Norinchukin Bank The bought a new stake in shares of Super Micro Computer, Inc. (NASDAQ:SMCI - Free Report) in the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund bought 22,692 shares of the company's stock, valued at approximately $692,000.

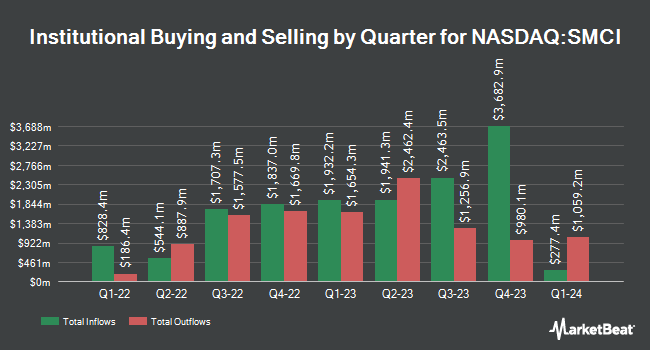

Other hedge funds have also made changes to their positions in the company. Parkside Financial Bank & Trust increased its holdings in Super Micro Computer by 2,890.9% during the fourth quarter. Parkside Financial Bank & Trust now owns 987 shares of the company's stock valued at $30,000 after buying an additional 954 shares during the period. Larson Financial Group LLC boosted its position in Super Micro Computer by 902.0% during the 4th quarter. Larson Financial Group LLC now owns 992 shares of the company's stock valued at $30,000 after acquiring an additional 893 shares in the last quarter. Salem Investment Counselors Inc. purchased a new position in shares of Super Micro Computer in the 4th quarter valued at $30,000. Trust Co. of Vermont raised its position in shares of Super Micro Computer by 900.0% in the 4th quarter. Trust Co. of Vermont now owns 1,000 shares of the company's stock worth $30,000 after acquiring an additional 900 shares in the last quarter. Finally, Toth Financial Advisory Corp purchased a new stake in shares of Super Micro Computer during the 4th quarter worth $31,000. 84.06% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling at Super Micro Computer

In other Super Micro Computer news, CEO Charles Liang sold 46,293 shares of the company's stock in a transaction that occurred on Wednesday, February 26th. The stock was sold at an average price of $50.17, for a total value of $2,322,519.81. Following the sale, the chief executive officer now owns 67,403,640 shares in the company, valued at approximately $3,381,640,618.80. This represents a 0.07 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. Also, Director Robert L. Blair sold 19,460 shares of Super Micro Computer stock in a transaction that occurred on Friday, February 28th. The shares were sold at an average price of $42.58, for a total transaction of $828,606.80. The disclosure for this sale can be found here. Over the last three months, insiders have sold 137,473 shares of company stock valued at $6,771,552. 17.60% of the stock is owned by insiders.

Analysts Set New Price Targets

Several equities analysts have issued reports on SMCI shares. Rosenblatt Securities initiated coverage on Super Micro Computer in a research note on Monday, March 10th. They issued a "buy" rating and a $60.00 target price on the stock. Cfra raised shares of Super Micro Computer from a "hold" rating to a "buy" rating and set a $48.00 price objective on the stock in a research report on Tuesday, February 11th. The Goldman Sachs Group cut shares of Super Micro Computer from a "neutral" rating to a "sell" rating and decreased their target price for the company from $40.00 to $32.00 in a research report on Monday, March 24th. StockNews.com raised shares of Super Micro Computer to a "sell" rating in a report on Friday, February 28th. Finally, Wedbush reiterated a "hold" rating on shares of Super Micro Computer in a report on Tuesday, February 18th. Three analysts have rated the stock with a sell rating, ten have given a hold rating, five have assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the company presently has an average rating of "Hold" and a consensus price target of $52.57.

Read Our Latest Research Report on SMCI

Super Micro Computer Stock Performance

Shares of NASDAQ:SMCI traded up $2.91 during midday trading on Thursday, reaching $35.81. The company's stock had a trading volume of 50,121,274 shares, compared to its average volume of 72,313,771. The firm has a market capitalization of $21.25 billion, a PE ratio of 17.98 and a beta of 1.22. The stock has a fifty day moving average of $38.75 and a 200 day moving average of $36.27. Super Micro Computer, Inc. has a twelve month low of $17.25 and a twelve month high of $101.40. The company has a quick ratio of 1.93, a current ratio of 3.77 and a debt-to-equity ratio of 0.32.

Super Micro Computer Company Profile

(

Free Report)

Super Micro Computer, Inc, together with its subsidiaries, develops and manufactures high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally. Its solutions range from complete server, storage systems, modular blade servers, blades, workstations, full racks, networking devices, server sub-systems, server management software, and security software.

Featured Articles

Before you consider Super Micro Computer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Super Micro Computer wasn't on the list.

While Super Micro Computer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.