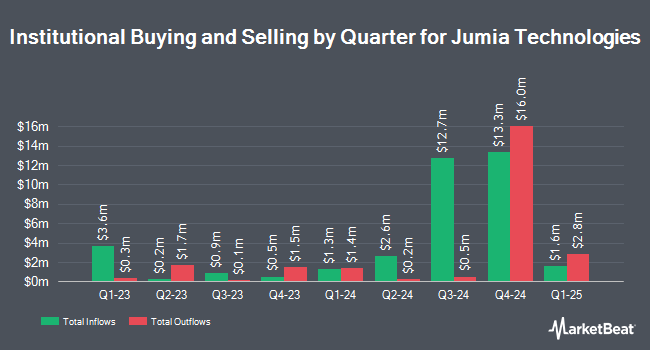

Dorsey Wright & Associates bought a new stake in shares of Jumia Technologies AG (NYSE:JMIA - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund bought 230,036 shares of the company's stock, valued at approximately $1,228,000. Dorsey Wright & Associates owned approximately 0.23% of Jumia Technologies at the end of the most recent reporting period.

Several other hedge funds have also recently added to or reduced their stakes in JMIA. BNP Paribas Financial Markets increased its position in shares of Jumia Technologies by 802.4% during the 3rd quarter. BNP Paribas Financial Markets now owns 2,413,574 shares of the company's stock valued at $12,888,000 after purchasing an additional 2,146,114 shares during the period. State Street Corp increased its position in shares of Jumia Technologies by 1.4% during the 3rd quarter. State Street Corp now owns 709,752 shares of the company's stock valued at $3,790,000 after purchasing an additional 9,567 shares during the period. Millennium Management LLC increased its position in shares of Jumia Technologies by 393.4% during the 2nd quarter. Millennium Management LLC now owns 372,920 shares of the company's stock valued at $2,618,000 after purchasing an additional 297,333 shares during the period. International Assets Investment Management LLC increased its position in shares of Jumia Technologies by 685.9% during the 3rd quarter. International Assets Investment Management LLC now owns 145,782 shares of the company's stock valued at $778,000 after purchasing an additional 127,232 shares during the period. Finally, Headlands Technologies LLC acquired a new position in shares of Jumia Technologies in the 2nd quarter worth $931,000. Institutional investors own 16.50% of the company's stock.

Analysts Set New Price Targets

Separately, Royal Bank of Canada started coverage on Jumia Technologies in a report on Wednesday, November 13th. They issued a "sector perform" rating and a $5.00 target price on the stock.

Read Our Latest Research Report on JMIA

Jumia Technologies Price Performance

Shares of Jumia Technologies stock traded up $0.04 during midday trading on Friday, hitting $4.57. The company's stock had a trading volume of 7,968,468 shares, compared to its average volume of 2,793,823. The stock has a 50-day simple moving average of $4.56 and a 200-day simple moving average of $6.43. The company has a debt-to-equity ratio of 0.07, a quick ratio of 1.73 and a current ratio of 1.80. Jumia Technologies AG has a 1-year low of $2.88 and a 1-year high of $15.04.

About Jumia Technologies

(

Free Report)

Jumia Technologies AG operates an e-commerce platform in West Africa, North Africa, East and South Africa, Europe, the United Arab Emirates, and internationally. The company's platform consists of marketplace that connects sellers with customers; logistics service, which enables the shipment and delivery of packages from sellers to consumers; and payment service, which facilitates transactions to participants active on the company's platform in selected markets under the JumiaPay name.

Read More

Before you consider Jumia Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jumia Technologies wasn't on the list.

While Jumia Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.