick ratio of 1.52. The business has a 50-day moving average of $155.72 and a 200-day moving average of $146.10. The stock has a market capitalization of $28.72 billion, a price-to-earnings ratio of 47.28, a PEG ratio of 4.46 and a beta of 0.98. Keysight Technologies, Inc. has a fifty-two week low of $119.72 and a fifty-two week high of $168.46.

Keysight Technologies (NYSE:KEYS - Get Free Report) last posted its quarterly earnings results on Tuesday, August 20th. The scientific and technical instruments company reported $1.57 earnings per share for the quarter, beating analysts' consensus estimates of $1.35 by $0.22. Keysight Technologies had a return on equity of 19.34% and a net margin of 12.32%. The firm had revenue of $1.22 billion during the quarter, compared to the consensus estimate of $1.19 billion. During the same period last year, the company earned $2.04 earnings per share. The business's revenue was down 11.9% compared to the same quarter last year. As a group, sell-side analysts predict that Keysight Technologies, Inc. will post 6.18 earnings per share for the current fiscal year.

Keysight Technologies Company Profile

(

Free Report)

Keysight Technologies, Inc provides electronic design and test solutions to commercial communications, networking, aerospace, defense and government, automotive, energy, semiconductor, electronic, and education industries in the Americas, Europe, and the Asia Pacific. The company operates in two segments, Communications Solutions Group and Electronic Industrial Solutions Group.

Recommended Stories

Before you consider Keysight Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keysight Technologies wasn't on the list.

While Keysight Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.