Walleye Capital LLC acquired a new stake in shares of VICI Properties Inc. (NYSE:VICI - Free Report) during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm acquired 21,517 shares of the company's stock, valued at approximately $717,000.

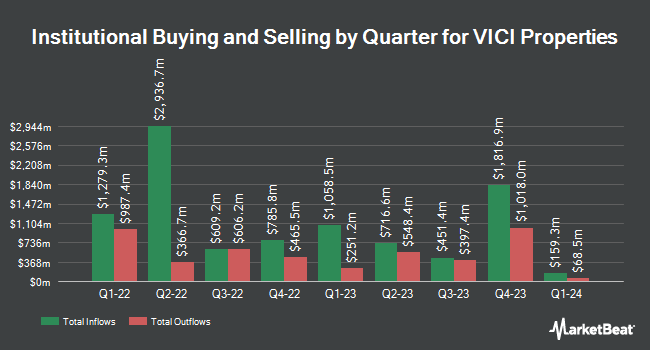

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Cetera Investment Advisers grew its position in shares of VICI Properties by 359.6% in the first quarter. Cetera Investment Advisers now owns 93,455 shares of the company's stock valued at $2,784,000 after purchasing an additional 73,123 shares during the period. Cetera Advisors LLC grew its holdings in VICI Properties by 47.9% in the 1st quarter. Cetera Advisors LLC now owns 32,372 shares of the company's stock valued at $964,000 after buying an additional 10,485 shares during the period. CWM LLC increased its stake in shares of VICI Properties by 16.0% during the 2nd quarter. CWM LLC now owns 14,993 shares of the company's stock valued at $429,000 after acquiring an additional 2,072 shares during the last quarter. Czech National Bank lifted its holdings in shares of VICI Properties by 9.2% during the 2nd quarter. Czech National Bank now owns 198,788 shares of the company's stock worth $5,693,000 after acquiring an additional 16,761 shares during the period. Finally, LVW Advisors LLC acquired a new stake in shares of VICI Properties in the second quarter worth approximately $342,000. Hedge funds and other institutional investors own 97.71% of the company's stock.

VICI Properties Stock Performance

Shares of NYSE:VICI remained flat at $31.65 during mid-day trading on Friday. The company had a trading volume of 4,069,284 shares, compared to its average volume of 4,547,312. The firm has a market capitalization of $33.36 billion, a price-to-earnings ratio of 11.72, a P/E/G ratio of 4.19 and a beta of 0.93. VICI Properties Inc. has a 1-year low of $27.08 and a 1-year high of $34.29. The stock's 50-day moving average price is $32.21 and its 200 day moving average price is $31.17. The company has a debt-to-equity ratio of 0.63, a quick ratio of 2.61 and a current ratio of 2.61.

VICI Properties Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, January 9th. Stockholders of record on Tuesday, December 17th will be paid a $0.4325 dividend. The ex-dividend date of this dividend is Tuesday, December 17th. This represents a $1.73 annualized dividend and a dividend yield of 5.47%. VICI Properties's dividend payout ratio (DPR) is presently 64.07%.

Wall Street Analyst Weigh In

VICI has been the subject of several research analyst reports. Evercore ISI upped their price target on shares of VICI Properties from $36.00 to $37.00 and gave the stock an "outperform" rating in a research report on Monday, September 16th. Wells Fargo & Company restated an "overweight" rating and set a $36.00 price objective (up from $33.00) on shares of VICI Properties in a report on Tuesday, October 1st. JMP Securities lifted their target price on VICI Properties from $34.00 to $35.00 and gave the company a "market outperform" rating in a report on Friday, November 1st. Finally, Mizuho dropped their price target on VICI Properties from $34.00 to $33.00 and set an "outperform" rating for the company in a research note on Thursday, November 14th. Two research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $34.22.

View Our Latest Stock Analysis on VICI

VICI Properties Company Profile

(

Free Report)

VICI Properties Inc is an S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Recommended Stories

Before you consider VICI Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VICI Properties wasn't on the list.

While VICI Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.