Raymond James Financial Inc. purchased a new position in shares of Pinterest, Inc. (NYSE:PINS - Free Report) in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 2,112,449 shares of the company's stock, valued at approximately $61,261,000. Raymond James Financial Inc. owned approximately 0.31% of Pinterest as of its most recent filing with the Securities and Exchange Commission (SEC).

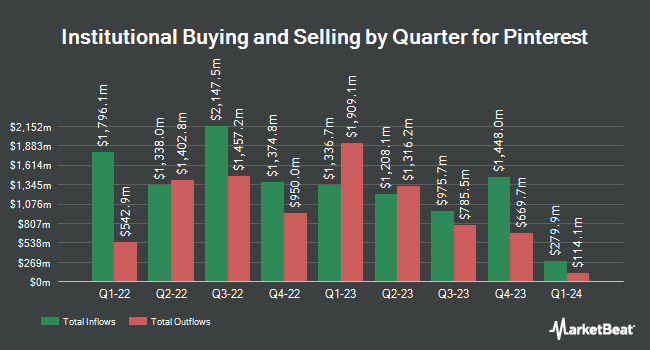

A number of other large investors also recently modified their holdings of PINS. Arizona State Retirement System raised its position in Pinterest by 2.1% in the fourth quarter. Arizona State Retirement System now owns 175,307 shares of the company's stock valued at $5,084,000 after purchasing an additional 3,595 shares during the last quarter. Aigen Investment Management LP bought a new position in Pinterest in the 4th quarter valued at approximately $545,000. Proficio Capital Partners LLC bought a new position in Pinterest in the 4th quarter valued at approximately $1,926,000. Victory Capital Management Inc. boosted its position in Pinterest by 3.0% during the 4th quarter. Victory Capital Management Inc. now owns 426,716 shares of the company's stock worth $12,375,000 after buying an additional 12,431 shares during the period. Finally, SWS Partners grew its holdings in Pinterest by 28.2% during the 4th quarter. SWS Partners now owns 144,364 shares of the company's stock worth $4,187,000 after acquiring an additional 31,723 shares during the last quarter. 88.81% of the stock is currently owned by institutional investors.

Pinterest Stock Performance

PINS traded down $2.28 during mid-day trading on Thursday, reaching $31.00. 17,008,509 shares of the stock were exchanged, compared to its average volume of 9,753,077. Pinterest, Inc. has a 1 year low of $27.00 and a 1 year high of $45.19. The stock has a market capitalization of $21.03 billion, a PE ratio of 11.52, a price-to-earnings-growth ratio of 1.95 and a beta of 1.02. The company has a 50 day moving average price of $34.32 and a two-hundred day moving average price of $32.27.

Pinterest (NYSE:PINS - Get Free Report) last issued its quarterly earnings data on Thursday, February 6th. The company reported $0.33 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.63 by ($0.30). Pinterest had a return on equity of 8.10% and a net margin of 51.07%. Sell-side analysts expect that Pinterest, Inc. will post 0.6 EPS for the current fiscal year.

Insider Activity at Pinterest

In related news, CAO Andrea Acosta sold 3,667 shares of the firm's stock in a transaction dated Monday, February 24th. The shares were sold at an average price of $37.46, for a total transaction of $137,365.82. Following the completion of the sale, the chief accounting officer now owns 144,129 shares in the company, valued at approximately $5,399,072.34. This trade represents a 2.48 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, insider Wanjiku Juanita Walcott sold 6,690 shares of the business's stock in a transaction dated Monday, March 10th. The shares were sold at an average price of $32.85, for a total transaction of $219,766.50. Following the completion of the transaction, the insider now owns 254,211 shares in the company, valued at approximately $8,350,831.35. The trade was a 2.56 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 106,879 shares of company stock valued at $3,653,577. 7.11% of the stock is owned by insiders.

Analyst Upgrades and Downgrades

A number of equities analysts have recently commented on the stock. TD Cowen began coverage on shares of Pinterest in a report on Tuesday, November 26th. They set a "buy" rating and a $38.00 price target on the stock. Jefferies Financial Group reaffirmed a "hold" rating and set a $32.00 target price (down from $40.00) on shares of Pinterest in a report on Monday, January 13th. Benchmark raised Pinterest from a "hold" rating to a "buy" rating and set a $55.00 price target for the company in a research note on Friday, February 7th. The Goldman Sachs Group lifted their price objective on Pinterest from $42.00 to $47.00 and gave the stock a "buy" rating in a research note on Friday, February 7th. Finally, Guggenheim upped their target price on Pinterest from $33.00 to $39.00 and gave the company a "neutral" rating in a report on Friday, February 7th. Eight equities research analysts have rated the stock with a hold rating and twenty-two have issued a buy rating to the company. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $43.47.

Check Out Our Latest Stock Analysis on Pinterest

Pinterest Profile

(

Free Report)

Pinterest, Inc operates as a visual search and discovery platform in the United States and internationally. Its platform allows people to find ideas, such as recipes, home and style inspiration, and others; and to search, save, and shop the ideas. The company was formerly known as Cold Brew Labs Inc and changed its name to Pinterest, Inc in April 2012.

Featured Stories

Before you consider Pinterest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pinterest wasn't on the list.

While Pinterest currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.